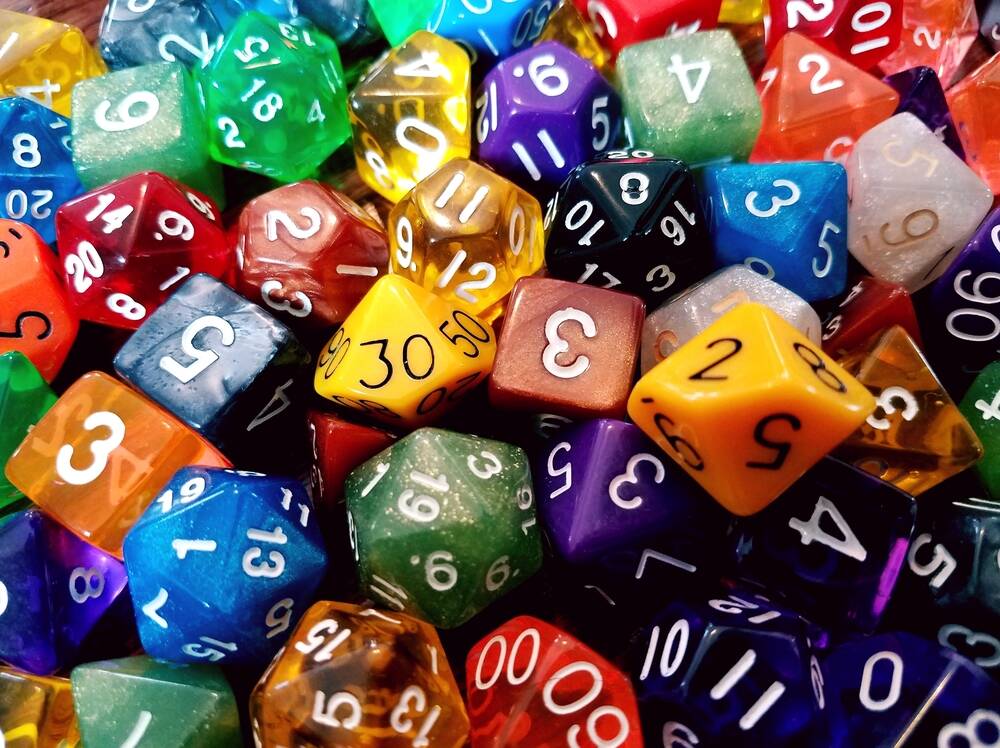

CEO Ryan Cohen lays out vision for GameStop’s future as stock plummets 20% – and trading cards play a big role

Former video game stronghold is going all in on something entirely different.

- GameStop says it plans to focus more on the trading-card business moving forward. This comes as the video game industry grows increasingly digital. Shares of the company fell 20% Thursday following an announcement of a bond sale.

GameStop is pouring money into Bitcoin, but that’s not the company’s main focus these days.

As the video game industry goes increasingly digital, cutting out retailers for software sales, GameStop is pivoting toward the trading-card business, CEO Ryan Cohen said at the company’s annual shareholder meeting.

“We’re focusing on trading cards as a natural extension of our existing business,” Cohen said. “The trading card market, whether it’s sports, Pokémon or collectibles, is aligned with our heritage. It fits our trade and model. It appeals to our core customer base. And it’s deeply embedded in physical retail.”

Collectibles, such as Pokémon and baseball cards, made up 29% of the company’s sales in the first quarter—outselling video game software, GameStop reported earlier this week.

GameStop was the original meme stock and still has a sizable percentage of individual investors. Lately, though, their faith in Cohen and the company has seemingly been dwindling. Shares fell 20% Thursday after GameStop announced a bond sale of $1.75 billion.

That followed a similarly large drop at the end of May when the company announced it had purchased 4,710 Bitcoin for roughly $500 million. Shares are down 35% since the day prior to that announcement. Year-to-date, GameStop shares have lost 26% of their value.

Analysts have largely thrown up their hands when it comes to the company, which no longer holds analyst calls or offers guidance.

“GameStop’s entry into the trading-card business has delivered modest success, but we see no potential for a rebound in GameStop’s core business, following failed attempts at an omnichannel strategy and NFT trading,” said Wedbush’s Michael Pachter in a note to investors earlier this month. “That said, despite a complete lack of an articulated strategy, GameStop has consistently been able to capitalize on the existence of ‘greater fool[s]’ willing to pay more than twice its asset value for its shares—and so far, they’ve been right.”

This story was originally featured on Fortune.com

![X Highlights Back-To-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)