The Role of Angel Investor Syndicates In Strengthening Emerging Startup Ecosystems

A thriving angel investment ecosystem gives early-stage startups a real chance to grow and makes investing accessible to a wider range of participants, explains venture investor and serial entrepreneur Murat Abdrakhmanov. In this guest article he shares the crucial impact angels make and lays out the key steps to build a thriving angel investor syndicate.

Angel investor syndicates are becoming a powerful force in shaping startup ecosystems, especially in emerging markets. By pooling capital, expertise and networks, they give early-stage startups a real chance to grow — while also making investing more accessible to a wider range of participants.

For the past decade, I’ve been an active angel investor, funding startups globally and in my home country of Kazakhstan. Given that, let me share some insights on how the growth of angel financing impacts startup ecosystems and the vital role that local syndicates can play.

The impact of angel investors on local startup markets

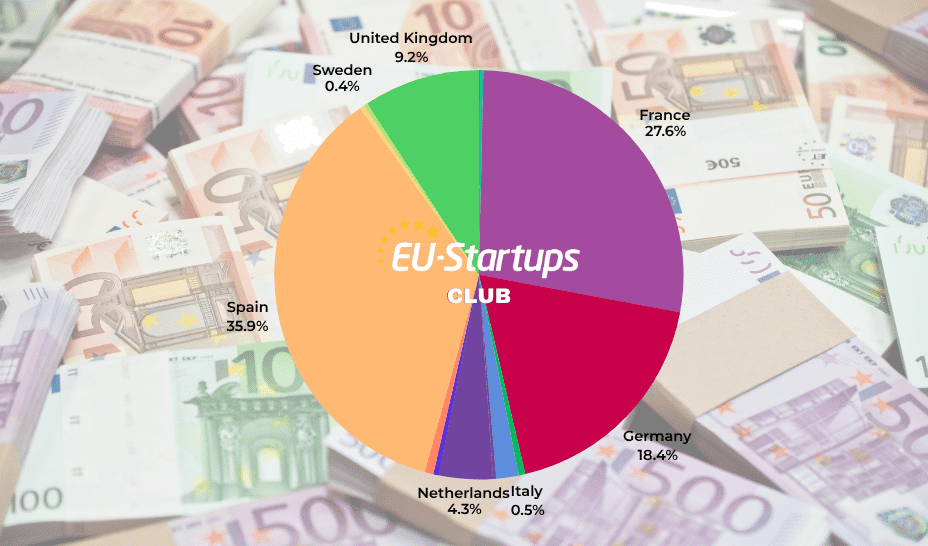

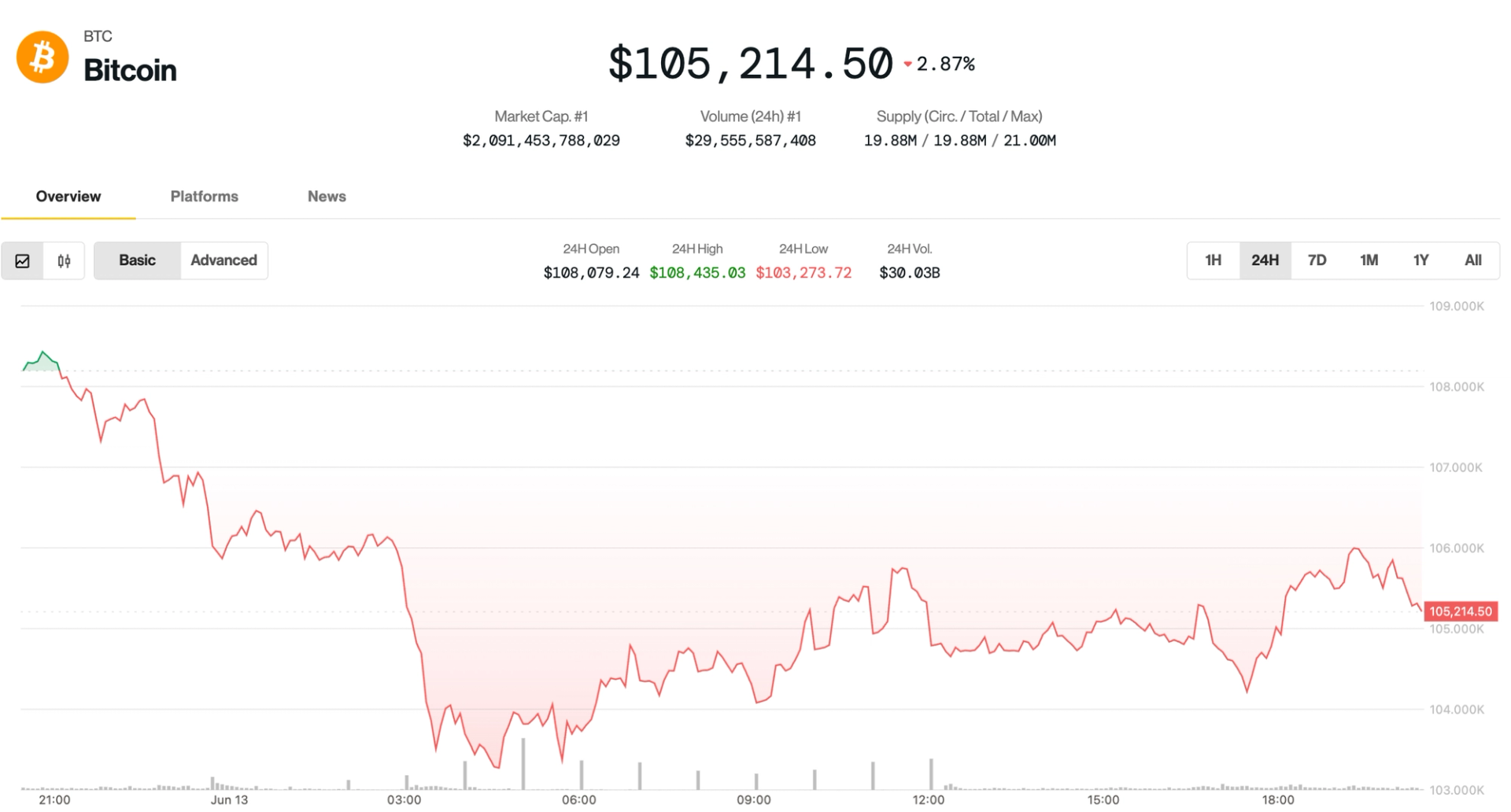

After a challenging period, the global startup ecosystem is slowly regaining balance. The steepest decline happened in 2023 when venture capital dropped to $285 billion — the lowest point since 2017. While a strong rebound has yet to occur, the first quarter of 2025 saw venture funding total $113 billion, in large part due to the $40 billion funding deal for OpenAI.

In the 2023 downturn, early-stage startups were the hardest hit. In emerging markets, the picture was different: local investors helped stabilize the ecosystem. In Turkey, nearly 60% of the $497 million in venture deals came from domestic investors, mostly in seed-stage startups. In Kazakhstan, local investors participated in 80% of deals, with 52% going to pre-seed rounds.

Local business angels are crucial to startup ecosystems. They invest in startups at the earliest stages, often with smaller checks starting at $10,000. In 2023, business angels in Kazakhstan accounted for 50% of all venture deals —10% more than traditional venture funds. This highlights how a robust angel investor network can drive market growth, even during uncertainty.

Building a thriving angel investment ecosystem

Most business angels are successful entrepreneurs looking for new investments. Unlike venture capitalists, they don’t invest full time and often lack the experience for effective dealmaking. Syndicates — collaborative groups of angel investors pooling resources to fund startups — can serve as an ideal gateway for venture investing.

Syndicates operate under the guidance of lead investors — experienced angels with deep market insights. The lead identifies high-potential startups, invests personally and invites others to participate — typically setting a minimum investment threshold to streamline the process. For example, in MA7 Angels Club, the syndicate I launched in Kazakhstan in 2024, the minimum check is $10,000.

One of the most impactful examples of a syndicate shaping its local investment landscape is Israel’s OurCrowd. Despite the funding downturn in 2022, it emerged as the third-most-active player in Israeli venture transactions. The syndicate has facilitated investments totaling $250 million — an impressive feat accomplished within just a decade since its founding.

COVID-19 and the lockdowns significantly accelerated the global growth of investment syndicates. Today, these groups are delivering results faster than ever. As I navigate this journey myself, I am eager to share my first key insights.

Key steps to building a thriving syndicate

MA7 Angels Club has rapidly grown to over 100 members, facilitating $2 million-plus in investments within six months. Our syndicate has backed several standout startups such as Pioneers, Zeely, Zibra.AI and Hero’s Journey.

What factors drive investor engagement and syndicate growth in an emerging market like Central Asia? Here are my top insights:

- Strong leadership and credibility. At MA7 Angels Club, every deal undergoes rigorous selection, personally led by me. Members trust the process because they know each deal is carefully vetted.

- Significant personal investment. The term “skin in the game” means the syndicate lead invests its own money in each deal. While most contribute under 10%, I commit 30%-50%. This level of personal risk strongly boosts investor confidence.

- User-friendly investment process. Most angel investors are busy entrepreneurs, so syndicate investing must be simple and transparent. We host video calls to review startups, explain financials and answer questions. With the U.S.-based Sydecar platform, investors register once, complete checks and join future deals without extra paperwork.

Angel investing isn’t a quick fix for capital shortages in Kazakhstan or other emerging markets. But it forms the backbone of early-stage funding and a gateway to larger investments. More angels mean more opportunities for startups — and faster ecosystem growth.

Murat Abdrakhmanov is a venture investor and serial entrepreneur. In his 30-plus years in the tech business, he has built dozens of successful projects, and in his decade’s worth of experience as a venture investor he has invested in 52 innovative startups. In total, he has invested about $25 million in startups and has had more than 10 successful exits. In 2024, Abdrakhmanov created a structured system for managing and scaling investments and launched MA7 Ventures, a comprehensive framework encompassing MA7 Self-funded Rolling Fund, MA7 Angels Club and MA7 Community.

Related reading:

- Startup Funding Regained Its Footing In 2024 As AI Became The Star Of The Show

- Global Startup Funding In 2023 Clocks In At Lowest Level In 5 Years

- Q1 Global Startup Funding Posts Strongest Quarter Since Q2 2022 With A Third Going To Massive OpenAI Deal

- Want To Sell Your Startup Quickly To A Strategic Buyer? Consider This From The Get-Go

Illustration: Dom Guzman

![X Highlights Back-To-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)