Nvidia manages sales beat despite China restrictions hanging over AI chip giant

Jensen Huang's chip behemoth posted quarterly revenues of TK, up TK

Nvidia weathered a storm of tariff uncertainty and export controls to exceed Wall Street’s lofty expectations for sales when the AI chip behemoth reported quarterly earnings Wednesday. The hit to profits and margins came in worse than expected, however.

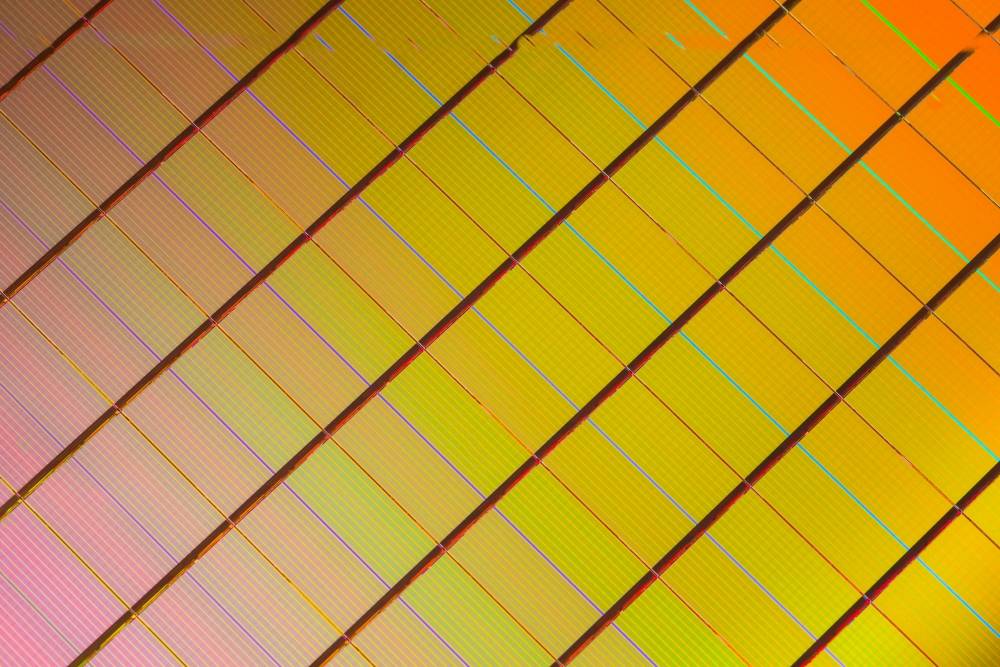

Revenue increased 69% from the same period last year, surpassing the Street’s projection of $44.1 billion, per Visible Alpha. Profits came in at $18.8 billion, though, falling from $22 billion last quarter and missing the $19.5 billion mark analysts expected. That meant Nvidia posted diluted earnings per share of $0.76, down from $0.89 last quarter and below the projected $0.79.

“Global demand for NVIDIA’s AI infrastructure is incredibly strong,” CEO Jensen Huang said in the earnings release.

“Countries around the world are recognizing AI as essential infrastructure—just like electricity and the internet—and NVIDIA stands at the center of this profound transformation,” he added.

Gross margins dipped to 60%, falling below the 66% figure Wall Street had feared. Last quarter, CFO Colette Kress said the company expected margins to be in the low 70s to start the year as Nvidia continues to ramp its next-generation Blackwell offering.

Meanwhile, new restrictions on China chip sales will continue to hit revenue going forward. The company said it expects sales in the current quarter to come in at $45 billion, below the Street’s $46 billion projection.

Dave Wagner, portfolio manager at Aptus Capital Advisors, told Fortune he thought revenue guidance of $45 billion or higher would keep most investors in the stock. For the first time since the company stormed to prominence, he said before the call, it felt like Nvidia had a relatively low bar to clear.

“Sentiment seems a little bit lower,” he said.

As Nvidia emerged as the first major darling of the AI boom—competing with Apple and Microsoft for the title of the world’s largest company by market capitalization—the company’s earnings calls became highly anticipated events for institutional and retail investors alike.

Some of that buzz may have eased, however, as the stock’s breakneck growth has waned. After skyrocketing 239% and 171% in 2023 and 2024, respectively—accounting for more than a fifth of the S&P’s 500 overall gain last year—Nvidia shares entered Wednesday’s earnings down slightly year-to-date, trading just short of the $140 mark. They had climbed more than 40%, however, after plunging as low as $94 amid President Donald Trump’s chaotic tariff rollout in early April.

Trade policy uncertainty is still hanging over the company. On April 9, the Trump administration told Nvidia it would require an export license for the H20 chip, a watered-down product the company specifically designed to comply with U.S. restrictions. Nvidia got caught a little blindsided, Thomas Martin, a partner and portfolio manager at Globalt Investments, told Fortune before the earnings call.

“Whether there’s a market for them in China under this administration at all is a reasonable question,” he said.

Nvidia said it would take a $5.5 billion charge to its inventory, with Huang revealing last week that the company had walked away from $15 billion in annual sales in China. Last quarter, the CEO told analysts revenues in the country had been roughly halved since the onset of export controls during Joe Biden’s presidency.

Regardless, Nvidia is still the bellwether of the AI trade, and Huang has continuously touted ravenous demand for its new Blackwell infrastructure. Both tariffs and the surprise success of Chinese AI startup DeepSeek, which sparked questions about the seemingly insatiable demand for greater processing power, is yet to dent the AI spending wave, with Big Tech set to splash roughly $320 billion on capital expenditures this year.

For now, that means companies continue to jostle to be first in line for the latest and greatest of what Nvidia has to offer.

This story was originally featured on Fortune.com