Crypto scams spike as meme coins, weak laws fuel $2.1B crime wave

Over 50% of some crypto protocol volumes involve stolen funds. $2.1 billion stolen via crypto hacks so far in 2025. Tron blockchain “Black U” market worth up to $10 billion. The crypto industry is facing a fresh wave of crime, driven by a rise in politically backed meme coins and legal loopholes that continue to […] The post Crypto scams spike as meme coins, weak laws fuel $2.1B crime wave appeared first on CoinJournal.

- Over 50% of some crypto protocol volumes involve stolen funds.

- $2.1 billion stolen via crypto hacks so far in 2025.

- Tron blockchain “Black U” market worth up to $10 billion.

The crypto industry is facing a fresh wave of crime, driven by a rise in politically backed meme coins and legal loopholes that continue to shield malicious actors.

Blockchain investigator ZachXBT, known for tracking on-chain fraud, warned in a recent post on X that crypto-related crimes have entered a “supercycle”, with fraudulent activities becoming more sophisticated and widespread.

His comments come amid a broader industry reckoning, as high-value hacks, phishing schemes, and the misuse of decentralised protocols threaten to undermine trust in the space.

Outdated court rulings and unchecked influencers add to the problem

According to ZachXBT, one of the major reasons behind the crime surge is the way courts continue to side with exploiters of smart contracts due to obsolete legal frameworks.

In many cases, those who manipulate decentralised systems walk free because judges interpret code-based exploits as fair use rather than theft.

He also highlighted the role of influencers and key opinion leaders (KOLs) who promote fraudulent crypto projects without facing any consequences.

In jurisdictions where failing to disclose paid advertisements is illegal, enforcement remains weak or non-existent.

ZachXBT estimated that regulators could have made between $50 million and $100 million in fines over the years by holding such individuals and projects accountable.

In a tweet, he remarked that “if you ever wanted the opportunity to extract from the industry, there’s not been much of a better time,” referencing the sense of lawlessness currently dominating the ecosystem.

He added that over half of all transaction volume in certain protocols involves stolen funds, and yet teams continue to collect fees without scrutiny.

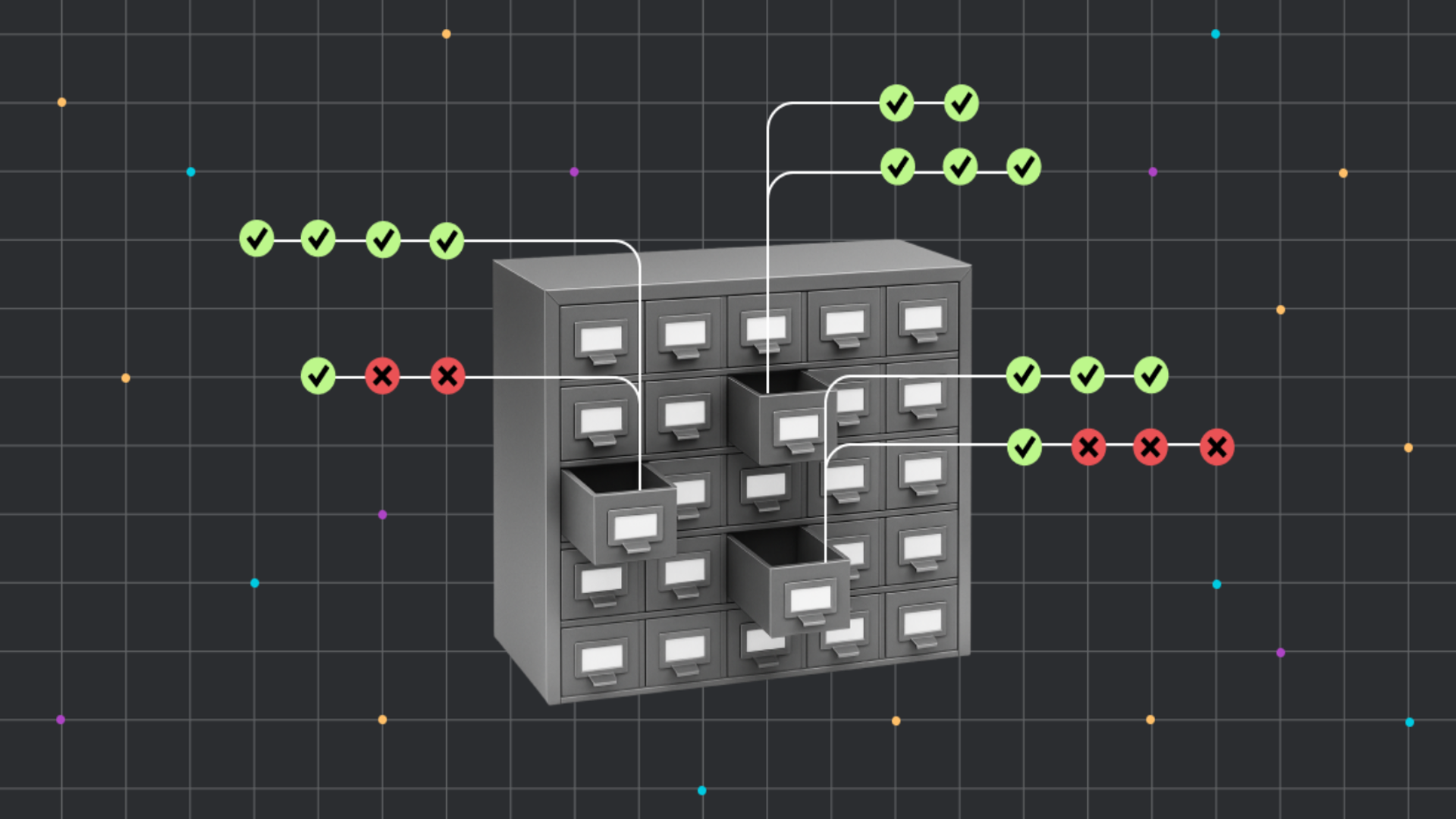

Criminals exploit blockchain transparency and weak oversight

While blockchain technology allows for full transaction transparency, which helps trace illicit funds, ZachXBT said that it also enables crime by giving bad actors insight into network activity and vulnerabilities.

North Korean-linked groups such as Lazarus have allegedly taken advantage of this.

ZachXBT suggested that laundering groups and OTC brokers have successfully processed stolen funds from platforms like Bybit, DMM Bitcoin, and WazirX.

These operations often go undetected for extended periods due to the volume and complexity of transactions involved.

He also claimed that a shadow market, dubbed “Black U,” has emerged on the Tron blockchain, with an estimated value between $5 billion and $10 billion.

Much of this activity is suspected to involve laundering operations that are difficult to track despite blockchain records.

Losses continue to mount across the industry in 2025

ZachXBT’s warning coincides with mounting evidence of damage. According to blockchain security firm CertiK, more than $2.1 billion has been lost to crypto attacks in 2025 so far.

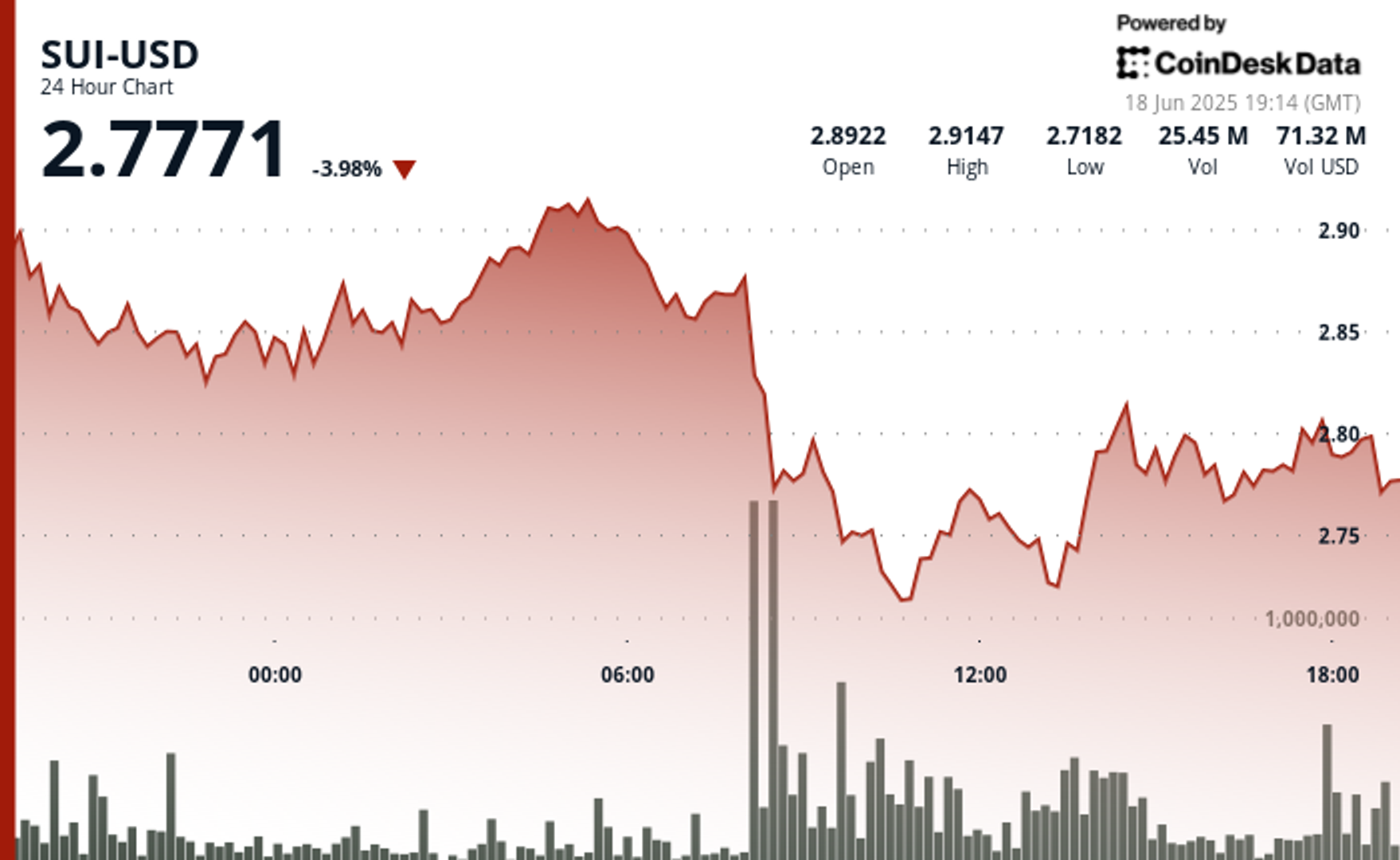

In May alone, cybersecurity company PeckShield reported 20 significant crypto hacks amounting to $244.1 million in stolen assets.

Although this marks a 39.29% decrease from April, the scale of ongoing theft remains alarming.

The recent rise in data leaks has further exposed user vulnerabilities, highlighting the need for stronger protections.

ZachXBT concluded his remarks by questioning whether systemic change would only occur after large-scale losses force regulators to act.

For now, the combination of speculative mania, regulatory gaps, and unchecked promotion continues to create a fertile environment for crypto-related crime.

The post Crypto scams spike as meme coins, weak laws fuel $2.1B crime wave appeared first on CoinJournal.