Intuit bets big on AI to boost efficiency and trust in QuickBooks

When it comes to AI agents, the makers of QuickBooks are hoping that you’re “into it.” Intuit—the fintech platform that owns TurboTax, Credit Karma, Mailchimp, and QuickBooks—announced that it has implemented a new set of AI agents into its products. The company showcased how the AI agents work within QuickBooks at an event on June 24, and Fast Company was able to see a demonstration of how the agents can help business owners and entrepreneurs use them to speed up their bookkeeping and accounting processes. QuickBooks will incorporate a Payments Agent, an Accounting Agent, a Customer Agent, and a Finance Agent, all of which are designed to become intimately familiar with a business’s specific customer base and financial track record, offer up insights, and make additional analyses. And though it’s just now being rolled out, the new AI capabilities have been in the works for a long time. “This is five or six years in the making,” Sasan Goodarzi, Intuit’s CEO, tells Fast Company. “We’ve made huge investments in the past five years,” he says, and the company has taken its time because when it comes to bookkeeping and accounting, “accuracy matters.” [Image: Intuit] In other words, Goodarzi says that while an AI tool like ChatGPT might spit out wrong or incorrect information, a customer relying on QuickBooks to crunch their numbers needs to be absolutely sure and trust in Intuit’s accuracy—otherwise, they could find themselves with serious issues. As such, Intuit wanted to make sure everything was above board before launching to its full customer base. “If it screws up, it’s a big problem,” he says. Additionally, Goodarzi says that business owners are relying on a huge number of apps and platforms to run their companies, an issue that Intuit is trying to simplify. “What I’m hearing from customers all the time is that they’re over-digitized, there are too many apps. They’re not getting the benefit from their time and money,” he says. “This is about creating a one-stop shop, a refreshed way to discover all of the capabilities within QuickBooks,” he says, noting that many of Intuit’s customers are unaware of how many tools exist within the QuickBooks ecosystem. And it’s the discovery and engagement with those tools that Goodarzi says “has been the area of the most positive feedback.” But the primary question: Are the AI implementations actually producing value for users? Yes, Goodarzi says. He notes that during the testing phase, the new AI capabilities have led to significant time and money savings for users, though that can be difficult to quantify, and expects that the new features will both resonate with QuickBooks’ wider user base when they officially launch on July 1, and help the company’s bottom line. “I was talking about AI changing the world six years ago, and people were laughing at me,” he says. Now, “we’re actually seeing natural adoption, driving incredible value.”

When it comes to AI agents, the makers of QuickBooks are hoping that you’re “into it.”

Intuit—the fintech platform that owns TurboTax, Credit Karma, Mailchimp, and QuickBooks—announced that it has implemented a new set of AI agents into its products. The company showcased how the AI agents work within QuickBooks at an event on June 24, and Fast Company was able to see a demonstration of how the agents can help business owners and entrepreneurs use them to speed up their bookkeeping and accounting processes.

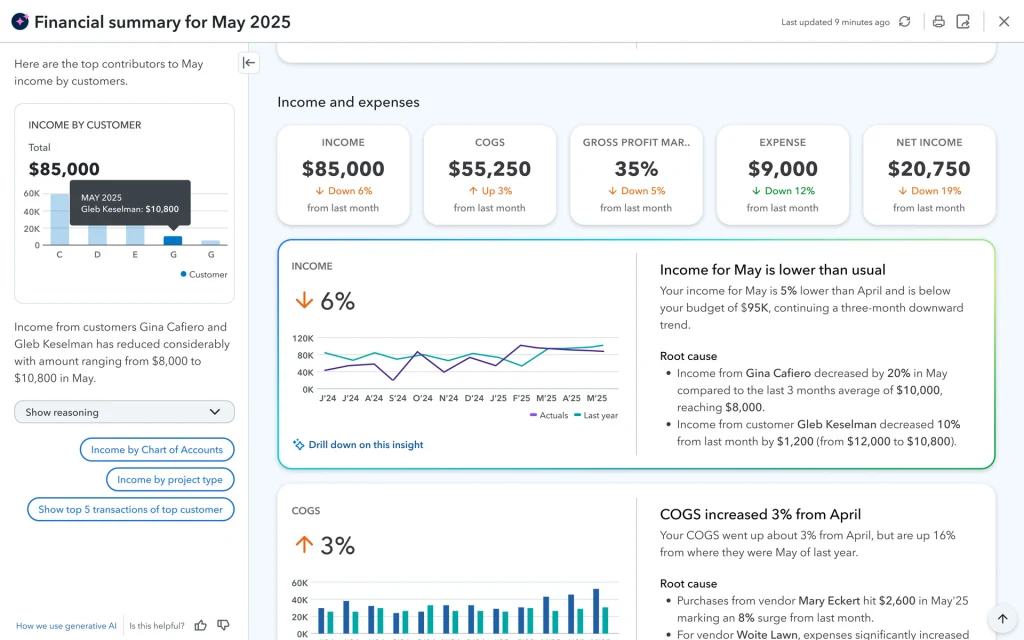

QuickBooks will incorporate a Payments Agent, an Accounting Agent, a Customer Agent, and a Finance Agent, all of which are designed to become intimately familiar with a business’s specific customer base and financial track record, offer up insights, and make additional analyses. And though it’s just now being rolled out, the new AI capabilities have been in the works for a long time.

“This is five or six years in the making,” Sasan Goodarzi, Intuit’s CEO, tells Fast Company. “We’ve made huge investments in the past five years,” he says, and the company has taken its time because when it comes to bookkeeping and accounting, “accuracy matters.”

In other words, Goodarzi says that while an AI tool like ChatGPT might spit out wrong or incorrect information, a customer relying on QuickBooks to crunch their numbers needs to be absolutely sure and trust in Intuit’s accuracy—otherwise, they could find themselves with serious issues. As such, Intuit wanted to make sure everything was above board before launching to its full customer base. “If it screws up, it’s a big problem,” he says.

Additionally, Goodarzi says that business owners are relying on a huge number of apps and platforms to run their companies, an issue that Intuit is trying to simplify. “What I’m hearing from customers all the time is that they’re over-digitized, there are too many apps. They’re not getting the benefit from their time and money,” he says. “This is about creating a one-stop shop, a refreshed way to discover all of the capabilities within QuickBooks,” he says, noting that many of Intuit’s customers are unaware of how many tools exist within the QuickBooks ecosystem.

And it’s the discovery and engagement with those tools that Goodarzi says “has been the area of the most positive feedback.”

But the primary question: Are the AI implementations actually producing value for users? Yes, Goodarzi says. He notes that during the testing phase, the new AI capabilities have led to significant time and money savings for users, though that can be difficult to quantify, and expects that the new features will both resonate with QuickBooks’ wider user base when they officially launch on July 1, and help the company’s bottom line.

“I was talking about AI changing the world six years ago, and people were laughing at me,” he says. Now, “we’re actually seeing natural adoption, driving incredible value.”

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)