Bitcoin Pepe price outlook as BTC ETFs continue to see robust inflows

Bitcoin’s strength has been further supported by steady institutional inflows. A rally in Bitcoin is also helping lift sentiment across the broader crypto market. The shift in sentiment is also helping early-stage projects such as Bitcoin Pepe. Bitcoin (BTC) has climbed back above $108,000, fully recovering from last week’s brief drop below the six-figure mark […] The post Bitcoin Pepe price outlook as BTC ETFs continue to see robust inflows appeared first on CoinJournal.

- Bitcoin’s strength has been further supported by steady institutional inflows.

- A rally in Bitcoin is also helping lift sentiment across the broader crypto market.

- The shift in sentiment is also helping early-stage projects such as Bitcoin Pepe.

Bitcoin (BTC) has climbed back above $108,000, fully recovering from last week’s brief drop below the six-figure mark amid elevated geopolitical tensions in the Middle East.

The rebound signals a broader shift toward risk-on sentiment, underpinned by improving macroeconomic indicators and growing optimism in the digital asset space.

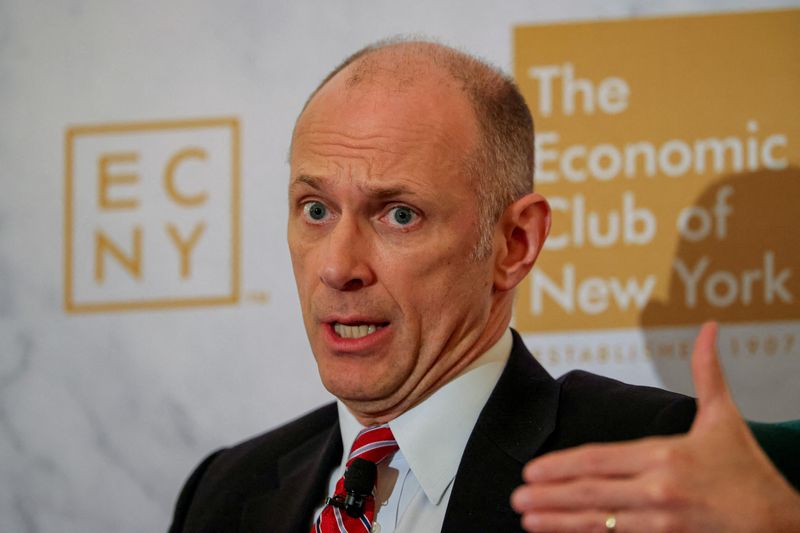

Federal Reserve Chair Jerome Powell stated this week that further rate adjustments remain on the table, contingent on progress in trade negotiations and signs of easing inflation.

Markets interpreted the remarks as a possible indication of a policy pivot by late 2025.

Bitcoin’s strength has been further supported by steady institutional inflows, which are helping to restore broader risk appetite across crypto markets.

This environment is fueling speculative capital flows into early-stage projects, with Bitcoin Pepe emerging as a notable beneficiary.

The project’s presale continues to attract investor attention.

US BTC ETFs continue to see strong inflows

US spot Bitcoin exchange-traded funds (ETFs) saw their second-largest single-day inflow for June on Tuesday, attracting $547.7 million, according to data from Farside Investors.

The surge marks 12 consecutive days of net positive flows—the longest such streak since December 2024.

BlackRock’s iShares Bitcoin Trust (IBIT) led the inflows, drawing $340 million on Tuesday, followed by Fidelity’s FBTC, which added $115 million.

Since June 10, Bitcoin ETFs have brought in more than $2.7 billion, reflecting sustained institutional demand despite ongoing geopolitical uncertainty.

The strong momentum follows Wednesday’s $580 million haul—the highest single-day inflow for the month so far.

Bitcoin Pepe price outlook

A rally in Bitcoin often lifts overall market sentiment, drawing sidelined capital back into the crypto space and reviving interest in altcoins, particularly meme tokens, which tend to outperform during speculative upswings.

Bitcoin Pepe is well-positioned to capitalise on this shift.

Billed as the first meme-focused Layer 2 solution on the Bitcoin network, the project combines Bitcoin’s base-layer security with Solana-like scalability.

It also introduces the PEP-20 token standard, allowing meme coins to be deployed natively on Bitcoin, a novel approach that appeals to investors seeking speculative assets with credible infrastructure.

To strengthen its ecosystem, Bitcoin Pepe has announced strategic partnerships with GETE Network, Catamoto, and Plena Finance.

These integrations aim to add functional utility to the BPEP token, setting it apart from meme coins that rely primarily on social momentum.

As per the team, the BPEP token is to be listed on MEXC and BitMart.

Investor interest has been robust. The presale has raised over $15.6 million, with a listing announcement scheduled for June 30.

The post Bitcoin Pepe price outlook as BTC ETFs continue to see robust inflows appeared first on CoinJournal.

![Snapchat Shares Trend Insights for Marketers To Tap Into This Summer [Infographic]](https://imgproxy.divecdn.com/7LB56F586EcY82vl5r47Ba6f7RdKcHkNelnSgSe8Umc/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9zbmFwX2tzYTIucG5n.webp)

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)