XRP drops 1.05% to $2.29 as key resistance blocks further gains

Trading below the 100-hourly SMA, signalling bearish momentum. Key support levels are $2.280, $2.260, and $2.2320. Bulls need a clear move above $2.3720 to shift short-term trend. XRP has lost momentum again, dropping by 1.05% over the last 24 hours to trade at $2.29. After a brief attempt to recover, bulls failed to break through […] The post XRP drops 1.05% to $2.29 as key resistance blocks further gains appeared first on CoinJournal.

- Trading below the 100-hourly SMA, signalling bearish momentum.

- Key support levels are $2.280, $2.260, and $2.2320.

- Bulls need a clear move above $2.3720 to shift short-term trend.

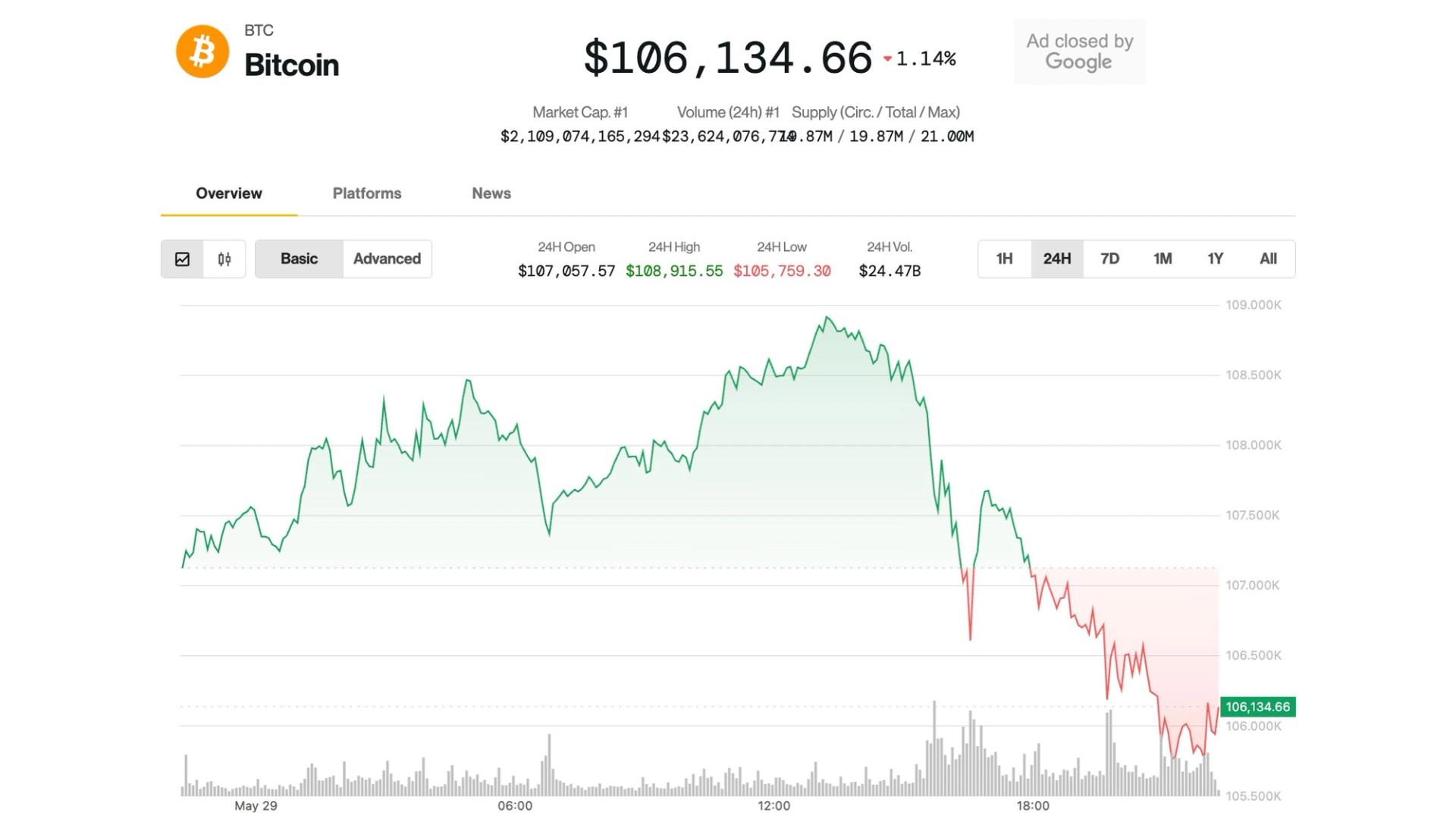

XRP has lost momentum again, dropping by 1.05% over the last 24 hours to trade at $2.29.

After a brief attempt to recover, bulls failed to break through the $2.36 resistance zone, leading to renewed selling pressure.

Market data from Kraken shows the XRP/USD pair remains under its 100-hourly Simple Moving Average (SMA), with technical indicators pointing to a potential retest of key support levels if selling continues.

This latest decline follows a modest bounce from a local low of $2.2670 earlier in the week.

XRP’s price action reflects broader weakness in the crypto market, where top tokens are struggling to maintain momentum amid macroeconomic uncertainty and regulatory headwinds.

Rising expectations of delayed interest rate cuts in the US have added pressure across all major risk assets, including cryptocurrencies.

XRP faces heavy resistance at $2.36

XRP briefly rallied above $2.320 and $2.350 earlier in the week, even climbing past the 23.6% Fibonacci retracement of the downward wave from $2.4768 to $2.2670.

It also broke a key descending trend line at $2.305, offering short-term optimism.

However, this recovery stalled at the $2.360 level—currently acting as the first major resistance.

Without a clear breakout above this zone, bears regained control, pushing the price back down to $2.29.

A move above $2.3720, which aligns with the 50% Fib retracement, would be needed for momentum to turn.

Until then, XRP remains technically weak and vulnerable to further short-term declines.

Price at risk of deeper decline below $2.260

XRP is now hovering just above the $2.280 support zone.

A sustained break below this could send the token toward $2.260. Below that, support levels sit at $2.2320 and $2.2000.

The 100-hourly SMA continues to act as a barrier to upside movement, and the chart structure still shows lower highs, confirming a bearish trend.

A close above $2.360 would be needed to change short-term sentiment, but with selling pressure intensifying, further downside remains a possibility.

Meanwhile, Ripple Labs, the company associated with XRP, continues to expand its partnerships and utility-based applications globally, including ongoing developments in central bank digital currency (CBDC) platforms.

However, these advancements have yet to translate into consistent price support for the XRP token, which remains closely tied to speculative flows and broader market sentiment dynamics.

Wider market uncertainty weighs on altcoins

The drop in XRP mirrors caution across the broader digital asset market.

Bitcoin and Ethereum have also faced resistance in recent sessions, with traders reluctant to make strong moves ahead of macroeconomic data from the US.

With no immediate bullish catalysts and interest rate speculation weighing on investor sentiment, altcoins are particularly vulnerable to further downside movement.

XRP’s next moves will likely depend on whether it can hold above the $2.260 zone.

A breakdown could extend losses and signal a deeper correction, while any bounce will require a clear move above the $2.36 and $2.3720 levels to be sustained.

The post XRP drops 1.05% to $2.29 as key resistance blocks further gains appeared first on CoinJournal.