How Austin became the robotaxi capital of America

The robotaxi race is heating up in Austin. A decade after Google’s self-driving car project quietly tested on the city’s streets, a new wave of autonomous vehicle companies is setting up shop. Waymo, now a dominant force in San Francisco, is expanding to the city. Tesla is preparing to debut its long-promised robotaxi. And smaller players like Zoox, Avride, and ADMT are using the Texas capital as a proving ground. What was once a fringe experiment is now a high-stakes industry comeback, deep in the heart of Texas. “You have a regulatory environment that’s keen to capitalize on these developments,” says Alison Brooks, research vice president for worldwide public safety at IDC. “At the same time, it’s a blue city in a red state that’s predisposed towards alternative vehicles that are more environmentally friendly.” The self-driving companies converging on Austin The only fully deployed and operational robotaxi company in Austin is Waymo. In 2023, the company announced it was expanding testing to “the city that keeps it weird,” more than two years after its Phoenix launch. Since its March launch, Waymo now has about 100 robotaxis in Austin, making up 20% of local Uber trips. “By expanding our partnership with Uber to Austin, we were able to bring Waymo rides to residents and visitors in Austin even faster,” a representative for Waymo tells Fast Company. Tesla is now gearing up for deployment in the city. The robotaxi—which Elon Musk has been teasing since 2019—appears finally ready for the streets. Musk, who once operated out of the Bay Area, relocated his companies to Texas and brought his robotaxis with him. According to his posts on X, some of the vehicles have already begun driving. (Tesla did not respond to a request for comment.) For the past several days, Tesla has been testing self-driving Model Y cars (no one in driver’s seat) on Austin public streets with no incidents. A month ahead of schedule.Next month, first self-delivery from factory to customer.— Elon Musk (@elonmusk) May 29, 2025 Several smaller robotaxi companies are also testing in Austin. Zoox, owned by Amazon, is operating vehicles with safety drivers across multiple districts. Avride is running tests as well, though its planned debut—through a partnership with Uber—will take place in nearby Dallas. ADMT, Volkswagen’s robotaxi subsidiary, has been testing in Austin since 2023. As these autonomous vehicle companies converge on Austin, the city is becoming a key arena for robotaxi competition. It may not have the highest adoption of self-driving vehicles—Phoenix and San Francisco still lead in that regard—but with Tesla’s entry, Austin is fast becoming the most competitive testing ground. A friendly regulatory environment Why Austin? Many point to the city’s favorable regulatory environment. In Texas, state law preempts local law, which means the relatively relaxed Senate Bill 2205—passed in 2017—sets the statewide standard for AV regulation. Still, Austin’s active local government has played a key supporting role, offering infrastructure and coordination through efforts like the Autonomous Vehicle Working Group, which brings together staff from several city departments. A spokesperson for the City of Austin tells Fast Company that, while the city cannot directly regulate AVs, it can support companies with valuable information. Each robotaxi company has received maps of school zones, schedules for special events, and guidance on emergency vehicle protocols. The spokesperson notes that Tesla, though not required to inform the city of testing, has communicated with the Working Group. Many companies view this top-down model—less restrictive than frameworks in states like California—as an advantage. While California has an extensive permitting system, Texas only mandates that AVs are registered, insured, and have systems to record crash data. A representative for Avride cited the “favorable regulatory environment” in Austin, adding: “The state has clear and supportive laws that allow us to operate and scale our technology confidently,” in a statement to Fast Company. Of course, regulations carry weight—both protective and limiting. They can restrict innovation but also safeguard the public. IDC’s Alison Brooks and Remi Letemple, a senior research analyst at the firm, both reference the Cruise crash in San Francisco as a cautionary tale. In 2023, a Cruise robotaxi dragged a pedestrian along the street, prompting a full recall of the company’s fleet. “How do we get an environment that balances innovation with regulation in a way that avoids catastrophic events?” IDC’s Brooks asks. “That’s the tension that I think exists in all of those markets. When I talk to adjacent mobility folks, they’re watching this market very carefully as well for the same reasons.” When asked about the risk of crashes or technical failures, the City of Austin spokesperson responded: “The City works with AV companies before

The robotaxi race is heating up in Austin. A decade after Google’s self-driving car project quietly tested on the city’s streets, a new wave of autonomous vehicle companies is setting up shop. Waymo, now a dominant force in San Francisco, is expanding to the city. Tesla is preparing to debut its long-promised robotaxi. And smaller players like Zoox, Avride, and ADMT are using the Texas capital as a proving ground.

What was once a fringe experiment is now a high-stakes industry comeback, deep in the heart of Texas.

“You have a regulatory environment that’s keen to capitalize on these developments,” says Alison Brooks, research vice president for worldwide public safety at IDC. “At the same time, it’s a blue city in a red state that’s predisposed towards alternative vehicles that are more environmentally friendly.”

The self-driving companies converging on Austin

The only fully deployed and operational robotaxi company in Austin is Waymo. In 2023, the company announced it was expanding testing to “the city that keeps it weird,” more than two years after its Phoenix launch. Since its March launch, Waymo now has about 100 robotaxis in Austin, making up 20% of local Uber trips. “By expanding our partnership with Uber to Austin, we were able to bring Waymo rides to residents and visitors in Austin even faster,” a representative for Waymo tells Fast Company.

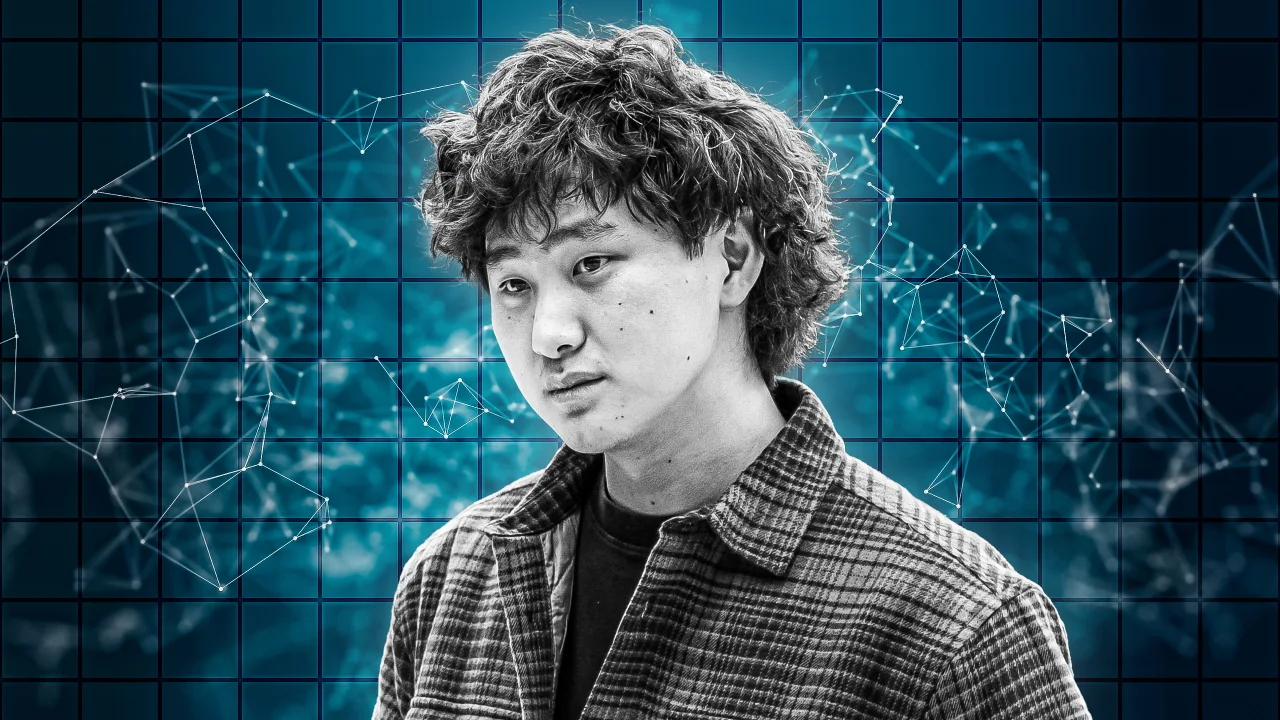

Tesla is now gearing up for deployment in the city. The robotaxi—which Elon Musk has been teasing since 2019—appears finally ready for the streets. Musk, who once operated out of the Bay Area, relocated his companies to Texas and brought his robotaxis with him. According to his posts on X, some of the vehicles have already begun driving. (Tesla did not respond to a request for comment.)

Several smaller robotaxi companies are also testing in Austin. Zoox, owned by Amazon, is operating vehicles with safety drivers across multiple districts. Avride is running tests as well, though its planned debut—through a partnership with Uber—will take place in nearby Dallas. ADMT, Volkswagen’s robotaxi subsidiary, has been testing in Austin since 2023.

As these autonomous vehicle companies converge on Austin, the city is becoming a key arena for robotaxi competition. It may not have the highest adoption of self-driving vehicles—Phoenix and San Francisco still lead in that regard—but with Tesla’s entry, Austin is fast becoming the most competitive testing ground.

A friendly regulatory environment

Why Austin? Many point to the city’s favorable regulatory environment. In Texas, state law preempts local law, which means the relatively relaxed Senate Bill 2205—passed in 2017—sets the statewide standard for AV regulation. Still, Austin’s active local government has played a key supporting role, offering infrastructure and coordination through efforts like the Autonomous Vehicle Working Group, which brings together staff from several city departments.

A spokesperson for the City of Austin tells Fast Company that, while the city cannot directly regulate AVs, it can support companies with valuable information. Each robotaxi company has received maps of school zones, schedules for special events, and guidance on emergency vehicle protocols. The spokesperson notes that Tesla, though not required to inform the city of testing, has communicated with the Working Group.

Many companies view this top-down model—less restrictive than frameworks in states like California—as an advantage. While California has an extensive permitting system, Texas only mandates that AVs are registered, insured, and have systems to record crash data. A representative for Avride cited the “favorable regulatory environment” in Austin, adding: “The state has clear and supportive laws that allow us to operate and scale our technology confidently,” in a statement to Fast Company.

Of course, regulations carry weight—both protective and limiting. They can restrict innovation but also safeguard the public. IDC’s Alison Brooks and Remi Letemple, a senior research analyst at the firm, both reference the Cruise crash in San Francisco as a cautionary tale. In 2023, a Cruise robotaxi dragged a pedestrian along the street, prompting a full recall of the company’s fleet.

“How do we get an environment that balances innovation with regulation in a way that avoids catastrophic events?” IDC’s Brooks asks. “That’s the tension that I think exists in all of those markets. When I talk to adjacent mobility folks, they’re watching this market very carefully as well for the same reasons.”

When asked about the risk of crashes or technical failures, the City of Austin spokesperson responded: “The City works with AV companies before and during deployment to obtain training for first responders, establish expectations for ongoing communication and share information about infrastructure and events.”

Austin’s intrinsic benefits

Beyond regulations, Austin offers several regional advantages. Its consistently high temperatures tend to keep pedestrians off the streets, reducing unexpected interactions for autonomous vehicles. The city is dense enough to challenge AV systems but not so congested as to make navigation unmanageable. A representative from Avride also highlighted the presence of the University of Texas, noting its “strong tech talent pool.”

Demographics add to Austin’s appeal as a testing ground. The city has a sizable base of affluent residents—it now ranks tenth among U.S. cities with the most millionaires. Despite the tech influx, Austin remains largely liberal. Local disability advocates have especially championed robotaxis for broadening access. A representative for Zoox tells Fast Company that locals “have established that they like to move around with on-demand rideshare.”

“Austin also presents unique environmental features including horizontal traffic lights, suspended cable traffic signals, and train track crossings that will help train our AI to better understand and navigate various road patterns and driving conditions,” the Zoox representative writes.

Pushback to the AV surge has been muted. Some Austin residents worried about Cruise, specifically cyclists who watched a Cruise vehicle veer into a bike lane in 2023. Kara Kockelman, a professor of transportation engineering at the University of Texas at Austin, says that the only safety worry she’s heard from Austinites was that Cruise cars “came too close to their vehicle.” Now, Cruise AVs are gone from the city’s roads.

“With Waymo, [Austin residents] only complain if it obeys the speed limit,” Kockelman says. “They drive really well, but they do need to speed up.”

Still, Austin’s local benefits may not translate elsewhere. Other cities have more pedestrians, more complex roadways, or more cautious consumers. “I don’t think Austin can be patient zero, even if it becomes a success. It’s not scalable to other states,” says IDC’s Remi Letemple. “Every city has its own infrastructure and its own barriers.”

![The Most Searched Things on Google [2025]](https://static.semrush.com/blog/uploads/media/f9/fa/f9fa0de3ace8fc5a4de79a35768e1c81/most-searched-keywords-google-sm.png)

![What Is a Landing Page? [+ Case Study & Tips]](https://static.semrush.com/blog/uploads/media/db/78/db785127bf273b61d1f4e52c95e42a49/what-is-a-landing-page-sm.png)