Czech investment manager Orbit Capital launches €100 million fund to support tech companies overlooked by banks

Prague-based Orbit Capital announced this morning that their Growth Debt II fund has made its first close of €70 million, with the aim of holding €100 million, to support Central and Eastern European tech companies overlooked by banks. Among the investors who have already signed up are the European Investment Fund (EIF), Česká Spořitelna, and […] The post Czech investment manager Orbit Capital launches €100 million fund to support tech companies overlooked by banks appeared first on EU-Startups.

Prague-based Orbit Capital announced this morning that their Growth Debt II fund has made its first close of €70 million, with the aim of holding €100 million, to support Central and Eastern European tech companies overlooked by banks.

Among the investors who have already signed up are the European Investment Fund (EIF), Česká Spořitelna, and the Rentea pension fund company (part of Partners Group). Smaller investors can also be part of the Growth Debt fund through another partner, Conseq. This second fund follows on the success of Growth Debt I, which held €40 million.

Orbit Capital partner Radovan Nesrsta, had the following to say: “Our firm has introduced Venture Debt – a new type of funding for our region that is attractive to young, fast-growing companies as well as already mature companies that do not yet meet the conditions for traditional bank financing.

“Venture Debt financing is up to four times cheaper for Founders and their investors than if they had to dilute their shares again. Our investors will also benefit: the portfolio of the first fund shows that we can deliver a return of 15%, combined with robust downside protection.”

Orbit Capital is a family of venture capital funds with focus on technology scaleups. The company was founded in 2019 and with Growth Debt I it enabled investors to invest in young technology companies. The fund claims to have filled the gap in debt financing that many CEE startups lacked.

In addition to the debt fund, the Orbit Capital family also includes Growth Equity I fund that currently has two unicorns in its portfolio. The funds provide scaleups with funding ranging from €3 to €10 million.

“I am pleased that we are bringing this innovative concept to the pension fund company, which will allow our clients to invest in a new and interesting way that was previously only available to a limited group of wealthy investors. In this way, we are fulfilling one of Partners’ visions, which is to make financial products accessible to all clients without distinction and to simplify them,” says Petr Borkovec, director of the Partners Group.

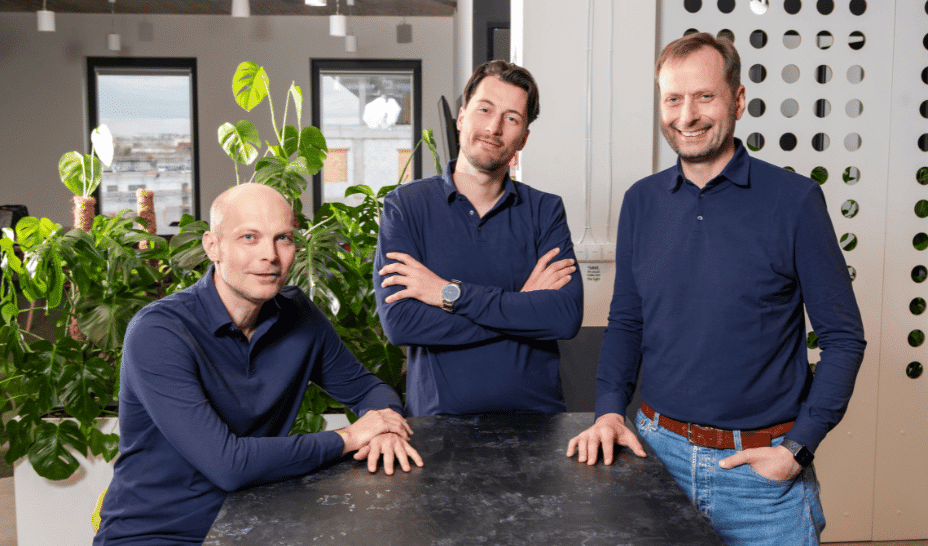

Since its inception, Orbit has been headed by venture capital investor Radovan Nesrsta. Other partners include Lukáš Macko, Wiktor Namysl and Jerzy Rozlucki. Orbit has offices in Prague, Czechia and Warsaw, Poland.

“We are providing crucial support to Orbit Capital in its mission to provide alternative financing to innovative companies in Central and Eastern Europe,” says EIF Chief Executive Marjut Falkstedt. “This investment will not only provide much-needed financing to SMEs and small Mid-Caps but also promote innovation, contributing to the region’s economic growth and competitiveness.”

Orbit Capital has invested in a total of fifteen Central European companies as part of its venture debt fund, including Czech online supermarket Rohlík, FinTech app Twisto, anti-fraud detection company ThreatMark, as well as AI-powered call centre software CloudTalk and the European yacht rental platform Boataround from Slovakia.

“Through this fund, we aim to provide indirect access to venture debt for companies and startups that may not qualify for traditional bank loans but show strong innovation potential and promising business models. We believe this investment also contributes to the broader goal of supporting the second economic transformation – a strategic effort to enhance the long-term competitiveness of the Czech economy,” added Jan Seger, Director of Financing and Advisory at Česká Spořitelna.

The debt fund primarily supports companies that already have established their reputation, have or are approaching positive cash flow, yet aspire to further charge their growth. Orbit Capital says that it was the success of the first fund that encouraged large institutional investors to join the journey of Orbit Capital.

Lukáš Macko, who became a partner at Orbit Capital last year, added the following: “For the second fund, we plan to follow a strategy that will apply what we learned from the first. Although venture debt is a common way of financing fast-growing technology companies in Western markets, we are a pioneer in our region. During the first five years, we managed to build a venture debt infrastructure from the ground up and also the trust of company founders. In the second fund, we will use these foundations to help as many companies as possible.”

The post Czech investment manager Orbit Capital launches €100 million fund to support tech companies overlooked by banks appeared first on EU-Startups.