Adda gives skilling a big push as it looks beyond test-prep

Adda is channelling its efforts into the technology and BFSI sectors. As a late entrant to the skilling game, the edtech firm has its task cut out. Skilling demands heavy investments, which could inflate burn rates, delay profitability, and possibly stretch the timeline of its IPO, caution experts.

S-K-I-L-L. This five-letter word stands between staying relevant in the job market and falling behind in today’s world where workplaces and job requirements are evolving faster than ever.

Whether it’s a college student mapping their future or a seasoned professional navigating change, everyone is asking themselves the same questions: Do I have the relevant skills for tomorrow? What skill should I acquire next?

One thing is clear: the need to upskill or reskill has never been greater, especially in the tech and BFSI (banking, financial services, and insurance) sectors.

Skills in data science, data analytics, digital marketing, and generative AI are all in great demand, and this is the space that learning platform Adda is keen to tap into.

WestBridge- and Google-backed Adda Education (more on this new branding later) has built its name helping millions of candidates prepare for competitive exams. Delivering content in 12 regional languages, besides English, the company primarily provides coaching for government exams for jobs in banking, railways, defence, police, teaching, judiciary, and civil services, besides the common university entrance test (CUET).

However, it now wants to do more than just get students past tests for government jobs.

As it eyes a public listing, the learning platform is making a big splash into skilling, hoping to create an adda of sorts for people to acquire job-related skills in the private sector. To drive its next wave of growth, it has invested more than Rs 30 crore in skilling in the last six months, and a lot more is to come.

While Adda had a negligible presence in skilling earlier, it began to focus seriously on it with the acquisition of tech skilling and placement platform PrepInsta in September last year, followed by the formal launch of career discovery and preparation platform Career247 and other investments in the skilling vertical.

Adda Education’s Founder and CEO, Anil Nagar, says, “A year ago, we started thinking about how we could support our students beyond government jobs, which are limited in number. Initially, we were cautious as our audience came for government jobs; we weren’t sure they would be open to private-sector pathways.”

Referring to the growth in the skilling vertical in recent times, he adds, “The last six months have been phenomenal. We are growing month by month; I’m excited about what’s ahead.”

The opportunity is massive, and so are the stakes in the skilling game.

While the appetite for upskilling is growing among those in or aspiring to join the workforce, there is also increased competition among players in the space, including Eruditus, upGrad, Great Learning, Simplilearn, and Scaler. In fact, all these players have made skilling their mainstay.

Interestingly, Adda’s rival PhysicsWallah, which is primarily into test prep, too has made big investments in the skilling segment.

As a late entrant to the skilling game Adda has its task cut out. Skilling demands heavy investments, which could inflate burn rates, delay profitability, and possibly stretch the timeline of its IPO, caution industry experts.

However, challenges notwithstanding, the Gurugram-based firm is approaching skilling with intent. At the helm is Bimaljeet Singh Bhasin, an industry veteran with nearly 25 years of experience in leadership roles at NIIT Limited, Manipal Global Education Services, and Wipro. He joined Adda a year ago to lead its skilling and higher education vertical.

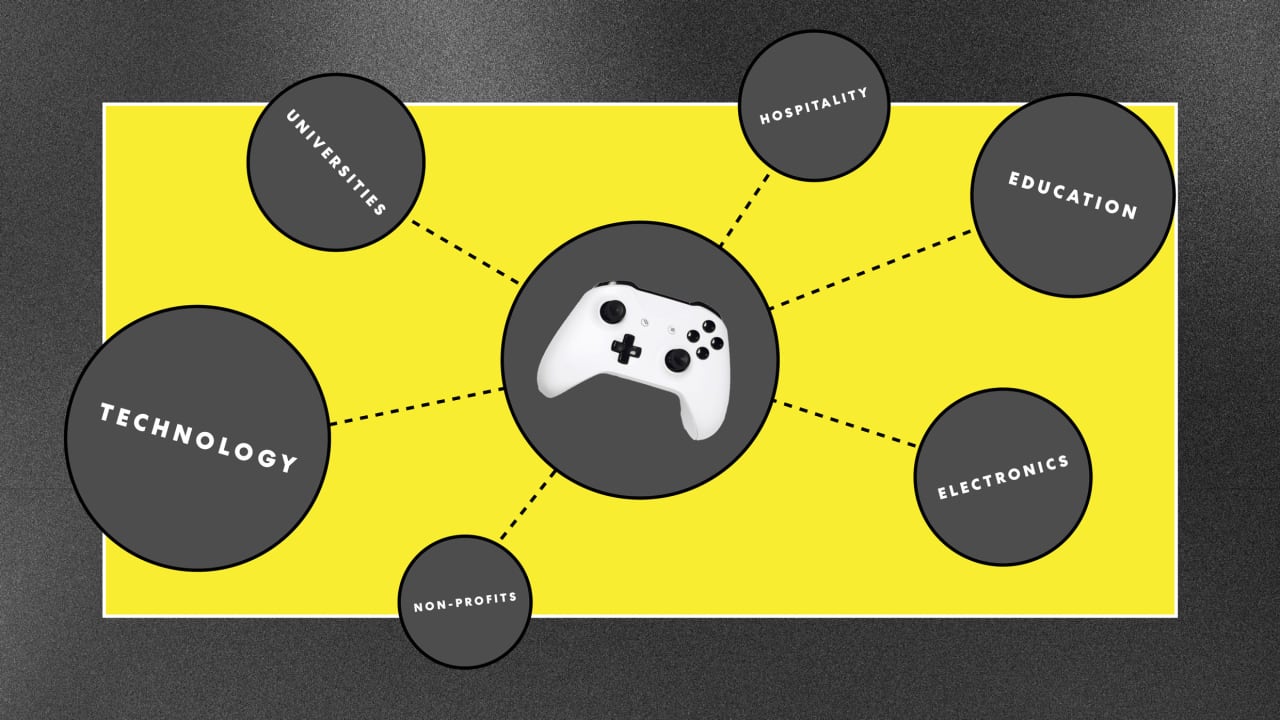

The skilling vertical makes up around 10% of Adda’s 2,100 workforce; this includes employees from PrepInsta as well. Design: Nihar Apte

Building a portfolio

Adda is channelling its skilling efforts into technology and BFSI (banking, financial services, and insurance)—sectors with good employment opportunities.

The acquisition of PrepInsta laid the groundwork for technology skilling.

PrepInsta offers a subscription-based self-learning online service in collaboration with colleges and universities to help final-year students prepare for assessments and interviews for tech jobs at companies like Infosys, Wipro, Cognizant, IBM, and Google.

Alongside PrepInsta, the company is also developing its BFSI skilling initiative in-house through the launch of the Career247 online skilling platform.

Career247 offers courses in areas such as data science, data analytics, digital marketing, generative AI, and BFSI. The BFSI module covers a wide range of roles in banking and financial services through cohort-based learning, wherein learners (college students and people in the early stage of their career) learn together as a group of 100-200, following a schedule.

Although there is an overlap between the technology skills that PrepInsta and Career247 offer, they are aimed at different audiences.

Career247 directly targets individual students (B2C), while PrepInsta works in collaboration with colleges and companies (B2B/B2I).

The B2C channel currently accounts for 80% of Adda’s skilling business, while the remaining comes from B2B or B2I (business-to-institute), says Nagar, adding that he expects the B2B/B2I segment to contribute more significantly in the future. Design: Nihar Apte

Through its skilling platforms, Adda offers certifications, online degrees, job-assisted programmes that offer support in finding jobs, and job-linked programmes that are directly tied to hiring. Currently the company offers skill training in English in Hindi and plans to add Telugu and Tamil in six months.

Alongside its online offerings, the edtech firm is also looking to establish an offline presence for its skilling initiatives. It is planning to set up two physical centres of excellence, focused on banking and artificial intelligence.

Under Career247’s banking programmes, candidates undergo two months of in-person training before being placed in private sector banks. Building a dedicated banking centre will formalise and scale this effort, says Nagar.

Through all these efforts, the company is attempting to create different pathways to employability.

“In my village, there are many young people who struggle to find jobs. They may have preferences like wanting to go into one field or another but ultimately, what matters most is employment. That’s how we view this: as an employability platform that builds a bridge between learning and actual job outcomes,” he shares.

Skilling and upskilling will continue to stay in demand as it helps students and professionals to stay relevant and prepared for growth and new opportunities, says Anil Joshi, Managing Partner of Unicorn India Ventures, which has invested in the edtech sector.

“Hence, Adda's strategy to focus on skilling has benefitted them in growing their footprint,” he says. Design: Nihar Apte

Striking a balance

Having said that, investing in skilling comes at a cost—and Adda knows it. A key priority for the company is to move towards profitability, especially with plans to go public in the next few years.

The focus, Nagar says, is on striking a balance: reduce burn while growing organically and expanding into new business areas such as skilling.

It all boils down to good planning and leadership.

If leaders are capable of owning the P&L (profit and loss), execution becomes simpler. For instance, under BFSI, the company has clearly delineated the initiative, the investment required, and the team that will take it forward. The senior leader takes full ownership of the vertical and drives it on the ground, Nagar elaborates.

He expects the skilling push to bear initial fruits this fiscal year, with the vertical expected to contribute 20–25% to the group’s revenue. He sees this growing to 30–40% in the coming years, as the company moves closer to its IPO.

“That’s a very ambitious target, and it is achievable. But their burn will go up, because their organic funnel isn’t fully built yet,” notes a senior executive at an edtech firm.

Ramping up the skilling arm entails a hefty capital outlay on content creation, marketing, platform upgrades, partnerships, hiring specialised talent, and setting up physical infrastructure.

While these investments are essential for scale and long-term growth, they could inevitably drive burn rate and delay profitability in the near term, caution industry experts.

“If the processes aren’t fixed, then stepping on the accelerator will only worsen things. Customer experience will take a hit, which in turn will damage referrals and word-of-mouth traction. As a result, much more will need to be spent on marketing to acquire customers, pushing customer acquisition costs (CAC) through the roof,” says the edtech executive.

By ‘processes’, he means the foundational systems that support sustainable growth—such as customer onboarding, learner engagement, course completion, and job placement mechanisms.

In FY24, Adda247, which includes the government test-prep business and Career247, reported Rs 243.39 crore in total revenue, an 88% jump from the previous year, while its net loss narrowed by 66% to Rs 101 crore. Design: Nihar Apte

While Nagar asserts that the company has narrowed its losses further in FY25, he does not disclose the top-line or bottom-line figures for the period. He says the goal is to make the government test-prep segment profitable this fiscal year (FY26) and achieve profitability at the group level by next year (FY27).

“Over 12–18 months, our focus is to double down on high-retention, outcome-led categories (which include skilling) where we have seen strong traction. We are also streamlining our portfolio, reducing CAC through organic channels and deeper learner engagement,” says Nagar.

Other challenges

Apart from a high burn rate, scaling the skilling vertical comes with other hurdles, such as customer acquisition and building sustainable operations.

“If you are targeting a scattered or disjointed audience, customer acquisition and building a sustainable business become difficult,” admits Nagar.

Adda could face challenges in drawing young people to enrol in the BFSI courses, opines the edtech executive quoted earlier.

He says, “Most roles in BFSI are in sales or customer-facing. Gen Z often finds such roles unappealing. So, the industry needs talent, the people exist, but many young people don’t want the jobs on offer. This mismatch could make Adda’s BFSI bet harder to pull off.”

However, Nagar believes the company's strong community connect and regional focus can make a difference here.

“We started this company for people from smaller towns and cities. We want to stay true to that mission and solve their employability problems as much as we can."

The edtech firm's skilling programmes in BFSI are designed to tackle a key industry challenge: high attrition and talent scarcity in Tier II and III cities.

With banks expanding into these regions, the need for reliable, local talent is growing. Upskilling candidates from small towns and cities helps reduce dependency on hiring from the metros—this improves retention and ensures strong alignment between candidates and job roles, says Nagar.

The company has partnered with about seven banks to run specialised training initiatives (largely online, along with some offline elements), including Axis Bank Sales Academy and Priority Banking Programme, to create a steady pipeline of job-ready professionals from smaller towns.

Eyes on IPO

Adda247 had last raised $35 million in October 2022 in a Series C funding round led by WestBridge Capital. The round also saw participation from Google, along with existing investors such as Info Edge Ventures and Asha Impact. In total, it has raised $63 million till date.

As the edtech company strengthens its skilling vertical and builds capacity in offline training, it is laying the groundwork for long-term growth and IPO readiness.

With the IPO buzz growing louder than ever in the startup ecosystem, it only seems natural for a growth-stage startup like Adda to eye a public listing.

Nagar points out that, when Adda reaches a revenue of Rs 600 crore to Rs 700 crore, that would be the ideal time for it to pursue a public listing. “If everything goes well, FY28 might be the time when we file for an IPO,” he says.

He outlines two key reasons driving the company’s IPO ambition.

First, going public provides liquidity and the strategic power to pursue inorganic growth through acquisitions and investments.

Second, it boosts brand visibility and trust, critical in a space like edtech, where credibility has taken a hit in recent times due to a few high-profile stumbles.

A listed company, Nagar believes, signals stability and long-term commitment.

While investor exits are not the main motive, he acknowledges they are part of the equation. Long-time backers are accountable to their limited partners who expect returns. “It’s our responsibility to give them good returns.” Design: Nihar Apte

Keeping its IPO target in mind, the company has created a unified corporate identity under ‘Adda Education’, integrating all its platforms.

“We have multiple platforms, each with its own identity and user base. Our aim was to bring them all under a single corporate brand—Adda Education—without changing anything for the users. Each platform will continue to operate as it is,” says Nagar.

Adda Education now serves as the umbrella for Adda247, StudyIQ, PrepInsta, Career247, CUET Adda, Career Power, Veeksha, and Ekagrata Eduserv.

Much of Adda’s IPO readiness may ultimately hinge on whether its skilling vertical delivers. If the company can scale this new business smartly—aligning with market demand, ensuring strong learning outcomes, and building reliable job linkages—it could significantly improve both revenue visibility and investor confidence, say industry watchers.

They add that the skilling gamble could pay off, but only if Adda stays focused on execution and operational discipline. The rewards won’t come overnight, they insist, but if the skilling initiative clicks, it could be the growth engine that drives Adda’s next leap.

(Cover image and infographics designed by Nihar Apte)

Edited by Swetha Kannan

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)