Berlin-based FinTech startup Payrails raises over €27 million for their global payment software

German FinTech startup Payrails, a global payment software company, today announced it has raised €27.7 million in Series A funding to accelerate product innovation, product roadmap expansion and support commercial growth across EMEA to meet enterprise demand. The round was led by HV Capital’s Growth Fund, with strong participation from all existing investors EQT Ventures, […] The post Berlin-based FinTech startup Payrails raises over €27 million for their global payment software appeared first on EU-Startups.

German FinTech startup Payrails, a global payment software company, today announced it has raised €27.7 million in Series A funding to accelerate product innovation, product roadmap expansion and support commercial growth across EMEA to meet enterprise demand.

The round was led by HV Capital’s Growth Fund, with strong participation from all existing investors EQT Ventures, General Catalyst, and Andreessen Horowitz, bringing total funding raised to over €45.8 million.

Orkhan Abdullayev, Co-founder and CEO of Payrails said: “We’re grateful for the trust our customers and investors have placed in us. Their continued support fuels our vision of empowering enterprises with an all-in-one platform to manage every aspect of payments, unlocking new levels of performance and innovation while driving down complexity and costs.

“With this funding, we’re doubling down on product development to expand our multi-product platform across the entire payment lifecycle. Our payment operating system is setting a new industry standard for how enterprises manage and optimise payments, with more control, visibility and flexibility than ever before,”.

Founded in 2021 by former FinTech innovators from Delivery Hero, Payrails’ all-in-one platform spans the entire payment lifecycle with a modular architecture that includes payment orchestration, payouts, tokenisation, unified analytics, automated reconciliation, and recently launched in-person payments.

The funding, allegedly one of the largest Series A rounds for a FinTech company in Europe this year, follows a period of notable growth. In 2024, Payrails processed more than 1 million in daily operations, expanded into 30 new markets across Europe and MENA, and attracted enterprise customers across industries such as mobility, marketplaces and platforms, travel, e-commerce, financial services and subscription services.

Payrails is trusted by global brands including Puma, Vinted, Flix, InDrive, Just Eat Takeaway, and Careem to boost performance, reduce operational complexity and costs, and enable faster innovation across their payment operations.

Alexander Joel-Carbonell, partner at HV Capital said: “Having worked closely with Orkhan and Emre for over eight years – starting from our shared time at Delivery Hero -I’ve consistently been impressed by their sharp strategic instincts and relentless execution. With Payrails, they’ve built a category-defining: an enterprise-grade, modular payment operating system that abstracts complexity, enhances performance, and enables rapid innovation. Their unwavering 24/7 customer focus and ability to deliver immediate impact is reflected in the caliber of their global enterprise clients and the speed at which they’re scaling, all shown in their great SaaS KPIs and traction. When we benchmarked the landscape, Payrails clearly led the pack of solutions, solving real pain points with a powerful enterprise product. I am thrilled to continue to support Orkhan and Emre with HV Growth from the sidelines!”

Enterprise payment operations are becoming increasingly complex and fragmented. Enterprises must manage local payment methods, coordinate multiple Payment Service Providers, sync with internal systems, and comply with evolving regulatory frameworks across multiple markets, while delivering a frictionless customer experience and maintaining cost efficiency.

With the global payments market projected to exceed $1.7 trillion in transactions by 2025, according to Payrails. Scaling payment operations and efficiently managing money movements has become a critical growth lever for large enterprises. Yet, Payrails says that rigid legacy systems or in-house built tools, that require deep domain expertise, significant investment and lengthy go-to-market timelines, limit agility and hinder innovation.

Payrails looks to address this with a payment operating system purpose-built for enterprises, allowing companies to orchestrate complex payment flows, optimise performance, and abstract the complexity of system integrations.

Kaushik Subramanian, partner at EQT Ventures said: “Payrails is tackling one of the most complex challenges for global enterprises with its unified payment platform. The power lies in composability – by offering composable software blocks, from pay-ins to tokenisation to reconciliation, Payrails gives companies the commercial flexibility and control that in-house or legacy systems can’t. The team is world-class, with deep FinTech and software experience, and their rapid traction with global brands speaks volumes. That is why we are doubling down on the team. We are excited about what is ahead.”

Acting as a deeply integrated meta layer, Payrails spans the entire payment lifecycle with a modular architecture that includes payment orchestration, payouts, tokenisation, unified analytics, automated reconciliation, and recently launched in-person payments, all powered by advanced data capabilities.

With a growing catalogue of over 100 integrations, Payrails works with payment service providers like Stripe, Adyen, fraud-prevention solutions like Forter, software solutions like SAP, Salesforce, Snowflake, and others. This gives enterprises flexibility, visibility, and control of their payment operations and checkout experiences across geographies, channels, and verticals.

David Haber, General Partner at a16z said: “As more companies go global from day one, the need for unified, scalable payments infrastructure has never been more urgent. Payrails is building the operating system for this world. We believe their modular approach, execution speed, and strong customer traction set them apart in a category overdue for transformation. We’re excited to continue to support Payrails as they become foundational infrastructure for the next generation of global enterprises.”

Earlier this year, Payrails entered a strategic partnership with Mastercard to accelerate digital transformation and unlock next-generation payment capabilities for large-scale enterprises.

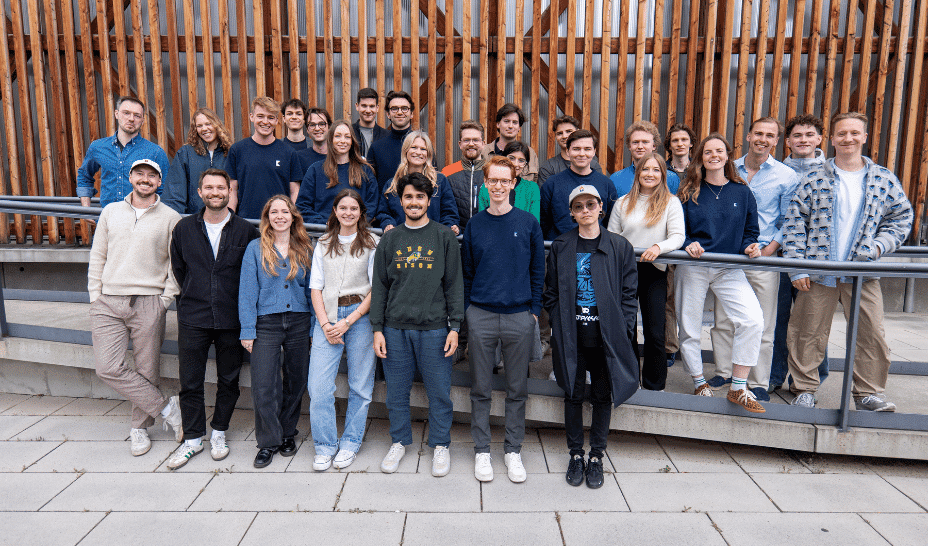

To support its continued growth, Payrails is actively growing its commercial and product teams across Berlin, London, Paris, Dublin, Cairo and Dubai, and has expanded its leadership team with senior hires:

- Edward Moore, Chief Revenue Officer (formerly Global Head of Sales at Stripe)

- Willian Carminato, Chief Technology Officer (formerly VP Engineering at Miro)

- Patrick Bellinghausen, VP Finance (formerly Senior Director at Delivery Hero)

Zeynep Yavuz, partner at General Catalyst said: “As global commerce grows and payment flows become more complex, enterprises need a reliable platform built to operate across multiple processors. Our early conviction in Payrails was driven by an exceptional founding team with deep industry experience and a clear vision for simplifying payments while reducing costs. Today, some of the world’s fastest-growing global enterprises trust Payrails to power their mission-critical payments – and are consistently delighted by the product’s performance, flexibility, and reliability. We’re proud to support them as they reshape the future of payments operations.”

The post Berlin-based FinTech startup Payrails raises over €27 million for their global payment software appeared first on EU-Startups.

![X Highlights Back-to-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)