Bitcoin tops $110K for 2nd day; altcoins UNI, AAVE rally on SEC Chair comments

Bitcoin (BTC) traded above $110,000 for a second day, up over 1% in 24 hours, buoyed by altcoin rally. DeFi tokens UNI (+24%) and AAVE (+13%) surged following optimistic comments from SEC Chair Paul Atkins. Despite price gains, market sentiment remains cautious, with low funding rates (1.3%) typically seen at bottoms. Bitcoin (BTC) revisited the […] The post Bitcoin tops $110K for 2nd day; altcoins UNI, AAVE rally on SEC Chair comments appeared first on CoinJournal.

- Bitcoin (BTC) traded above $110,000 for a second day, up over 1% in 24 hours, buoyed by altcoin rally.

- DeFi tokens UNI (+24%) and AAVE (+13%) surged following optimistic comments from SEC Chair Paul Atkins.

- Despite price gains, market sentiment remains cautious, with low funding rates (1.3%) typically seen at bottoms.

Bitcoin (BTC) revisited the $110,000 level for the second day in a row on Tuesday, seemingly pulled higher by even more substantial gains among various altcoins.

However, despite this upward movement, a prevailing sense of caution and skepticism among traders suggests that the sustainability of this breakout remains in question.

Bitcoin was trading just above $110,000 shortly after the close of U.S. stock markets on Tuesday, marking a gain of over 1% in the preceding 24 hours.

The broader cryptocurrency market, as measured by the CoinDesk 20 index—which tracks the top 20 cryptocurrencies by market capitalization (excluding stablecoins, exchange coins, and memecoins)—had risen by a more significant 3.3% over the same period.

This broader rally was largely attributed to strong performances from major altcoins such as Ether (ETH), Solana (SOL), and Chainlink (LINK), all of which posted gains in the 5%-7% range.

The most impressive performances of the day, however, came from decentralized finance (DeFi) tokens Uniswap (UNI) and Aave (AAVE).

These tokens soared by a remarkable 24% and 13%, respectively.

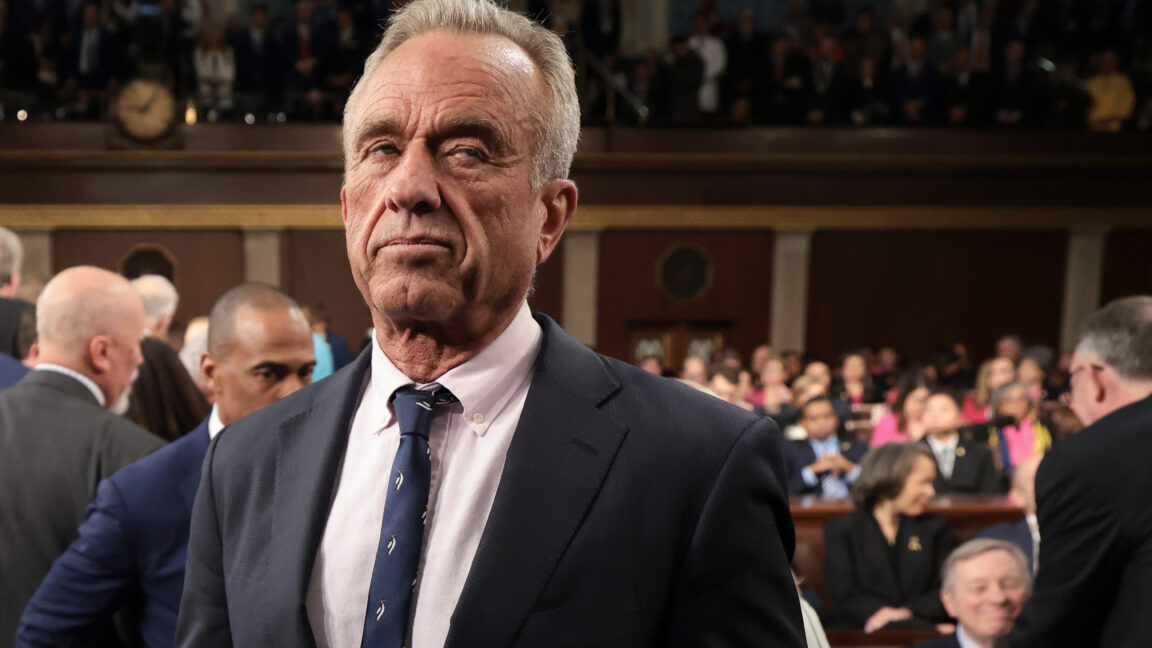

This surge was reportedly prompted by optimistic comments regarding DeFi made by Securities and Exchange Commission (SEC) Chair Paul Atkins on Monday, which appeared to inject fresh enthusiasm into the DeFi sector.

In contrast, the traditional equity markets linked to cryptocurrency showed a more subdued picture, with most crypto stocks trading flat on the day.

A notable exception was Semler Scientific (SMLR), a company aiming to emulate MicroStrategy’s (MSTR) strategy of accumulating significant Bitcoin holdings.

Semler Scientific’s shares fell another 10% on Tuesday, with the stock now trading for less than the value of the Bitcoin on its balance sheet, highlighting the risks associated with such strategies.

Defensive posturing despite proximity to highs

Despite Bitcoin’s recent gains and its proximity to previous all-time highs, positioning across cryptocurrency markets continues to reflect a largely defensive and cautious sentiment among traders.

“Funding rates and other leverage proxies point toward a steadily cautious sentiment in the market,” Vetle Lunde, head of research at K33 Research, pointed out in a Tuesday report.

“The broad risk appetite is remarkably weak, given that BTC is trading close to former all-time highs.”

This observation suggests that traders are not fully convinced of the rally’s strength and are hesitant to take on excessive risk.

Lunde further noted that Binance’s BTC perpetual swaps posted negative funding rates on multiple days last week, with the average annualized funding rate now sitting at just 1.3%.

This level, he explained, is typically associated with local market bottoms rather than tops.

“Bitcoin does not usually peak in environments with negative funding rates,” Lunde wrote, adding that past instances of such defensive positioning have more often preceded rallies than significant corrections.

Flows into leveraged Bitcoin ETFs paint a similar picture of cautious engagement.

The ProShares 2x Bitcoin ETF (BITX) currently holds exposure equivalent to 52,435 BTC, which is well below its December 2023 peak of 76,755 BTC.

Inflows into such products remain muted.

According to Lunde, this defensive positioning, paradoxically, leaves room for a potential “healthy rally” in BTC to develop, as it suggests the market is not overly leveraged or euphoric.

Skepticism greets potential breakout

However, not all market watchers are convinced that the current price action signals the beginning of a sustainable upward trend.

Some analysts remain skeptical about the durability of any breakout above the $110,000 level.

“Is this a true breakout that will continue? In my view, probably not,” said Kirill Kretov, senior automation expert at CoinPanel.

More likely, it’s part of the same volatility cycle where we see a rally now, followed by a sharp drop triggered by a negative announcement or some other narrative shift.

According to Kretov, the current market environment favors experienced traders who are adept at navigating volatility-driven market structures.

From a technical perspective, he identifies Bitcoin’s next key support levels at $105,000 and $100,000.

These are zones that could be tested if selling pressure re-emerges and the current upward momentum falters.

The market now watches to see if Bitcoin can consolidate its gains and build a stronger foundation for a continued ascent, or if skepticism will be validated by a retreat from current levels.

The post Bitcoin tops $110K for 2nd day; altcoins UNI, AAVE rally on SEC Chair comments appeared first on CoinJournal.