Crypto ETPs see $3.3B weekly inflows, top $10.8B year to date

Cryptocurrency investment products saw a sharp increase in inflows last week, driving the year-to-date (YTD) total above $10 billion, according to data from European crypto investment manager CoinShares.Global crypto exchange-traded products (ETPs) recorded $3.3 billion of inflows during the week ending May 24, bringing total inflows YTD to a record $10.8 billion, CoinShares reported on May 26.CoinShares head of research James Butterfill said total assets under management (AUM) in crypto ETPs briefly reached an all-time high of $187.5 billion, reflecting strong investor interest. “We believe that growing concerns over the US economy, driven by the Moody’s downgrade and the resulting spike in treasury yields, have prompted investors to seek diversification through digital assets,” Butterfill wrote.Bitcoin ETPs lead with $2.9 billion in inflowsBitcoin (BTC) led last week’s inflows to crypto ETPs with $2.9 billion, a quarter of total inflows for 2024.As Bitcoin surged above $110,000 for the first time on May 22, some investors turned to short-BTC products, with inflows surging to $12.7 million, the highest since December 2024.Crypto ETP flows by asset as of May 23, 2025 (in millions of US dollars). Source: CoinSharesEther (ETH) ETPs continued to see healthy inflows totaling $326 million last week, marking a fifth straight week of gains as momentum continued following the successful Pectra upgrade that went live on May 7.Related: US Bitcoin ETFs near record month after $1.5B inflows in 2 daysWhile the majority of altcoin ETPs saw meager or even zero inflows, XRP (XRP) ETPs were hit with massive outflows. After posting an 80-week inflow streak, XRP investment products posted $37.2 million in outflows, the largest on record, according to Butterfill.The wave of outflows for XRP ETPs came amid an underperforming price despite two key bullish developments for the asset, including a potential spot XRP exchange-traded fund in the US and $2.2 billion in XRP futures.Crypto ETPs keep breaking recordsThe latest CoinShares data marks another record-breaking milestone for crypto ETPs, following a historic surge in YTD inflows the previous week.In mid-May, crypto investment products added $785 million in new inflows, pushing the YTD total to $7.5 billion by May 16, according to CoinShares.Weekly crypto ETP inflows since late 2024. Source: CoinSharesThe new inflow record not only surpassed the previous peak of $7.2 billion recorded in February 2025 but also fully recovered the nearly $7 billion of outflows seen during the subsequent price correction in February and March, Butterfill said.Magazine: Bitcoin bears eye $69K, CZ denies WLF ‘fixer’ rumors: Hodler’s Digest, May 18 – 24

Cryptocurrency investment products saw a sharp increase in inflows last week, driving the year-to-date (YTD) total above $10 billion, according to data from European crypto investment manager CoinShares.

Global crypto exchange-traded products (ETPs) recorded $3.3 billion of inflows during the week ending May 24, bringing total inflows YTD to a record $10.8 billion, CoinShares reported on May 26.

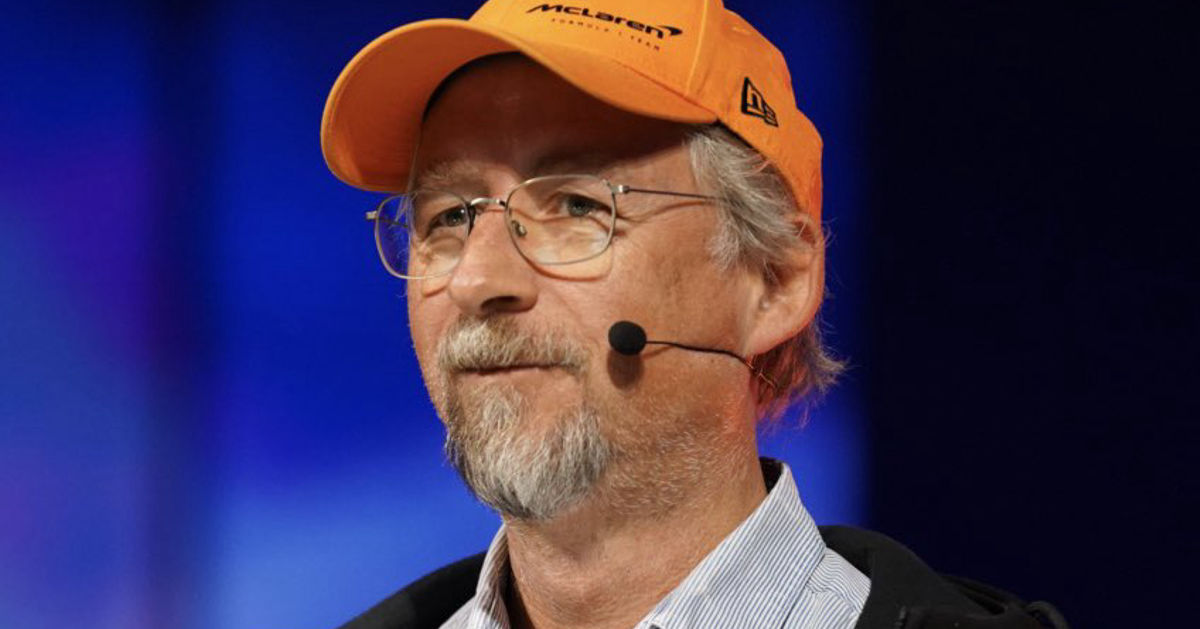

CoinShares head of research James Butterfill said total assets under management (AUM) in crypto ETPs briefly reached an all-time high of $187.5 billion, reflecting strong investor interest.

“We believe that growing concerns over the US economy, driven by the Moody’s downgrade and the resulting spike in treasury yields, have prompted investors to seek diversification through digital assets,” Butterfill wrote.

Bitcoin ETPs lead with $2.9 billion in inflows

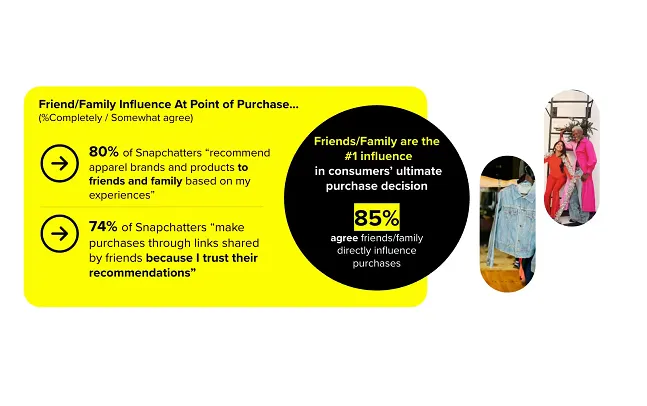

Bitcoin (BTC) led last week’s inflows to crypto ETPs with $2.9 billion, a quarter of total inflows for 2024.

As Bitcoin surged above $110,000 for the first time on May 22, some investors turned to short-BTC products, with inflows surging to $12.7 million, the highest since December 2024.

Ether (ETH) ETPs continued to see healthy inflows totaling $326 million last week, marking a fifth straight week of gains as momentum continued following the successful Pectra upgrade that went live on May 7.

Related: US Bitcoin ETFs near record month after $1.5B inflows in 2 days

While the majority of altcoin ETPs saw meager or even zero inflows, XRP (XRP) ETPs were hit with massive outflows. After posting an 80-week inflow streak, XRP investment products posted $37.2 million in outflows, the largest on record, according to Butterfill.

The wave of outflows for XRP ETPs came amid an underperforming price despite two key bullish developments for the asset, including a potential spot XRP exchange-traded fund in the US and $2.2 billion in XRP futures.

Crypto ETPs keep breaking records

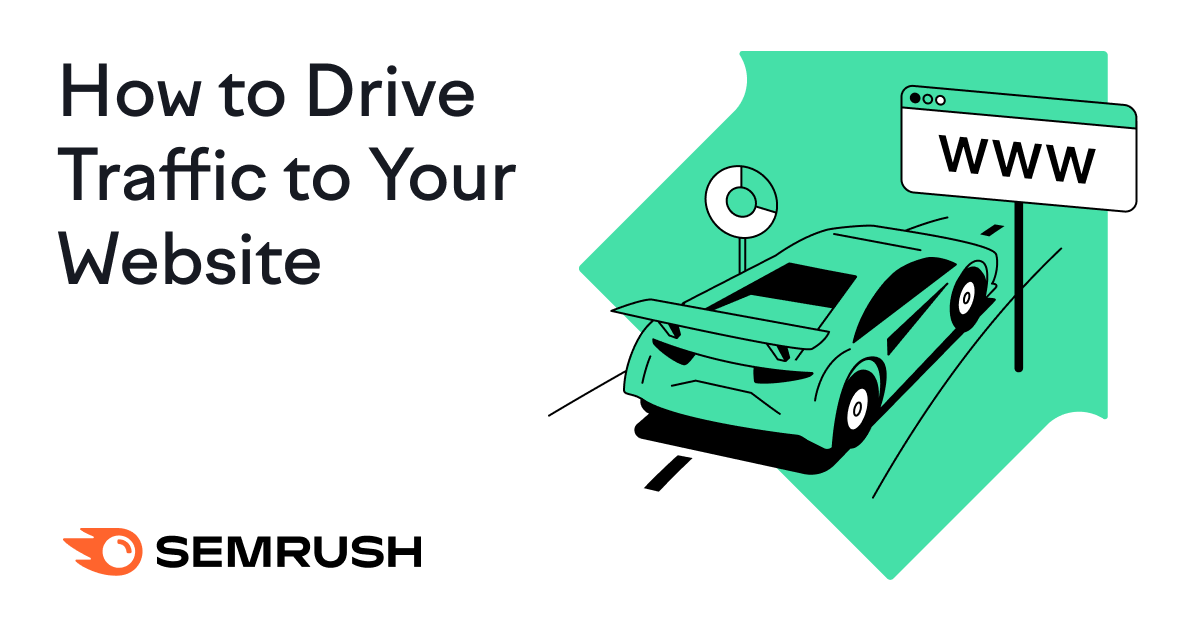

The latest CoinShares data marks another record-breaking milestone for crypto ETPs, following a historic surge in YTD inflows the previous week.

In mid-May, crypto investment products added $785 million in new inflows, pushing the YTD total to $7.5 billion by May 16, according to CoinShares.

The new inflow record not only surpassed the previous peak of $7.2 billion recorded in February 2025 but also fully recovered the nearly $7 billion of outflows seen during the subsequent price correction in February and March, Butterfill said.

Magazine: Bitcoin bears eye $69K, CZ denies WLF ‘fixer’ rumors: Hodler’s Digest, May 18 – 24