Flipspaces raises Rs 50 Cr from Asiana Fund to expand global footprint

Flipspaces also aims to invest in its proprietary technology platform and explore strategic acquisitions in new markets and adjacent categories.

Commercial interior design startup Flipspaces on Thursday said it raised Rs 50 crore (about $5.9 million) from Asiana Fund, as part of a broader $35 million funding round.

According to a statement, the new capital will support the company’s plans to scale its operations in India, the US, and the UAE.

Flipspaces also aims to invest in its proprietary technology platform and explore strategic acquisitions in new markets and adjacent categories.

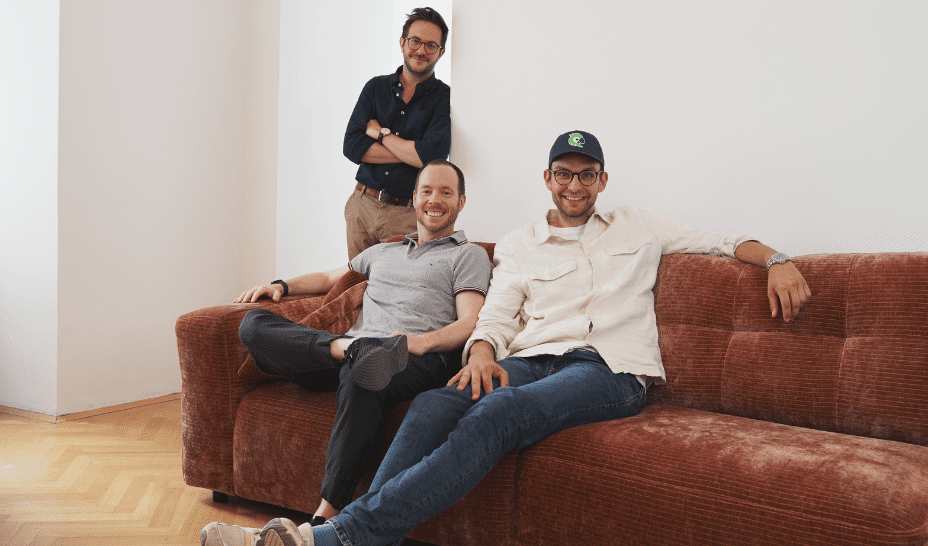

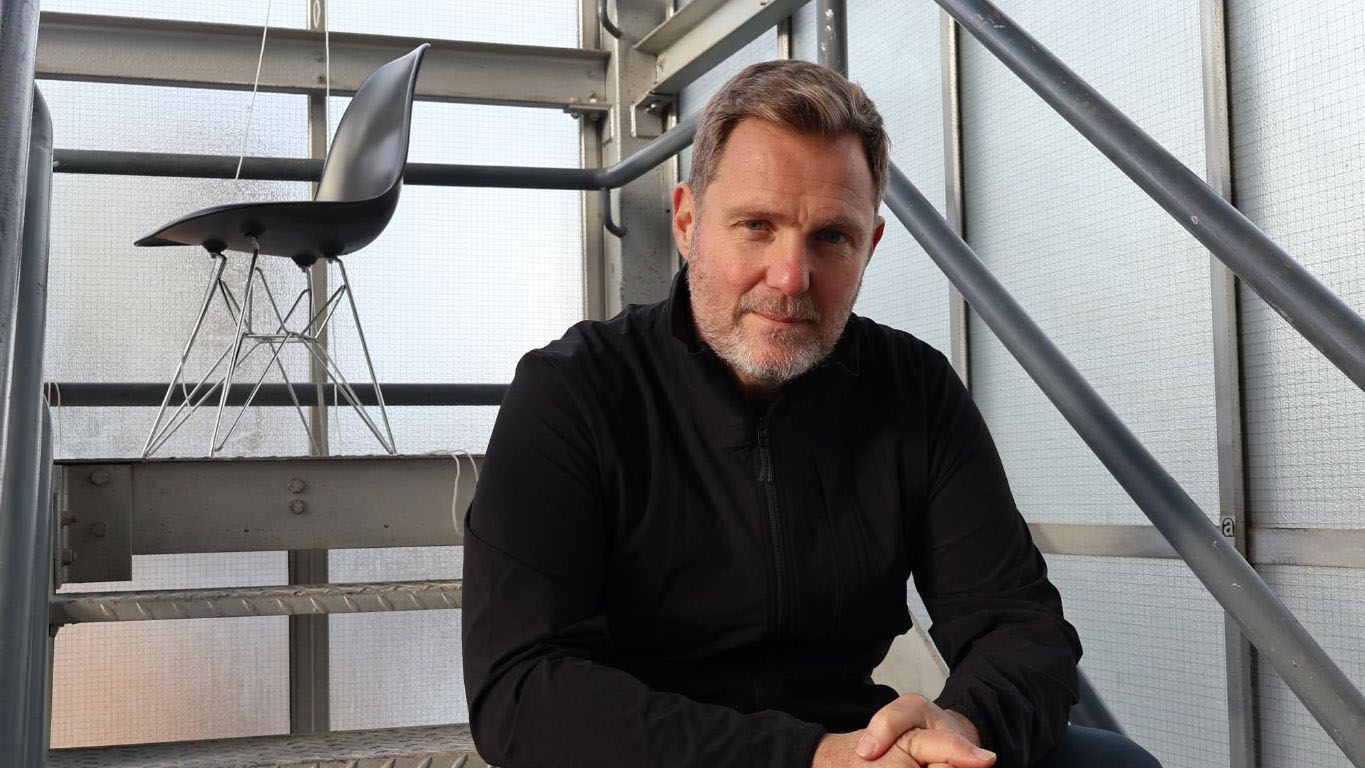

“Asiana team’s collective experience of over 10 decades in scaling operations and building customer-centric brands will be invaluable to Flipspaces. Our core team will benefit tremendously from their insights and assistance,” said Kunal Sharma, Founder and CEO of Flipspaces. Flipspaces Co-founders (L:R) - Ankur Muchhal; Ritesh Ranjan(CPO); Kunal Sharma(CEO); Mrinal Sharma; Vikash Anand

Founded in 2015 by Kunal Sharma, Ankur Muchhal, Vikash Anand, Mrinal Sharma, Prafful Sahu, and Ritesh Rajan, Flipspaces offers end-to-end design and build services for commercial spaces, supported by a technology stack, including space visualisation, project management, and product sourcing tools.

The round also saw participation from existing investors Synergy Capital Partners, Iron Pillar, and a consortium led by Prashasta Seth. Asiana Fund is sponsored by Jalaj Dani, a promoter of Asian Paints Limited.

Commenting on the investment, Jalaj Dani said Flipspaces has developed robust systems and processes that have the potential to bring greater efficiency and transparency to the commercial interiors space.

Synergy Capital’s Managing Partner Apurva Patel added, “We are elated with Asiana Fund joining our investor group to participate in the Flipspaces transaction, and are looking forward to working closely with Asiana’s team to help Flipspaces achieve its vision.”

Edited by Suman Singh

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)