Forget chocolate! The world now envies Switzerland’s zero interest rates

The world envies Swiss chocolate, army knives, and now . . . interest rates? Swiss National Bank, Switzerland’s central bank, moved interest rates to zero this week, a reduction of 25 basis points, and a notable detraction from other central banks around the world, such as the Federal Reserve in the U.S. and the Bank of England in the U.K. In a statement, the Swiss National Bank said that the move was made in relation to declining inflation worries—and that it’s expecting the economies to buckle under the volatility created, in part, due to the Trump administration’s trade policies. “With today’s easing of monetary policy, the SNB is countering the lower inflationary pressure. The SNB will continue to monitor the situation closely and adjust its monetary policy if necessary, to ensure that inflation remains within the range consistent with price stability over the medium term,” the statement read. “The global economic outlook for the coming quarters has deteriorated due to the increase in trade tensions. In its baseline scenario, the SNB anticipates that growth in the global economy will weaken over the coming quarters. Inflation in the U.S. is likely to rise over the coming quarters. In Europe, by contrast, a further decrease in inflationary pressure is to be expected.” Meanwhile, in the U.S., the Federal Reserve’s latest meeting wrapped up this week with no change in interest rates, despite pressure from the White House and others to lower them. Fed Chair Jerome Powell and other Fed governors have been reluctant to do so, as inflation data still has not gotten close enough to its 2% target, and employment data has remained positive. Across the Atlantic, however, another European country, Norway, also cut rates this week. And some experts think that the Swiss could go even further, instituting negative interest rates at some point this year. “There are risks that the SNB will go further in the future if inflationary pressures don’t start to increase, and the lowest the policy rate could go is -0.75%, the rate it reached in the 2010s,” Swiss National Bank’s Chairman Martin Schlegel told CNBC on Thursday. “But what I can say is that going negative, we would not take this decision lightly.”

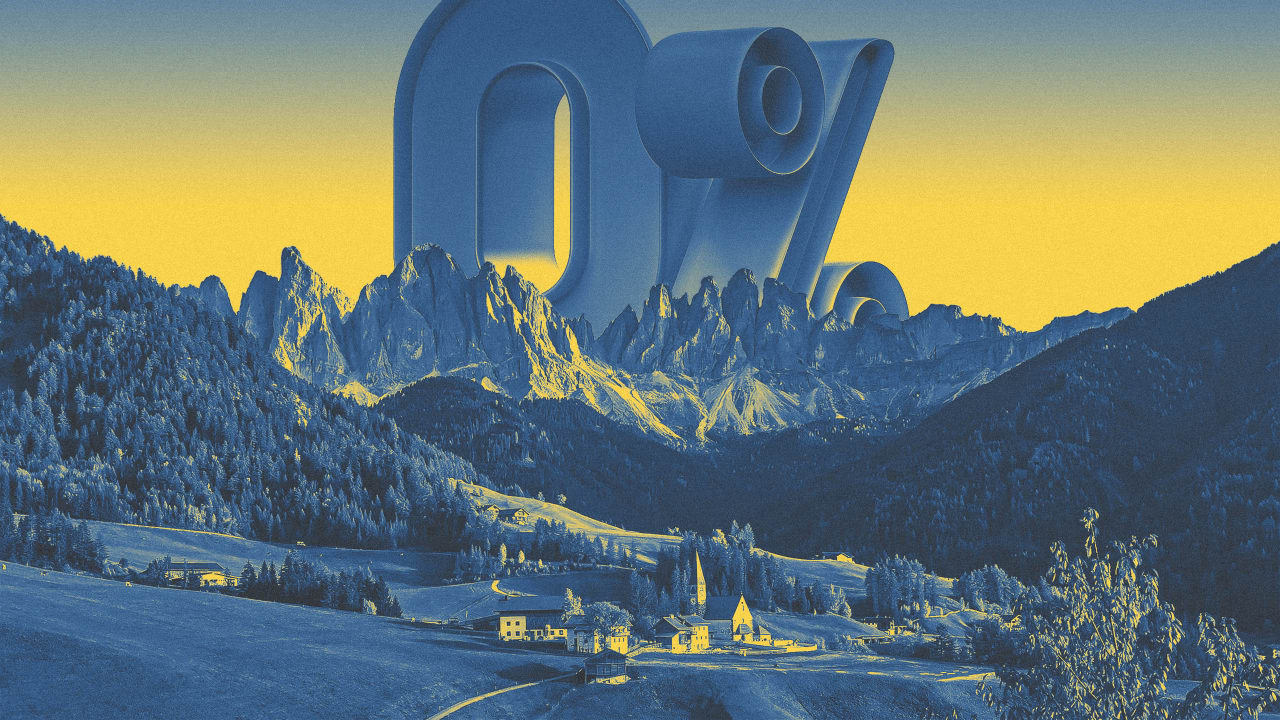

The world envies Swiss chocolate, army knives, and now . . . interest rates?

Swiss National Bank, Switzerland’s central bank, moved interest rates to zero this week, a reduction of 25 basis points, and a notable detraction from other central banks around the world, such as the Federal Reserve in the U.S. and the Bank of England in the U.K.

In a statement, the Swiss National Bank said that the move was made in relation to declining inflation worries—and that it’s expecting the economies to buckle under the volatility created, in part, due to the Trump administration’s trade policies.

“With today’s easing of monetary policy, the SNB is countering the lower inflationary pressure. The SNB will continue to monitor the situation closely and adjust its monetary policy if necessary, to ensure that inflation remains within the range consistent with price stability over the medium term,” the statement read.

“The global economic outlook for the coming quarters has deteriorated due to the increase in trade tensions. In its baseline scenario, the SNB anticipates that growth in the global economy will weaken over the coming quarters. Inflation in the U.S. is likely to rise over the coming quarters. In Europe, by contrast, a further decrease in inflationary pressure is to be expected.”

Meanwhile, in the U.S., the Federal Reserve’s latest meeting wrapped up this week with no change in interest rates, despite pressure from the White House and others to lower them. Fed Chair Jerome Powell and other Fed governors have been reluctant to do so, as inflation data still has not gotten close enough to its 2% target, and employment data has remained positive.

Across the Atlantic, however, another European country, Norway, also cut rates this week. And some experts think that the Swiss could go even further, instituting negative interest rates at some point this year.

“There are risks that the SNB will go further in the future if inflationary pressures don’t start to increase, and the lowest the policy rate could go is -0.75%, the rate it reached in the 2010s,” Swiss National Bank’s Chairman Martin Schlegel told CNBC on Thursday. “But what I can say is that going negative, we would not take this decision lightly.”

![The Largest Communities on Reddit [Infographic]](https://imgproxy.divecdn.com/vfTS-YsC_ZrqM6F4tAXJgV6qj3gCHSsf2dvHufDbrrQ/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9sYXJnZXN0X3JlZGRpdF9jb21tdW5pdGllczIucG5n.webp)