This Chinese company turned collectible dolls into a $1.8B empire

What do you get when you mix surprise, storytelling, and a sprinkle of cuteness? A $1.8 billion global sensation. Pop Mart, the Chinese...

What do you get when you mix surprise, storytelling, and a sprinkle of cuteness? A $1.8 billion global sensation. Pop Mart, the Chinese company behind the viral Labubu dolls, has taken the toy and collectible industry by storm, redefining what it means to shop, collect, and connect in the age of Gen Z and kidult fandom.

From vending machines to plush plushies, from blind boxes to celebrity buzz, Pop Mart has created more than a product—it’s built an empire. Here's how.

The mystery behind the box: A retail revolution

At the heart of Pop Mart's success lies a deceptively simple idea: blind box collectibles. These are sealed packages that contain one figure from a known collection, but buyers don’t know exactly which one until they open it.

The element of surprise turns each purchase into an experience—and a gamble. You might get the common character, or you might hit the jackpot with a rare or “chase” figure (sometimes with odds of 1 in 72). That mechanic taps into two powerful drivers: curiosity and completionism. People want to complete the set. And they’ll keep buying until they do.

In fact, over 70% of Pop Mart's revenue in 2019 came from these blind box sales. That number has remained strong even as the company expanded into other categories.

Labubu: The monster that made millions

While Pop Mart has dozens of artist-designed toy lines, none have matched the wild popularity of Labubu, a wide-eyed, snaggle-toothed imp created by Hong Kong artist Kasing Lung.

Labubu isn't just a toy—it's a phenomenon. Some of its rare editions resell for tens of thousands of dollars in secondary markets. In 2024 alone, revenue from Labubu grew by 726%, with the character now accounting for a significant chunk of Pop Mart’s income.

Fans line up for hours—even overnight—for new releases. When the “Big into Energy” Labubu line dropped in April 2024, more than 2,500 people queued up before 6:30 AM at a single location in Century City.

Going global: From Beijing to Brooklyn

Pop Mart’s empire isn’t limited to China. As of 2025, the company boasts:

- 500+ retail stores worldwide

- 2,000 vending machines in malls and airports

- A rapidly growing international footprint, especially in North America

In 2024, overseas revenue tripled, rising from 17% to nearly 40% of total sales. The company plans to open 20+ new stores in the U.S. by the end of 2025, targeting young, urban collectors in places like New York, Los Angeles, and San Francisco.

Art meets commerce: The IP goldmine

Unlike companies that rely heavily on licensed IPs like Marvel or Disney, Pop Mart generates over 85% of its revenue from original collaborations with independent artists. This means exclusivity, cultural cachet, and full control over storytelling.

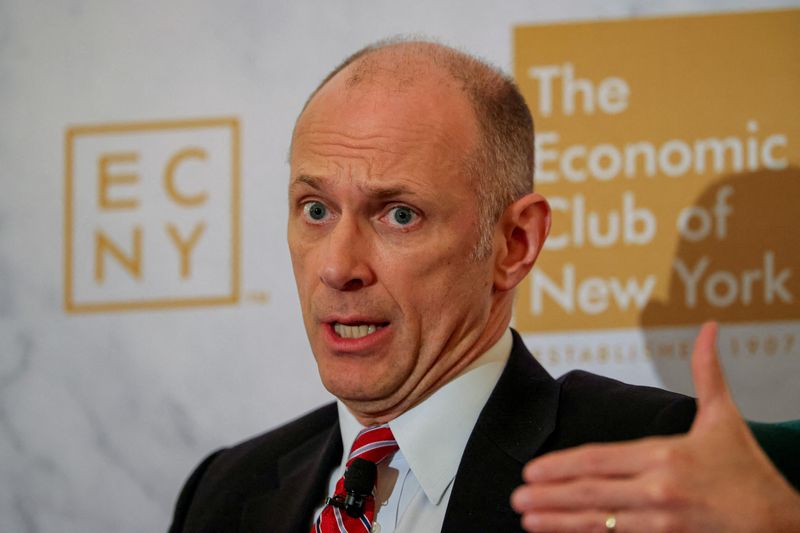

It all started in 2016 with a survey. CEO Wang Ning, looking to innovate, asked fans what kind of artists and characters they’d like to see in blind box form. That led to partnerships with artists like:

- Kenny Wong (creator of Molly)

- Kasing Lung (Labubu)

- Libby Frame, a U.S. artist behind the wildly successful Peach Riot series

Peach Riot, by the way, became Pop Mart’s best-selling IP in North America within a year of launch.

Beyond the box: Plushies, parks, and more

Pop Mart knows that viral moments fade—but fandoms can last. To secure its future, the company is diversifying beyond figurines, including:

- Plush toys, now one of the fastest-growing segments (22% of 2024 revenue)

- Accessories like phone charms and lifestyle items

- Pop Mart theme parks, where fans can meet mascot versions of their favorite characters

- Digital content, expanding the stories and universes around characters like Labubu and Molly

This strategy positions Pop Mart not just as a toy company but as a full-blown entertainment and lifestyle brand.

A soft-power empire in a hard market

Pop Mart’s rise comes with challenges. Several Asian governments have moved to regulate blind boxes due to their similarities to gambling.

- Singapore proposed a cap of SGD 100 (~US$77) on mystery box purchases

- China banned blind box sales to children under eight

- Regulatory pressure has affected the stock, with price swings of 3–5% tied to trade or compliance news

There’s also the risk of oversaturation. Viral IPs don’t last forever. And with copycats emerging across Asia and the West, maintaining originality and fan loyalty is key.

But Pop Mart seems ready. It’s already crafting its next generation of characters, licensing deals, and experiences to keep the magic alive.

Final unboxing: What's next for Pop Mart?

Pop Mart’s story is a case study in what happens when design, psychology, and pop culture collide. It didn’t invent blind boxes, but it perfected them. By turning surprise into an emotion and collectibles into culture, the company built a global community of fans.

It’s not just about owning a toy—it’s about participating in a world. And as long as people crave surprise, connection, and a little dose of joy from a 3-inch doll, Pop Mart might just be the company that continues to deliver—one blind box at a time.

![Snapchat Shares Trend Insights for Marketers To Tap Into This Summer [Infographic]](https://imgproxy.divecdn.com/7LB56F586EcY82vl5r47Ba6f7RdKcHkNelnSgSe8Umc/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zbmFwX2tzYTIucG5n.webp)

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)