Kraken Gains MiCA Licence from Ireland as Euro-Denominated Crypto Trading Doubles

Kraken has become the first cryptocurrency exchange to receive a Markets in Crypto-Assets Regulation (MiCA) licence from the Central Bank of Ireland. Its European presence has strengthened following a sharp rise in euro-denominated spot trading, which now accounts for 17.5 per cent of its total volume.The Rush to Gain a MiCA Licence“Being the first major global crypto platform to receive authorisation from the CBI affirms Kraken’s commitment to building for the long term,” said Arjun Sethi, co-CEO of Kraken.“Over the past several years, our team has worked tirelessly to meet the CBI’s gold-standard regulatory expectations.”Kraken is among several exchanges to receive a MiCA licence after the European bloc made the regulations mandatory last year. Other major players include Crypto.com and OKX, which received theirs from Malta, while Coinbase and Bitstamp were approved by Luxembourg’s regulator. Notably, Europe-based Bitpanda secured MiCA licences from three countries, including its home country, Austria.Although a single EU national authority grants the MiCA licence, it allows the holder to “passport” services across all 30 EEA states.Larger platforms such as Binance and Gemini have confirmed their applications are underway, but no licence has been granted yet.Rad more: MiCA's Impact Reaches Beyond Regulated FirmsKraken’s Expanding FootprintBefore receiving the MiCA licence, Kraken already held Virtual Asset Service Provider (VASP) registrations in Ireland, Belgium, France, Italy, the Netherlands, Poland and Spain. It also obtained an electronic money licence from the Irish regulator last year.However, Kraken is not only focused on the European spot markets. The exchange acquired a Cyprus-based contracts for differences (CFDs) broker to secure a Markets in Financial Instruments Directive (MiFID II) licence. Last month, it began offering crypto derivatives, including perpetual and fixed-maturity contracts, under the MiFID licence.Kraken is one of the oldest crypto exchanges still in operation. It is now expanding into traditional finance. The exchange bought US-based futures trading platform NinjaTrader in a $1.5 billion deal and recently announced plans to launch tokenised stocks. This article was written by Arnab Shome at www.financemagnates.com.

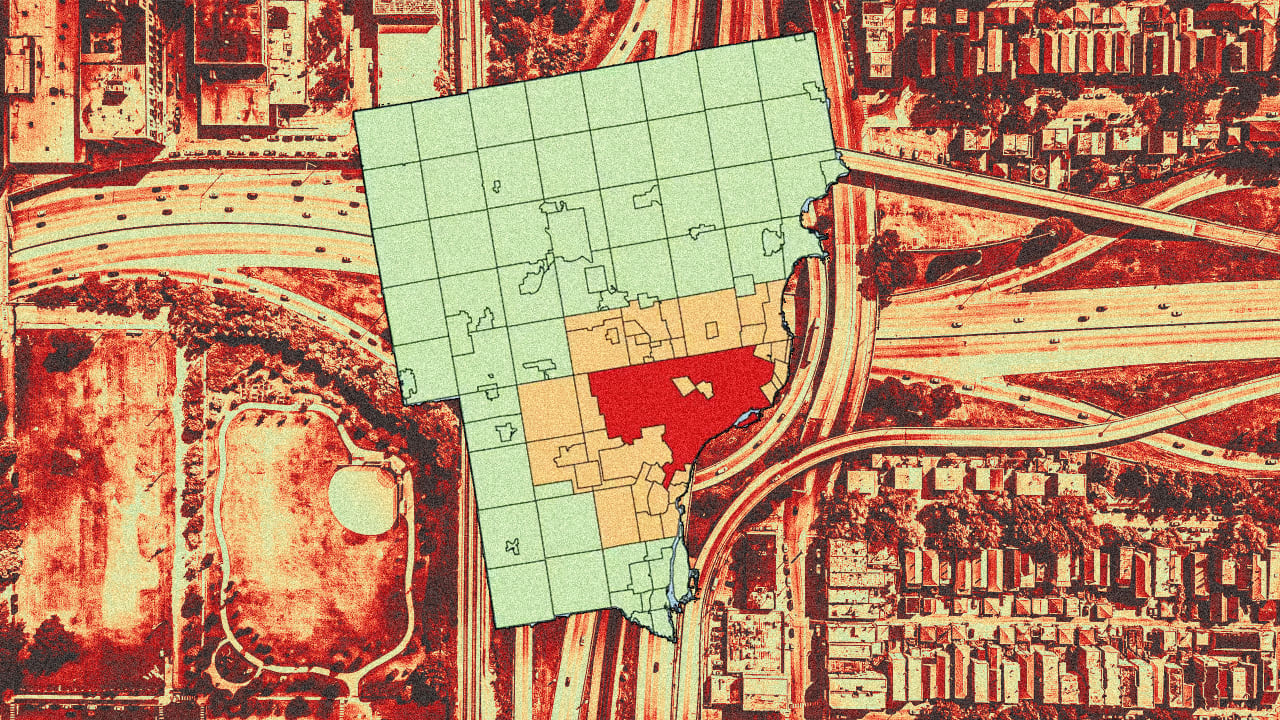

Kraken has become the first cryptocurrency exchange to receive a Markets in Crypto-Assets Regulation (MiCA) licence from the Central Bank of Ireland. Its European presence has strengthened following a sharp rise in euro-denominated spot trading, which now accounts for 17.5 per cent of its total volume.

The Rush to Gain a MiCA Licence

“Being the first major global crypto platform to receive authorisation from the CBI affirms Kraken’s commitment to building for the long term,” said Arjun Sethi, co-CEO of Kraken.

“Over the past several years, our team has worked tirelessly to meet the CBI’s gold-standard regulatory expectations.”

Kraken is among several exchanges to receive a MiCA licence after the European bloc made the regulations mandatory last year. Other major players include Crypto.com and OKX, which received theirs from Malta, while Coinbase and Bitstamp were approved by Luxembourg’s regulator. Notably, Europe-based Bitpanda secured MiCA licences from three countries, including its home country, Austria.

Although a single EU national authority grants the MiCA licence, it allows the holder to “passport” services across all 30 EEA states.

Larger platforms such as Binance and Gemini have confirmed their applications are underway, but no licence has been granted yet.

Rad more: MiCA's Impact Reaches Beyond Regulated Firms

Kraken’s Expanding Footprint

Before receiving the MiCA licence, Kraken already held Virtual Asset Service Provider (VASP) registrations in Ireland, Belgium, France, Italy, the Netherlands, Poland and Spain. It also obtained an electronic money licence from the Irish regulator last year.

However, Kraken is not only focused on the European spot markets. The exchange acquired a Cyprus-based contracts for differences (CFDs) broker to secure a Markets in Financial Instruments Directive (MiFID II) licence. Last month, it began offering crypto derivatives, including perpetual and fixed-maturity contracts, under the MiFID licence.

Kraken is one of the oldest crypto exchanges still in operation. It is now expanding into traditional finance. The exchange bought US-based futures trading platform NinjaTrader in a $1.5 billion deal and recently announced plans to launch tokenised stocks. This article was written by Arnab Shome at www.financemagnates.com.

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)