Best crypto to buy as global companies continue to load up on BTC

Retail focus is turning to alternative narratives like Bitcoin Pepe, which is nearing the end of its presale. Bitcoin Pepe’s presale has raised over $11.8 million, investors can still scoop up the coin at $0.0377. To advance its Layer 2 ecosystem, Bitcoin Pepe has formed strategic partnerships. The total crypto market capitalisation has slipped 0.8% […] The post Best crypto to buy as global companies continue to load up on BTC appeared first on CoinJournal.

- Retail focus is turning to alternative narratives like Bitcoin Pepe, which is nearing the end of its presale.

- Bitcoin Pepe’s presale has raised over $11.8 million, investors can still scoop up the coin at $0.0377.

- To advance its Layer 2 ecosystem, Bitcoin Pepe has formed strategic partnerships.

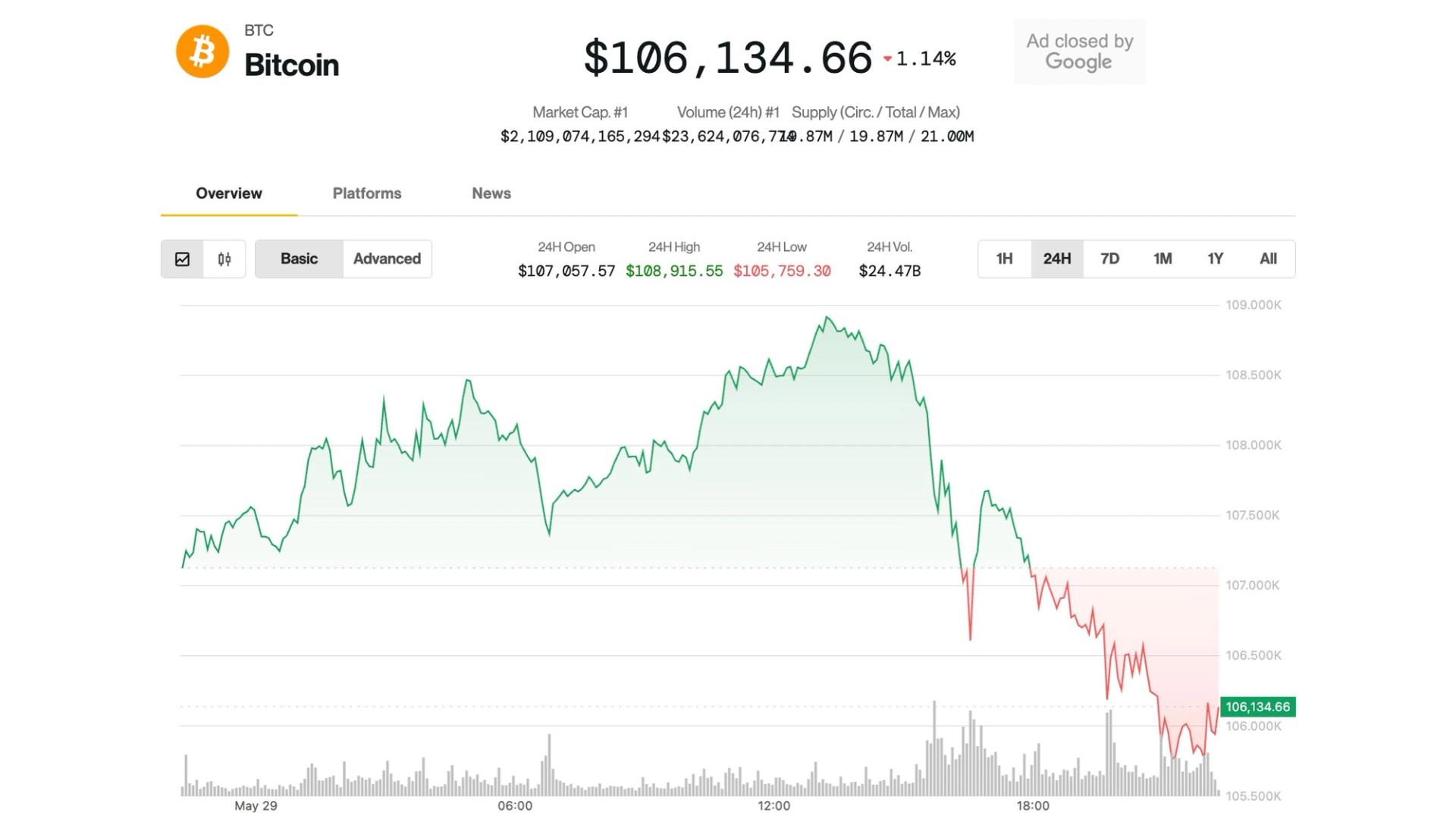

The total crypto market capitalisation has slipped 0.8% over the past 24 hours to $3.43 trillion.

The retreat is notable, especially given the uptick in risk appetite across equity markets over the last two days, underscoring a more restrained mood in the crypto sector.

Bitcoin has traded within a narrow range since May 22, moving between $106,600 and $111,700. It currently sits near $108,000, suggesting continued consolidation.

As BTC holds steady and some investors take profits, retail focus is turning to alternative narratives like Bitcoin Pepe, which is nearing the end of its presale.

Bitcoin’s maturing profile, with lower volatility and increased institutional involvement, has made it less attractive to high-risk, high-reward traders.

In contrast, interest is building around speculative plays such as Bitcoin Pepe, where investors are betting on early-stage momentum and the potential for outsized returns.

Corporations continue to purchase BTC

Metaplanet has issued its largest tranche of 0% ordinary bonds to date, raising $50 million through a deal with venture capital firm EVO FUND.

The issuance, announced recently, marks the Tokyo-based investment firm’s 16th series of ordinary bonds and continues its strategy of using bond proceeds to increase Bitcoin holdings.

The company confirmed that the $50 million will be allocated toward additional Bitcoin purchases.

As of May 19, Metaplanet holds 7,800 BTC, with its total Bitcoin investments valued at approximately $846.9 million at current market prices.

CEO Simon Gerovich has reiterated the company’s goal of reaching 10,000 BTC by the end of 2025.

In a similar move, GameStop announced on Wednesday that it has purchased 4,710 Bitcoins, marking its entry into cryptocurrency investment.

The acquisition, valued at around $513.6 million based on Wednesday’s BTC price of about $108,000, signals a strategic shift for the video game retailer, echoing a playbook made famous by MicroStrategy.

Why Bitcoin Pepe is grabbing attention

Bitcoin’s recent advance to new highs is reinforcing market sentiment, a pattern that has historically signaled the start of broader rallies within the crypto sector.

As funds flow back into digital assets, speculative areas like meme coins are gaining traction among investors.

Bitcoin Pepe is emerging as a prominent beneficiary of this trend.

As the first meme-centric Layer 2 protocol on the Bitcoin network, Bitcoin Pepe combines meme culture with practical blockchain utility.

To advance its Layer 2 ecosystem, Bitcoin Pepe has formed strategic partnerships, including with Super Meme and Plena Finance. Furthermore, collaboration with the GETE Network aims to expand its presence into the cross-chain Web3 gaming arena.

This strategy clearly seeks to blend real-world utility with meme-driven appeal—a combination positioned to resonate in the current market climate.

Investor response is strong. Bitcoin Pepe’s presale has raised over $11.8 million, with BPEP tokens currently priced at $0.0377.

With the presale ending on May 31, 2025—just three days away—the project is attracting significant attention.

A centralized exchange listing is anticipated soon after, potentially serving as a near-term price catalyst.

The post Best crypto to buy as global companies continue to load up on BTC appeared first on CoinJournal.