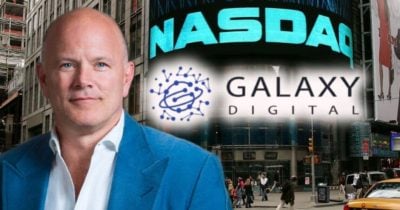

Exclusive: Crypto giant Galaxy raises $175 million for first venture fund

The publicly traded company is led by blockchain veteran Mike Novogratz.

Mike Novogratz, a colorful former Goldman Sachs partner and blockchain industry veteran, founded Galaxy in 2018 to bridge the worlds of traditional finance and crypto. After years of investing in digital assets startups using capital from its balance sheet capital, Galaxy is expanding its venture business through a $175 million fund. On Thursday, the company announced the final close of the fund, which exceeded its initial target of $150 million.

In an interview with Fortune, Galaxy general partner Mike Giampapa said the firm decided to grow its venture capital operations in order to broaden its bets into startups working on the growing intersection between traditional finance and crypto, including stablecoins and decentralized finance applications. “You’re seeing this fundamental shift from more speculative use cases of blockchains to something that’s much more…tangible,” Giampapa said.

The vehicle is Galaxy’s first to take outside capital, though it is anchoring the fund through its own balance sheet capital, with Galaxy serving as a limited partner in the fund along with owning a general partner stake. As a publicly traded company after listing on the Nasdaq in May, Galaxy’s new fund also offers retail investors a rare opportunity to gain exposure to a crypto venture portfolio.

Crypto empire

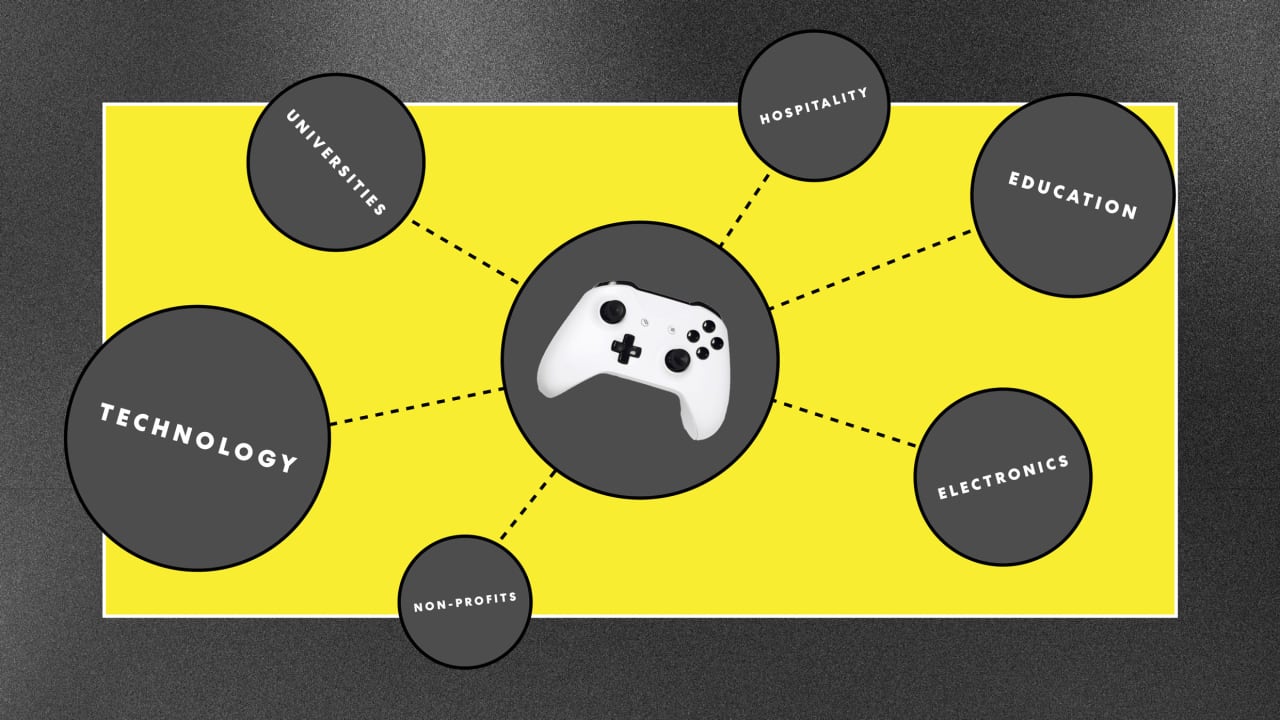

Galaxy operates in a wide scope of business lines, ranging from asset management to crypto mining to its own Bitcoin ETF, which the company launched in conjunction with the investment company Invesco in early 2024. Galaxy is also exploring launching a Solana ETF. Though the company has had a rocky history, including a disastrous investment (and ensuing legal headache) in the failed stablecoin Luna, Galaxy has grown into one of the most influential U.S. crypto empires.

In May, the company reported around $7 billion of assets under management, though it had a net loss of $295 million in the first quarter of 2025 due to dropping crypto prices and costs related to winding down some of its mining operations.

While Galaxy has long been a major player in the crypto venture space, investing in startups such as the crypto custodian Fireblocks, Giampapa said the company decided to raise outside capital for a dedicated venture fund following the collapse of Sam Bankman-Fried’s crypto exchange FTX in 2022 and the subsequent downturn in prices. “Quietly, we had this stablecoin revolution,” he told Fortune. “While the industry was getting our feet underneath us again, it became obvious that we wanted to take our venture franchise to the next level.”

Galaxy began to raise capital in 2024. Though Giampapa declined to name the investors in the fund, he said many of the limited partners are institutional investors, including family offices and fund of funds, that work with Galaxy’s asset management business. Galaxy announced an initial close of $113 million last July.

He added that Galaxy has never taken a corporate venture approach, where some corporations invest in companies that are synergistic to their business lines. Instead, Galaxy has followed a more traditional strategy of focusing on returns, which it will continue with its newly raised venture fund. According to Giampapa, Galaxy has already deployed around $50 million of the fund, investing in companies including the trading-focused blockchain Monad and the synthetic dollar protocol Ethena, which issues a yield-bearing stablecoin backed by crypto assets. Giampapa, who previously worked at venture firms IVP and Bessemer, is running the fund alongside Will Nuelle.

As a piece of Galaxy’s broader crypto operation, the venture fund has strategic overlap with other parts of the business, said Giampapa, such as helping connect them with its institutional customer base.

“We’ve had this thesis going back pretty much since Galaxy’s inception, which is we think these two worlds are colliding,” Giampapa told Fortune. “We want to invest at the earliest stages.”

This story was originally featured on Fortune.com

![Snapchat Shares Trend Insights for Marketers To Tap Into This Summer [Infographic]](https://imgproxy.divecdn.com/7LB56F586EcY82vl5r47Ba6f7RdKcHkNelnSgSe8Umc/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zbmFwX2tzYTIucG5n.webp)

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)