Two hill states, similar concessions, one policy difference: How Uttarakhand overtook Himachal Pradesh

Given identical incentives under a central industrial package, Uttarakhand and Himachal Pradesh made radically different choices in 2003—one State bet big on planned industrial estates. Two decades on, the results are striking.

In 2003, the Government of India offered fiscal concessions for industrial investments in the newly-formed State of Uttarakhand and its north-western neighbour Himachal Pradesh. The Concessional Industrial Package (CIP) promised tax breaks and capital investment subsidies to industries willing to set up shop in these hill States. The two, identical in land area and topography, then went on to unveil industrial policies that were identical in every respect except one, town planning.

This single point of difference was the reason why one State could leverage the benefits of CIP significantly better than the other, according to a comparative study published recently by the Economic Advisory Council of the Prime Minister (EAC-PM).

‘A Natural Experiment’

The CIP came just three years after Uttarakhand had been carved out of Uttar Pradesh. Uttarakhand was newer as a State, 40% more populous, and had a narrower tax base than its neighbour.

Still, for Dr Shamika Ravi (Member, EAC-PM) and Alok Kumar (Principal Secretary, Industrial Development & MSME, Government of UP)—the authors of the report, ‘The Great Convergence: A Case Study of Uttarakhand and Himachal Pradesh (2000 to 2020)’—what emerged from the CIP was “akin to a ‘natural experiment’ given the close similarities of the two neighboring states.

Comparing the paths taken by the two States over two decades later, it is clear to the authors that Uttarakhand came out stronger than Himachal in leveraging the benefits of CIP.

Between 2000 and 2010, Uttarakhand’s economy grew at a compound annual rate (CAGR) of 11.05%, compared to Himachal’s 6.91%. In per capita Gross State Domestic Product terms, Uttarakhand zoomed from 64% of Himachal in 2000-01 to 102% in 2009-10.

The big divergence came in the industrial sector growth. Uttarakhand’s manufacturing output grew 9.5 times over two decades, while Himachal’s rose 4.6 times. In the former, the share of the industrial sector in the overall GDP grew from a low of 32.3% in 2000-01 to a peak of 53.8% in 2011-12 before settling down at 47.3% in 2019-20. Himachal’s industrial sector share, similarly, grew from an identical low of 32.3% in 2000-01 to 44.6% in 2009-10.

Uttarakhand came off better in three other metrics as well: capital investment per factory and growth in factory workforce, and State’s Own Tax Revenue. To elaborate on the last metric, Uttarakhand’s own tax revenue grew 18-fold over 22 years, compared with Himachal’s more modest increases.

However, Himachal held its own on another front: central grants, especially under centrally sponsored schemes. The study attributes this to Himachal’s stronger administrative machinery and better human development indicators—areas where Uttarakhand, a younger state, still lags. The State also does better than Uttarakhand in per capita expenditure, not surprising given the latter’s larger population base.

The one critical difference

Why did similar-sized States, with similar attributes and stage of development, show such divergence in results following the implementation of CIP-backed policies? They might have set up near-indential industrial policies, say the authors, but the two differed “in their approach to town planning and land policy.”

They write: “When analyzed closely, UK's (Uttarakhand’s remarkable economic turnaround can be associated with this one strategic call. While HP (Himachal Pradesh) took the easier route of permitting industries to buy land directly from farmers, through private negotiation liberally allowing land use conversions and providing support for creating infrastructure around the new industrial clusters (the classic regulatory approach to industrial development), UK opted for a planned industrialization in designated Industrial Estates complete with infrastructure facilities provided and financed by the State Government (the infrastructure led approach to industrial development).”

This, the authors say, “was the most important factor that catalyzed a change in the growth trajectories of the two states.”

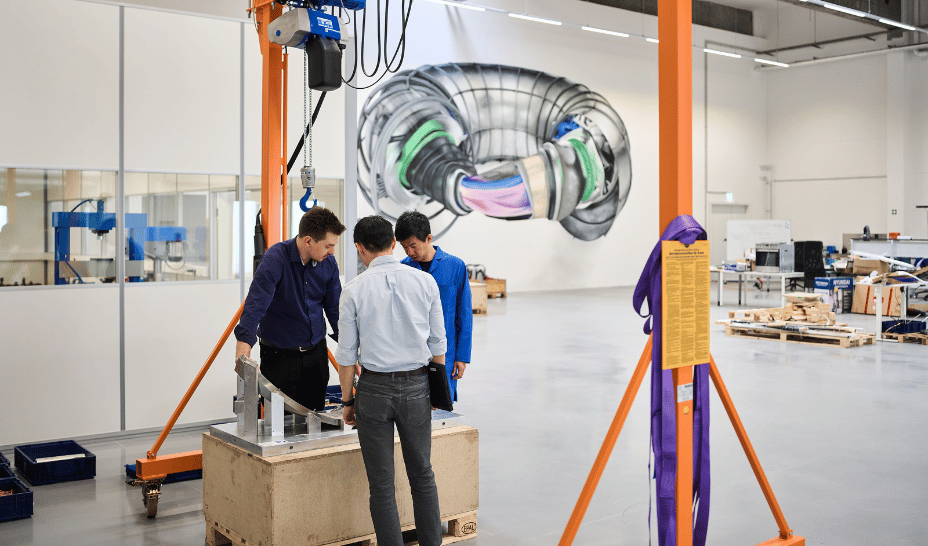

The Uttarakhand model did face scepticism on the question of the capacity of its bureaucracy, the study points out. This was because it was opting for a State-led model (with the newly-created State Infrastructure & Industrial Development Corporation of Uttarakhand Ltd, or SIIDCUL) in its negotiations for land acquisition, financing and execution of the infrastructure. Time was short, what with CIP having stringent sunset clauses.

The scepticism seemed valid, especially in the first few years when Uttarakhand appeared to be losing out to Himachal as a preferred industrial based. Himachal, of course, was familiar to investors while its neighbour was new. Potential investors would have been cautious.

But the authors write, “Defying common expectations, within 3 years, the government of UK was able to create an industrial infrastructure from a green field stage over 8000 acres of land, complete with roads, 220kV power stations, drinking water supply system, drainage, sewage and effluent treatment plants, logistic parks, residential & business districts with other related amenities.”

Uttarakhand developed three full-fledged industrial townships in just 3 years. “Two of the estates were developed through the classical governmental approach; the third estate was developed through Public Private Partnership approach to ensure rapid development unencumbered by the constraints of the limited bandwidth available with SIIDCUL (both finance and HR).” Himachal lagged, in comparison.

The study saw a big divergence in growth between the two States in the first 10 years. “The growth rates of the two states reverted to the business-as-usual case in the second decade of the millennium, once the fiscal concessions were withdrawn.”

Edited by Sriram Srinivasan

![The Most Searched Things on Google [2025]](https://static.semrush.com/blog/uploads/media/f9/fa/f9fa0de3ace8fc5a4de79a35768e1c81/most-searched-keywords-google-sm.png)

![What Is a Landing Page? [+ Case Study & Tips]](https://static.semrush.com/blog/uploads/media/db/78/db785127bf273b61d1f4e52c95e42a49/what-is-a-landing-page-sm.png)