Following Successful Public Listing, Circle’s Stablecoin Launches on XRP Ledger

Circle’s USDC stablecoin debuted on the XRP Ledger, a move expected to significantly expand its utility across decentralized finance and cross-border payments. The launch, which requires no bridging, highlighted Ripple’s ongoing strategy to link traditional finance and crypto with seamless infrastructure.Stablecoins Find New Ground on XRPLAccording to the announcement, the launch of USDC on the XRP Ledger (XRPL) gives developers, institutions, and users a direct way to access the second-largest dollar-pegged stablecoin on Ripple’s layer-1 network. According to Ripple, the integration enables stablecoin transfers between decentralized exchanges using XRP as a bridge currency via auto-bridging.This native integration follows Circle’s recent IPO success and comes amid growing interest in stablecoins as geopolitical and monetary tools. With over $61 billion in circulation, USDC continues to grow its footprint across blockchain networks.The move aligns with a broader push in the United States to regulate stablecoins and establish them as credible financial instruments. The dollar’s credibility has come under pressure as some foreign holders sell off US Treasury bonds, leading to rising yields and higher debt servicing costs.In this context, stablecoins backed by dollar-denominated assets are increasingly seen as a means to protect the dollar’s role in global finance.However, critics like Bitcoin advocate Max Keiser argue that this is merely a delay tactic. Keiser claims that gold-backed stablecoins could outcompete dollar-pegged tokens, citing gold’s resistance to inflation through its high stock-to-flow ratio.Ripple-Circle Taps Into Broader Liquidity and Institutional GoalsThe XRPL-USDC integration brings several technical enhancements. Circle Mint and Circle APIs now support USDC on XRPL, allowing institutions and developers to tap into DeFi protocols, cross-border payments, and fiat on/off-ramps without the need for bridging.Ripple, which recently denied reports of a Circle buyout attempt, still benefits significantly from this integration. It aims to control 14% of global SWIFT liquidity by 2030 and needs broader stablecoin adoption to fuel its global payment ambitions.The stablecoin market now exceeds $237 billion and continues to draw attention from regulators, institutions, and technologists. As more issuers like Circle expand into cross-chain functionality, the competition to anchor the digital dollar intensifies.By going live on XRPL, USDC enters a new phase where speed, compliance, and access matter more than ever. For Ripple and Circle, this isn’t just a product release; it’s a step toward shaping the infrastructure of tomorrow’s digital finance. This article was written by Jared Kirui at www.financemagnates.com.

Circle’s USDC stablecoin debuted on the XRP Ledger, a move expected to significantly expand its utility across decentralized finance and cross-border payments.

The launch, which requires no bridging, highlighted Ripple’s ongoing strategy to link traditional finance and crypto with seamless infrastructure.

Stablecoins Find New Ground on XRPL

According to the announcement, the launch of USDC on the XRP Ledger (XRPL) gives developers, institutions, and users a direct way to access the second-largest dollar-pegged stablecoin on Ripple’s layer-1 network.

According to Ripple, the integration enables stablecoin transfers between decentralized exchanges using XRP as a bridge currency via auto-bridging.

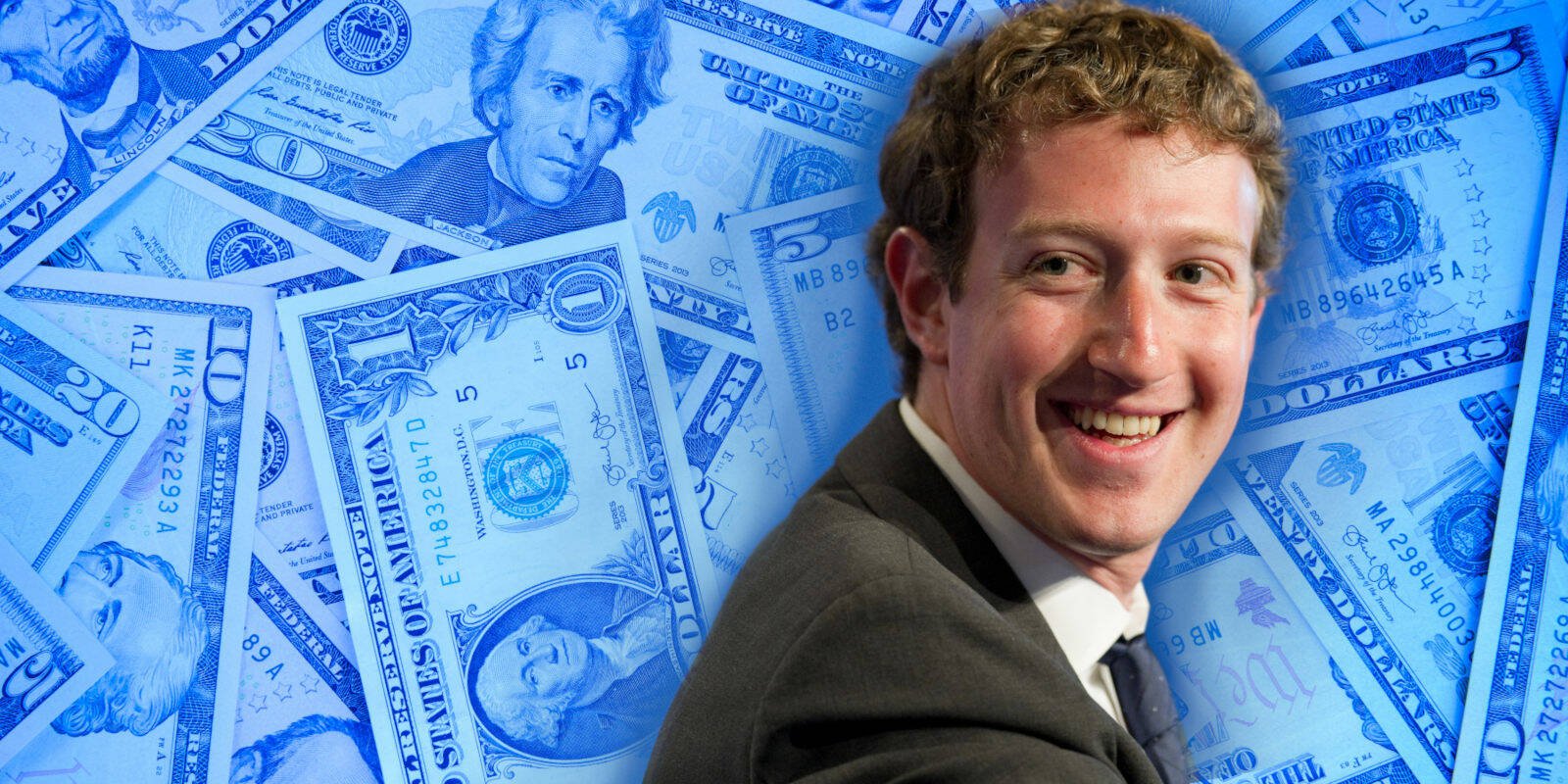

This native integration follows Circle’s recent IPO success and comes amid growing interest in stablecoins as geopolitical and monetary tools. With over $61 billion in circulation, USDC continues to grow its footprint across blockchain networks.

The move aligns with a broader push in the United States to regulate stablecoins and establish them as credible financial instruments. The dollar’s credibility has come under pressure as some foreign holders sell off US Treasury bonds, leading to rising yields and higher debt servicing costs.

In this context, stablecoins backed by dollar-denominated assets are increasingly seen as a means to protect the dollar’s role in global finance.

However, critics like Bitcoin advocate Max Keiser argue that this is merely a delay tactic. Keiser claims that gold-backed stablecoins could outcompete dollar-pegged tokens, citing gold’s resistance to inflation through its high stock-to-flow ratio.

Ripple-Circle Taps Into Broader Liquidity and Institutional Goals

The XRPL-USDC integration brings several technical enhancements. Circle Mint and Circle APIs now support USDC on XRPL, allowing institutions and developers to tap into DeFi protocols, cross-border payments, and fiat on/off-ramps without the need for bridging.

Ripple, which recently denied reports of a Circle buyout attempt, still benefits significantly from this integration. It aims to control 14% of global SWIFT liquidity by 2030 and needs broader stablecoin adoption to fuel its global payment ambitions.

The stablecoin market now exceeds $237 billion and continues to draw attention from regulators, institutions, and technologists. As more issuers like Circle expand into cross-chain functionality, the competition to anchor the digital dollar intensifies.

By going live on XRPL, USDC enters a new phase where speed, compliance, and access matter more than ever. For Ripple and Circle, this isn’t just a product release; it’s a step toward shaping the infrastructure of tomorrow’s digital finance. This article was written by Jared Kirui at www.financemagnates.com.

![X Highlights Back-To-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)