Crypto.com Exchange Takes Nevada to Court Over Event Contracts and Sports Betting Ban

The derivatives division of cryptocurrency exchange Crypto.com has filed a federal lawsuit against Nevada's gaming regulators, alleging the state improperly blocked the company from offering sports-related financial binary event contracts to residents.Crypto.com Takes Nevada to Court Over Event Contracts BanNorth American Derivatives Exchange Inc., operating as Crypto.com's derivatives business, filed the complaint Tuesday in U.S. District Court for Nevada against the Nevada Gaming Control Board. The lawsuit represents the latest escalation in a broader conflict between state gaming authorities and federally regulated prediction markets.The legal challenge centers on whether state gaming laws can govern financial instruments regulated by federal authorities. Crypto.com maintains that the Commodity Futures Trading Commission holds exclusive jurisdiction over its event-based derivatives contracts under the Commodity Exchange Act."NGCB has no authority to regulate, let alone prohibit, derivatives trading offered by a federally regulated designated contract market operating pursuant to federal law," the company stated in its filing.Nevada gaming officials sent Crypto.com a cease-and-desist letter on May 20, threatening criminal and civil penalties unless the exchange stopped offering sports event contracts to Nevada residents. The state contends these products constitute illegal sports wagering under Nevada law.You may also like: Crypto.com’s Annual Sports Spending at $213M Is 3x That of CoinbasePrecedent from Similar CasesCrypto.com's legal strategy draws heavily on recent federal court victories involving prediction marketplace KalshiEX. In April, U.S. District Judge Andrew Gordon blocked Nevada gaming regulators from taking enforcement action against Kalshi, the most popular provider of event-based contracts, ruling that federal law preempts state authority over CFTC-regulated event contracts.Similar rulings emerged from disputes with New Jersey gaming authorities, establishing a pattern of federal courts siding with CFTC-regulated platforms over state gaming boards.Last month, FinanceMagnates.com conducted an analysis and spoke with industry representatives to explore whether event contracts still qualify as investments or whether they resemble binary options (banned in Europe) and pure gambling. While opinions on the matter remain sharply divided, Jack Such of Kalshi, who is responsible for Business & Media Development, claims they have the potential to become “a trillion-dollar asset class.”Related: CFTC Folds Its Hand in Election Betting Showdown with KalshiRegulatory Scrutiny ContinuesBoth Crypto.com and Kalshi previously faced CFTC scrutiny over Super Bowl-related contracts in February. The federal regulator investigated whether these products complied with existing derivatives regulations, though both companies maintained their offerings were legally compliant.Robinhood, which briefly offered similar prediction markets through Kalshi's platform, withdrew its March Madness contracts from New Jersey following regulatory pressure, though the company later resumed offering prediction trading products.Crypto.com is requesting a permanent injunction preventing Nevada from enforcing gaming laws against its federally regulated derivatives business. The company also seeks a declaratory judgment confirming that federal law preempts state gaming authority over CFTC-regulated event contracts. This article was written by Damian Chmiel at www.financemagnates.com.

The derivatives division of cryptocurrency exchange Crypto.com has filed a federal lawsuit against Nevada's gaming regulators, alleging the state improperly blocked the company from offering sports-related financial binary event contracts to residents.

Crypto.com Takes Nevada to Court Over Event Contracts Ban

North American Derivatives Exchange Inc., operating as Crypto.com's derivatives business, filed the complaint Tuesday in U.S. District Court for Nevada against the Nevada Gaming Control Board. The lawsuit represents the latest escalation in a broader conflict between state gaming authorities and federally regulated prediction markets.

The legal challenge centers on whether state gaming laws can govern financial instruments regulated by federal authorities. Crypto.com maintains that the Commodity Futures Trading Commission holds exclusive jurisdiction over its event-based derivatives contracts under the Commodity Exchange Act.

"NGCB has no authority to regulate, let alone prohibit, derivatives trading offered by a federally regulated designated contract market operating pursuant to federal law," the company stated in its filing.

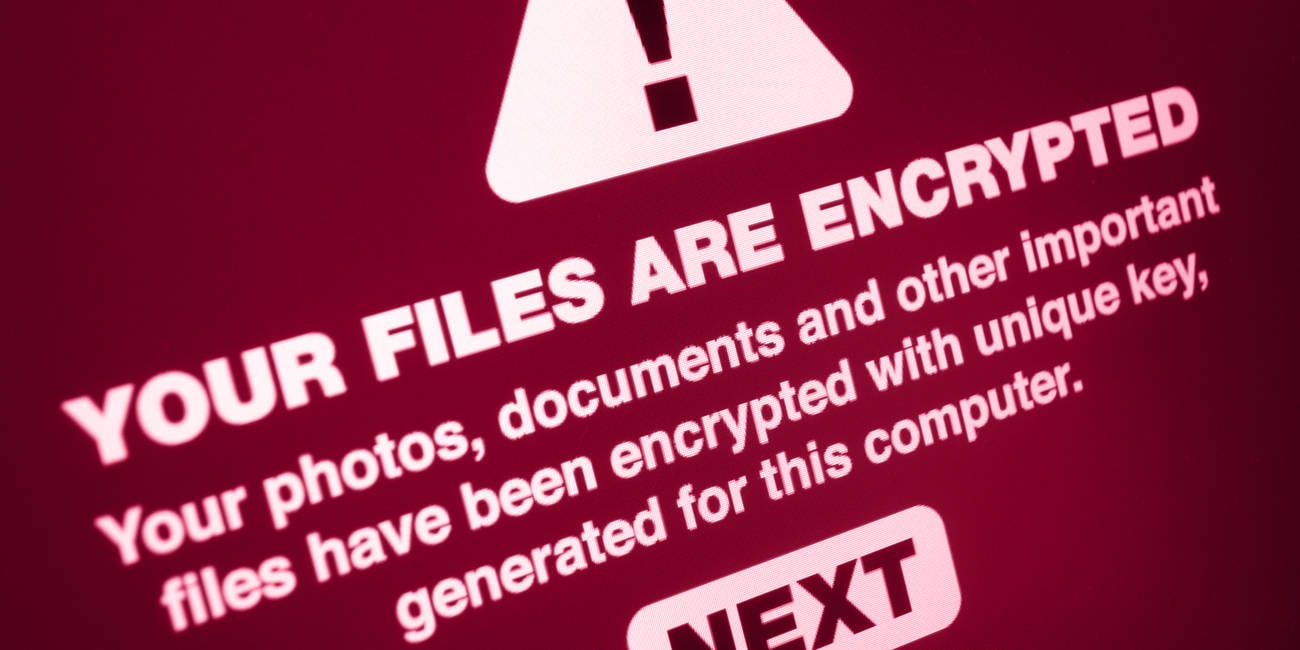

Nevada gaming officials sent Crypto.com a cease-and-desist letter on May 20, threatening criminal and civil penalties unless the exchange stopped offering sports event contracts to Nevada residents. The state contends these products constitute illegal sports wagering under Nevada law.

You may also like: Crypto.com’s Annual Sports Spending at $213M Is 3x That of Coinbase

Precedent from Similar Cases

Crypto.com's legal strategy draws heavily on recent federal court victories involving prediction marketplace KalshiEX. In April, U.S. District Judge Andrew Gordon blocked Nevada gaming regulators from taking enforcement action against Kalshi, the most popular provider of event-based contracts, ruling that federal law preempts state authority over CFTC-regulated event contracts.

Similar rulings emerged from disputes with New Jersey gaming authorities, establishing a pattern of federal courts siding with CFTC-regulated platforms over state gaming boards.

Last month, FinanceMagnates.com conducted an analysis and spoke with industry representatives to explore whether event contracts still qualify as investments or whether they resemble binary options (banned in Europe) and pure gambling. While opinions on the matter remain sharply divided, Jack Such of Kalshi, who is responsible for Business & Media Development, claims they have the potential to become “a trillion-dollar asset class.”

Related: CFTC Folds Its Hand in Election Betting Showdown with Kalshi

Regulatory Scrutiny Continues

Both Crypto.com and Kalshi previously faced CFTC scrutiny over Super Bowl-related contracts in February. The federal regulator investigated whether these products complied with existing derivatives regulations, though both companies maintained their offerings were legally compliant.

Robinhood, which briefly offered similar prediction markets through Kalshi's platform, withdrew its March Madness contracts from New Jersey following regulatory pressure, though the company later resumed offering prediction trading products.

Crypto.com is requesting a permanent injunction preventing Nevada from enforcing gaming laws against its federally regulated derivatives business. The company also seeks a declaratory judgment confirming that federal law preempts state gaming authority over CFTC-regulated event contracts. This article was written by Damian Chmiel at www.financemagnates.com.

![[Weekly funding roundup May 31-June 6] VC inflow continues to remain stable](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)