NYC landlords can’t require tenants to pay broker fees anymore

Though there was technically no cap on these fees, they averaged around 12% to 15% of the annual rent of the listing.

Excessive moving costs can now be reserved for couches and the physical toll of eating a loaded-up Subway sandwich in a moving U-Haul. New York City’s FARE Act took effect yesterday, banning landlords from requiring renters to pay broker fees. While it’s considered a win for New York renters, experts say landlords may just raise rents to make up the difference.

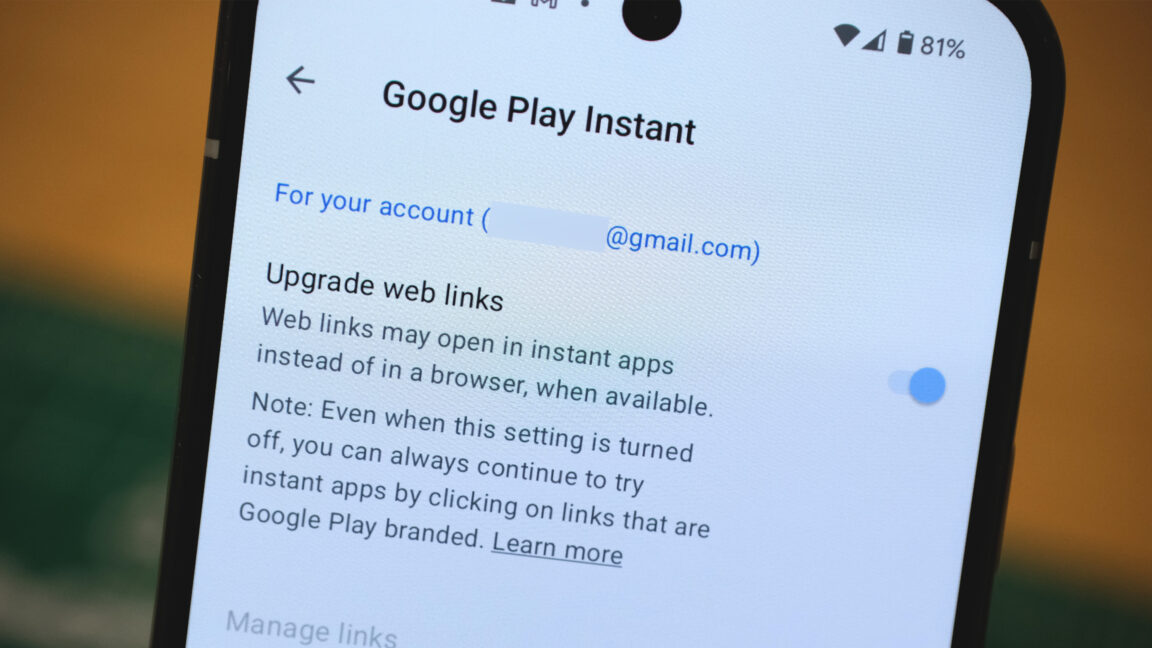

Before yesterday, landlords could hire brokers for their properties and pass on the cost to future tenants. Though there was technically no cap on these fees, they averaged around 12% to 15% of the annual rent of the listing—meaning that with the first month’s rent + security deposit + broker fees, the amount due at signing in NYC averaged $13,000, according to StreetEasy:

- That average drops to about $7,500 without broker fees.

- NYC was one of the last major cities to allow tenant-paid broker fees, with Boston being the biggest city where they’re still common.

It could still end up costing New Yorkers. Brokers and property owners unsurprisingly campaigned against the change, saying landlords would have to raise rents drastically to eat the cost. Analysts, however, say initial rent surges will likely taper off eventually. Trade groups sued in order to try to stop the measure from going into effect, but Tuesday, a judge denied their request to stall it while the suit proceeds.—MM

This report was originally published by Morning Brew.

This story was originally featured on Fortune.com

![X Highlights Back-To-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)