Food Tech Funding Stays Lean While Buyers Show Appetite For M&A

Global funding to food tech startups is down significantly so far in 2025 when compare to last year, but M&A in the space is growing.

Protein bar company David recently raised $75 million and announced it had acquired Epogee, a food tech company behind a plant-based fat alternative. The deal comes as venture funding for food tech has fallen, but as M&A activity in the space appears to be on the rise.

The funding and dealmaking trends indicate that in the face of declining investor interest, consolidation is proving to be a viable alternative for some companies in the food tech space.

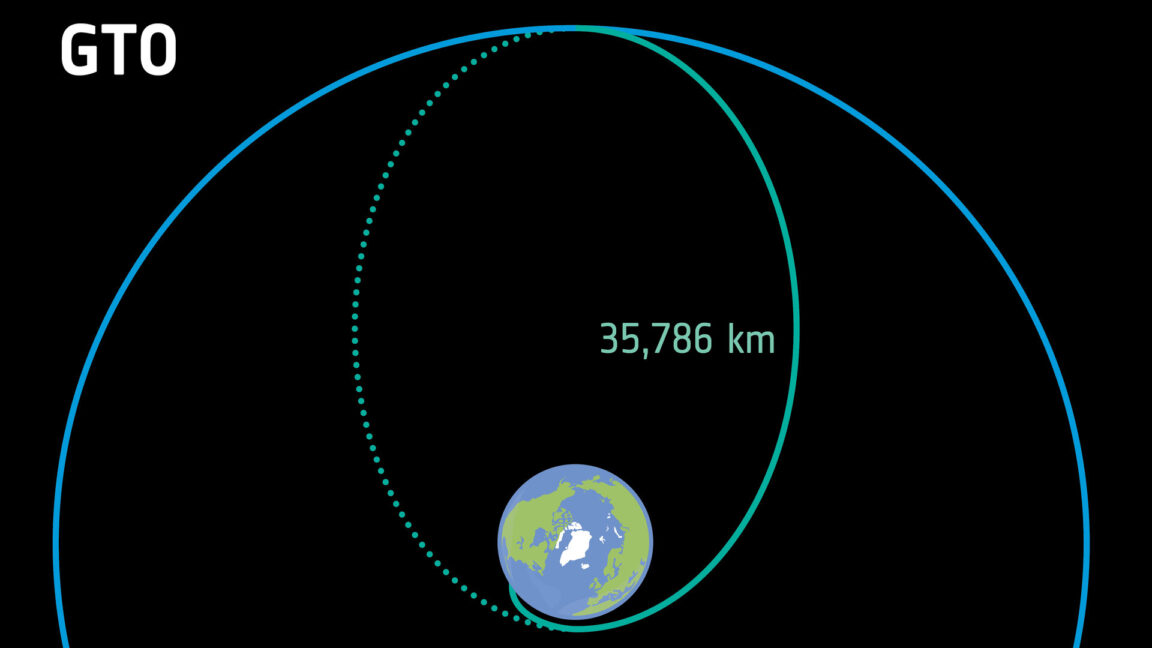

Per Crunchbase data, funding to food tech startups globally totaled $6 billion in 2024, down significantly from $14.5 billion in 2022 and $20.7 billion in 2021. It was up only slightly from the $5.3 billion invested in the space in 2023. So far in 2025, $1.7 billion in funding has flowed to food tech companies.

However, M&A transactions for food tech companies in 2025 so far seem to be on track to outpace 2024. Crunchbase data shows about $4 billion worth of M&A transactions in the sector have occurred globally already this year. That compares to nearly $5.5 billion in all of 2024, and a mere $34 million worth in 2023. (Many acquisition deals don’t include prices, so the figures are likely higher.)

David CEO and co-founder Peter Rahal told Crunchbase News that the company’s recent funding enabled the acquisition of Indianapolis-based Epogee, a 14-year-old food tech supplier of a key ingredient for his company called EPG. The ingredient is a plant-based fat alternative believed to significantly reduce calories and fat without compromising taste or texture.

“Bringing Epogee in-house was a strategic move that will allow us to scale production to meet growing demand,” he said.

To date, New York-based David has raised a total of $85 million. Its latest financing, which was led by Greenoaks with participation from Valor Equity Partners, valued the company at $725 million.

‘Attractive window’ for strategic buyers opens up

Nate Cooper, founder and managing partner at Barrel Ventures, believes funding in food tech is down mostly due to “post hype correction.”

“Many of the companies that were funded were years, if not decades away from commercial viability. They were seeing tech valuations, and required substantial amounts of cap-ex, when at the end of the day what they were selling was a CPG (consumer packaged goods) product and should have been valued as such,” he told Crunchbase News. “Many of these companies have struggled to reach commercial viability and the broader market is now wanting clear paths to break-even, not just visionary technology.”

In Cooper’s view, M&A is up because large CPG companies naturally go through cycles “where they think they can do it and realize that they can’t and then go on buying sprees.”

His firm has invested in a number of food tech startups, including Helaina and Olipop.

Andrew D. Ive, founder and managing general partner at Big Idea Ventures, believes that M&A activity in food tech is accelerating primarily because the funding environment “remains extremely tight.”

“Many startups unable to raise follow-on capital are opting to sell,” he told Crunchbase News. “At the same time, valuations have normalized compared to two years ago, creating an attractive window for strategic buyers to acquire de-risked, well-funded companies with validated technologies — often at reasonable prices.”

Big Idea Ventures has backed dozens of food tech startups including Gourmey, Actual Veggies, Perfect Technologies and Aqua Cultured Foods. Ive said several portfolio companies have recently been acquired, or acquired another company.

Other notable acquisitions in the food tech space in 2025 so far include Pepsi’s $1.95 billion acquisition of Poppi, a beverage company that specializes in flavored sparkling probiotic drinks; Flowers Foods’ $795 million buy of Simple Mills, which produces organic, gluten-free and plant-based food products; and The Hershey Co.’s $750 million purchase of LesserEvil, a food manufacturing company that produces a variety of packaged snack products.

Food tech outlier

David is a bright spot in a sector whose popularity has waned in recent years. The company officially incorporated in late September 2023 and launched its product for sale nearly one year later. Today, it sells in more than 3,000 retail stores.

The company’s first product is a protein bar that David claims offers “the highest protein-per-calorie ratio of any protein bar on the market.”

Impressively, David is already profitable, according to Rahal. He projects the company will generate more than $100 million in sales during its first 12 months of operations.

Rahal is no stranger to food tech. While he’s no longer involved in the day-to-day operations there, he also co-founded RXBAR, which was sold to Kellogg’s in 2017.

Methodology

Food tech is defined by the industries of food and beverage, nutrition, food processing and organic food according to Crunchbase data. Most announced rounds are represented in the database; however, there could be a small time lag for rounds reported late in the quarter. It does not include incubators or accelerators due to the fluctuations their investment numbers can have.

Related Crunchbase queries:

Illustration: Li-Anne Dias

![X Highlights Back-to-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)