Stock market fear index spikes after Trump’s war threats

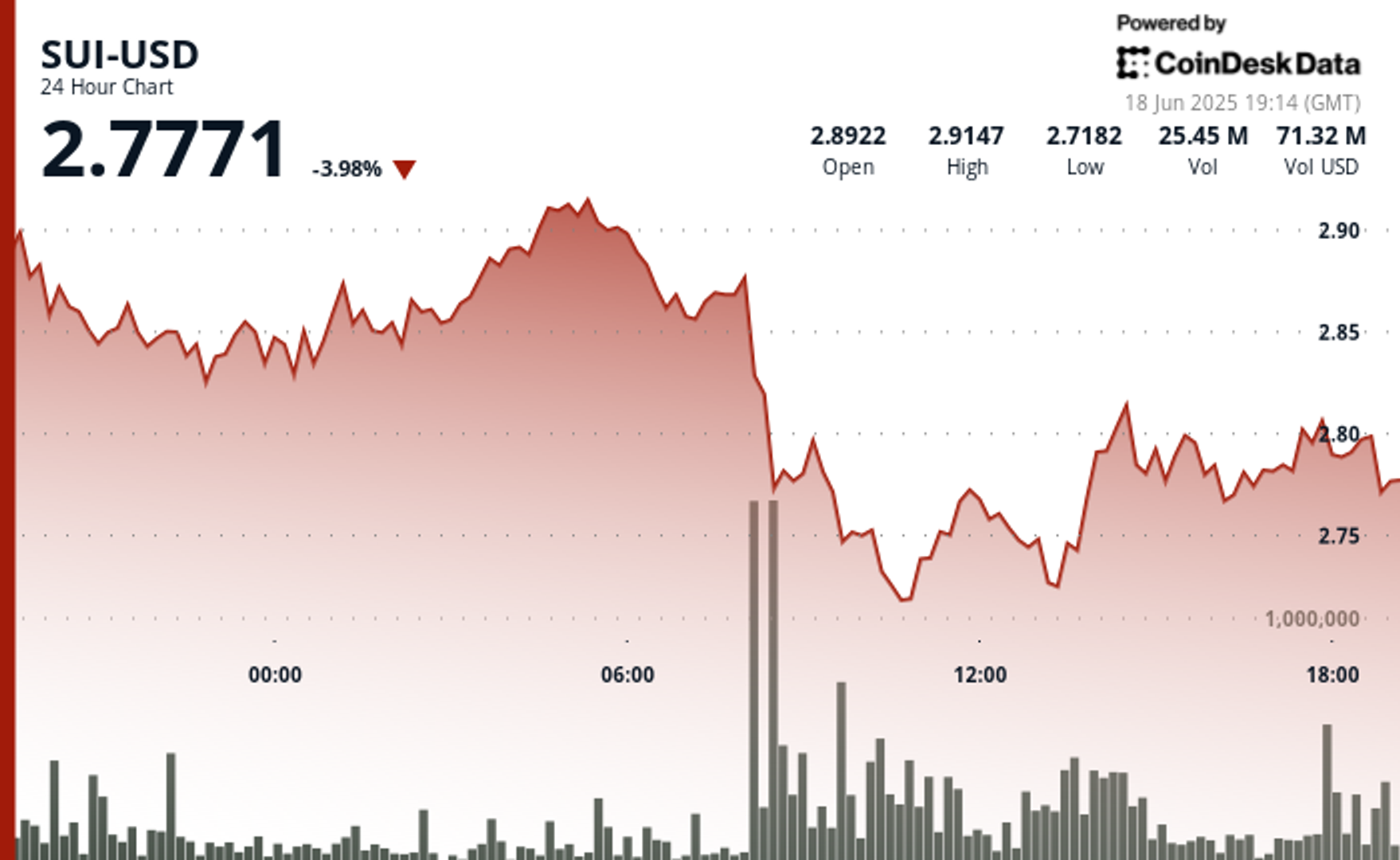

Here’s a snapshot of the action this morning prior to the opening bell in New York.

- The U.S. Federal Reserve will give us a new interest rate decision today and offer commentary on how it sees the economy. The Israel-Iran war enters its sixth day. And yet, in the markets, somehow it’s all going to be about President Trump.

The Fed will likely keep interest rates on hold today. The CME Fedwatch market has priced that in with a 99.9% (!) level of certainty. Normally, therefore, investors would spend the rest of the day closely parsing Federal Reserve Chairman Jerome Powell’s remarks for changes of tone and clues as to when the Fed might next change interest rates.

But whatever Powell says might well be overshadowed by Trump, who will no doubt complain this afternoon that Powell did not cut rates.

“US President Trump advocates rate cuts, but this is a distinctly minority view. The trade tax increase is big, and the Fed wants greater certainty about its impact before changing policy,” UBS analyst Paul Donovan told clients this morning.

Although today’s Fed decision is the most predictable in years, the VIX volatility index (often called the “fear index”) is elevated today. It was up nearly 9% this morning—and global stock markets are all over the place as a result: The broad Europe market was down in early trading but the U.K. market was up. Japan was up but Hong Kong was down.

Stocks just don’t know where to go.

Why?

Trump, again.

In the last 24 hours he has threatened to intervene militarily in Iran:

“We now have complete and total control of the skies over Iran. Iran had good sky trackers and other defensive equipment, and plenty of it, but it doesn’t compare to American made, conceived, and manufactured ‘stuff.’ Nobody does it better than the good ol’ USA,” he wrote on Truth Social. “We know exactly where the so-called “Supreme Leader” is hiding. He is an easy target, but is safe there – We are not going to take him out (kill!), at least not for now. But we don’t want missiles shot at civilians, or American soldiers. Our patience is wearing thin. Thank you for your attention to this matter!” He then added: “UNCONDITIONAL SURRENDER!”

Oil prices have spiked as a result. A month ago a barrel of WTI crude was $62 and change. Today it’s about $74.

In that light, the sudden uptick in volatility is not a surprise.

Donovan, though, thinks the markets are becoming more inured to the president’s interventions.

“Trump’s social media posts have suggested increased hostility toward Iran, raising the possibility of the US striking (presumably) Iranian nuclear facilities. Markets are still inclined to view this as a local conflict, with limited global economic consequences,” he said.

Here’s a snapshot of the action prior to the opening bell in New York:

- S&P 500 futures rose 0.21% this morning even though the index itself sunk 0.84% yesterday, ending below 6,000 again, at 5,982.72.

- The VIX volatility index was up nearly 9% this morning.

- Japan’s Nikkei 225 was up 0.9%.

- China’s SSE Composite was flat.

- The Stoxx Europe 600 was flat in early trading.

- The U.K.’s FTSE 100 was up 0.2% in early trading.

- Hong Kong’s Hang Seng was down more than 1%.

This story was originally featured on Fortune.com