BlackRock in-house portfolio boosts IBIT Bitcoin ETF exposure by 25%

BlackRock’s in-house portfolio has been quietly accumulating shares of its Bitcoin exchange-traded fund (ETF), underscoring the asset manager’s growing commitment to the cryptocurrency as part of a broader diversification strategy.As of March 31, 2025, the BlackRock Strategic Income Opportunities Portfolio held 2,123,592 shares of the company’s iShares Bitcoin Trust (IBIT), valued at $99.4 million, according to filings with the US Securities and Exchange Commission (SEC). That’s a notable uptick from Dec. 31, 2024, when the portfolio held 1,691,143 IBIT shares. The BlackRock Strategic Income Opportunities Portfolio’s consolidated schedule of investments as of March 31, 2025. Source: SECBlackRock’s IBIT was among 11 spot Bitcoin ETFs approved by the SEC in January 2024. Since then, it has emerged as the largest fund in its category with more than $72 billion in net assets, according to Bitbo data.The second-largest US Bitcoin ETF is the Fidelity Wise Origin Fund (FBTC), which trails IBIT in net assets by $50 billion. The Strategic Income Opportunities Portfolio is primarily a bond-focused strategy that also seeks diversified exposure to other markets, aiming to boost total returns while preserving capital, BlackRock’s prospectus reads. Source: MacroScopeRelated: Spot Bitcoin ETFs broke records in 2024 — Can they do it again in 2025?Bitcoin ETF demand continues to rise among institutional investorsUS spot Bitcoin ETFs shattered records in their debut year, and 2025 is shaping up to deliver a similar performance. As reported by Cointelegraph, May is shaping up to be a record month for spot ETFs, which saw more than $1.5 billion in net inflows over just two days.BlackRock’s IBIT has driven much of that growth, posting consistent inflows since April 9, including multiple days with net buys topping $500 million. Net inflows indicate that asset managers are buying shares of the Bitcoin ETFs to meet growing investor demand.Using the early success of gold ETFs as a benchmark, asset manager Bitwise recently projected that Bitcoin fund inflows could reach $120 billion this year and more than double to $300 billion by 2026.In terms of net inflows, Bitcoin ETFs vastly outperformed gold ETFs in their debut year. This trend is expected to continue in the coming years. Source: Bitwise Asset ManagementWhile spot Bitcoin ETFs have opened the door for retail and institutional investors, a major untapped market remains: the wealth management platforms and wirehouses of major institutions, Bitwise analysts Juan Leon, Guillaume Girard and Will Owens wrote in the report.Magazine: Bitcoin bears eye $69K, CZ denies WLF ‘fixer’ rumors: Hodler’s Digest, May 18 – 24

BlackRock’s in-house portfolio has been quietly accumulating shares of its Bitcoin exchange-traded fund (ETF), underscoring the asset manager’s growing commitment to the cryptocurrency as part of a broader diversification strategy.

As of March 31, 2025, the BlackRock Strategic Income Opportunities Portfolio held 2,123,592 shares of the company’s iShares Bitcoin Trust (IBIT), valued at $99.4 million, according to filings with the US Securities and Exchange Commission (SEC). That’s a notable uptick from Dec. 31, 2024, when the portfolio held 1,691,143 IBIT shares.

BlackRock’s IBIT was among 11 spot Bitcoin ETFs approved by the SEC in January 2024. Since then, it has emerged as the largest fund in its category with more than $72 billion in net assets, according to Bitbo data.

The second-largest US Bitcoin ETF is the Fidelity Wise Origin Fund (FBTC), which trails IBIT in net assets by $50 billion.

The Strategic Income Opportunities Portfolio is primarily a bond-focused strategy that also seeks diversified exposure to other markets, aiming to boost total returns while preserving capital, BlackRock’s prospectus reads.

Related: Spot Bitcoin ETFs broke records in 2024 — Can they do it again in 2025?

Bitcoin ETF demand continues to rise among institutional investors

US spot Bitcoin ETFs shattered records in their debut year, and 2025 is shaping up to deliver a similar performance.

As reported by Cointelegraph, May is shaping up to be a record month for spot ETFs, which saw more than $1.5 billion in net inflows over just two days.

BlackRock’s IBIT has driven much of that growth, posting consistent inflows since April 9, including multiple days with net buys topping $500 million.

Net inflows indicate that asset managers are buying shares of the Bitcoin ETFs to meet growing investor demand.

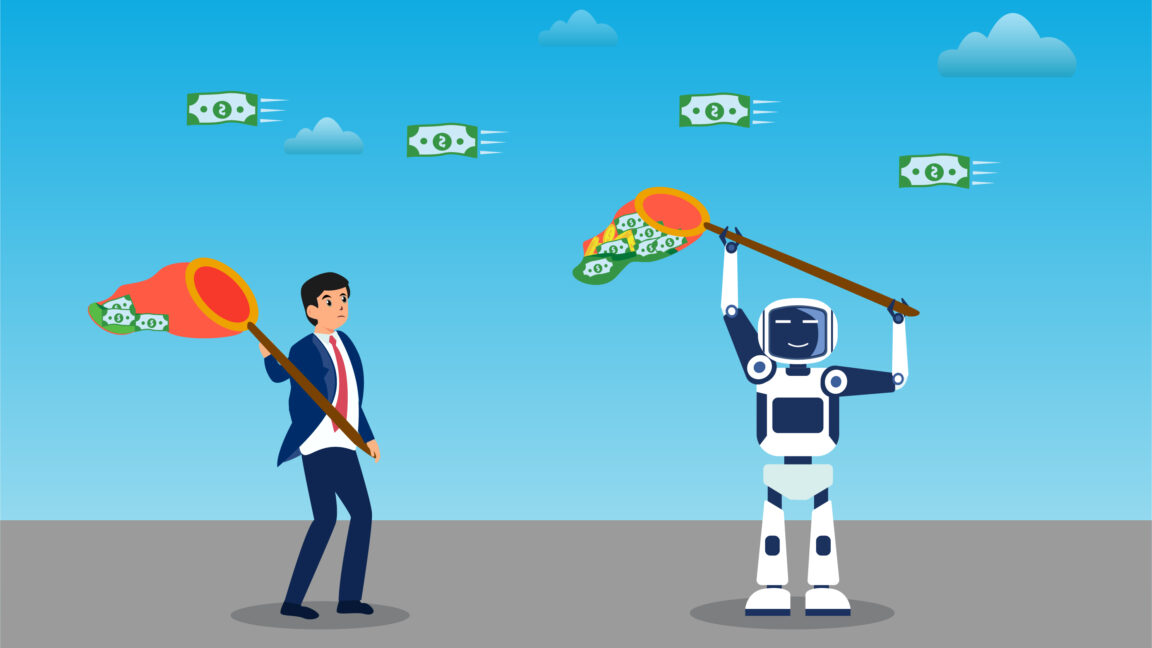

Using the early success of gold ETFs as a benchmark, asset manager Bitwise recently projected that Bitcoin fund inflows could reach $120 billion this year and more than double to $300 billion by 2026.

While spot Bitcoin ETFs have opened the door for retail and institutional investors, a major untapped market remains: the wealth management platforms and wirehouses of major institutions, Bitwise analysts Juan Leon, Guillaume Girard and Will Owens wrote in the report.

Magazine: Bitcoin bears eye $69K, CZ denies WLF ‘fixer’ rumors: Hodler’s Digest, May 18 – 24