Trump Media stock price: DJT shares shrug off Bitcoin and Ethereum ETF news, down significantly in 2025

Despite crypto being all the rage (again) in 2025, the announcement yesterday that President Trump’s Trump Media & Technology Group Corp. (Nasdaq: DJT) is seeking approval from the Securities and Exchange Commission (SEC) to launch a crypto-based ETF has so far done little to turn around the fortunes of DJT stock, which is currently down over 45% since the beginning of the year. Here’s what you need to know about the Trump Media crypto ETF and the company’s latest stock price movement. What does Trump Media want to launch? Yesterday, Trump Media & Technology Group, owner of President Trump’s Truth Social social media network, announced its intention to launch an exchange-traded fund (ETF) comprising two assets: Bitcoin and Ethereum. Those two cryptocurrencies are the most popular in the world, so it’s no surprise that Trump Media would focus on combining them into a single ETF. The fund would allow people to invest in two cryptocurrencies at once by purchasing a single share of the ETF. Announcing that it has filed its Form S-1 registration statement with the SEC, declaring its intentions to launch the ETF, Trump Media said that the ETF, officially called the “Truth Social Bitcoin and Ethereum ETF, B.T.,” will hold Bitcoin and Ethereum directly. Bitcoin will make up 75% of the ETF’s assets, with Ethereum accounting for 25% of the ETF’s assets. The ETF announcement represents a further expansion of Trump Media’s business portfolio, which currently includes the Truth Social social media network, the Truth+ streaming platform, and the FinTech brand Truth.Fi. Yet if executives at Trump Media were hoping for a stock price boost from the news, they’ll be disappointed today. As of the time of this writing, DJT shares are currently up around 1.69% to $18.98. The stock actually sank yesterday when the news was announced. Investors shrug off the crypto news Yesterday, on the same day that Trump Media filed its SEC paperwork for the crypto ETF, Trump Media shares closed at $18.67. However, today’s modest price rise suggests that investors so far don’t seem to think that the potential ETF offering will significantly impact the company’s financials. One reason for this could be that cryptocurrency ETFs are becoming an increasingly crowded market. As noted by Reuters, Morningstar ETF analyst Bryan Armour said that any company newly entering the crowded crypto ETF market will face challenges. “The only way to stand out will be through fees or brand,” Armour said. However, another reason could be that many investors still view Truth Social’s stock as a “belief stock”—a proxy for Donald Trump’s popularity, rather than a company with strong fundamentals behind it. Whatever the reason, the ETF news so far hasn’t turned Trump Media’s fortunes around when it comes to the company’s share price. As of this writing, DJT’s share price has fallen over 11% in the last five trading days alone. Over the past month, DJT shares are down more than 27%. And since the beginning of the year, DJT shares have cratered more than 45%. What do Trump Media’s financials look like? On May 9, Trump Media reported its most recent quarterly results, which cover the company’s Q1 of fiscal 2025, which ended on March 31. The company reported a net loss of $31.7 million for the quarter. In other Trump business news, yesterday, the Trump Organization, a separate entity from Trump Media, announced its plans to launch a new cellular network called Trump Mobile and also a new smartphone called the T1 Phone. The move largely baffled industry experts. Disclosure: Morningstar was founded by Joe Mansueto, owner of Fast Company‘s parent company.

Despite crypto being all the rage (again) in 2025, the announcement yesterday that President Trump’s Trump Media & Technology Group Corp. (Nasdaq: DJT) is seeking approval from the Securities and Exchange Commission (SEC) to launch a crypto-based ETF has so far done little to turn around the fortunes of DJT stock, which is currently down over 45% since the beginning of the year.

Here’s what you need to know about the Trump Media crypto ETF and the company’s latest stock price movement.

What does Trump Media want to launch?

Yesterday, Trump Media & Technology Group, owner of President Trump’s Truth Social social media network, announced its intention to launch an exchange-traded fund (ETF) comprising two assets: Bitcoin and Ethereum.

Those two cryptocurrencies are the most popular in the world, so it’s no surprise that Trump Media would focus on combining them into a single ETF. The fund would allow people to invest in two cryptocurrencies at once by purchasing a single share of the ETF.

Announcing that it has filed its Form S-1 registration statement with the SEC, declaring its intentions to launch the ETF, Trump Media said that the ETF, officially called the “Truth Social Bitcoin and Ethereum ETF, B.T.,” will hold Bitcoin and Ethereum directly.

Bitcoin will make up 75% of the ETF’s assets, with Ethereum accounting for 25% of the ETF’s assets.

The ETF announcement represents a further expansion of Trump Media’s business portfolio, which currently includes the Truth Social social media network, the Truth+ streaming platform, and the FinTech brand Truth.Fi.

Yet if executives at Trump Media were hoping for a stock price boost from the news, they’ll be disappointed today. As of the time of this writing, DJT shares are currently up around 1.69% to $18.98. The stock actually sank yesterday when the news was announced.

Investors shrug off the crypto news

Yesterday, on the same day that Trump Media filed its SEC paperwork for the crypto ETF, Trump Media shares closed at $18.67. However, today’s modest price rise suggests that investors so far don’t seem to think that the potential ETF offering will significantly impact the company’s financials.

One reason for this could be that cryptocurrency ETFs are becoming an increasingly crowded market. As noted by Reuters, Morningstar ETF analyst Bryan Armour said that any company newly entering the crowded crypto ETF market will face challenges. “The only way to stand out will be through fees or brand,” Armour said.

However, another reason could be that many investors still view Truth Social’s stock as a “belief stock”—a proxy for Donald Trump’s popularity, rather than a company with strong fundamentals behind it.

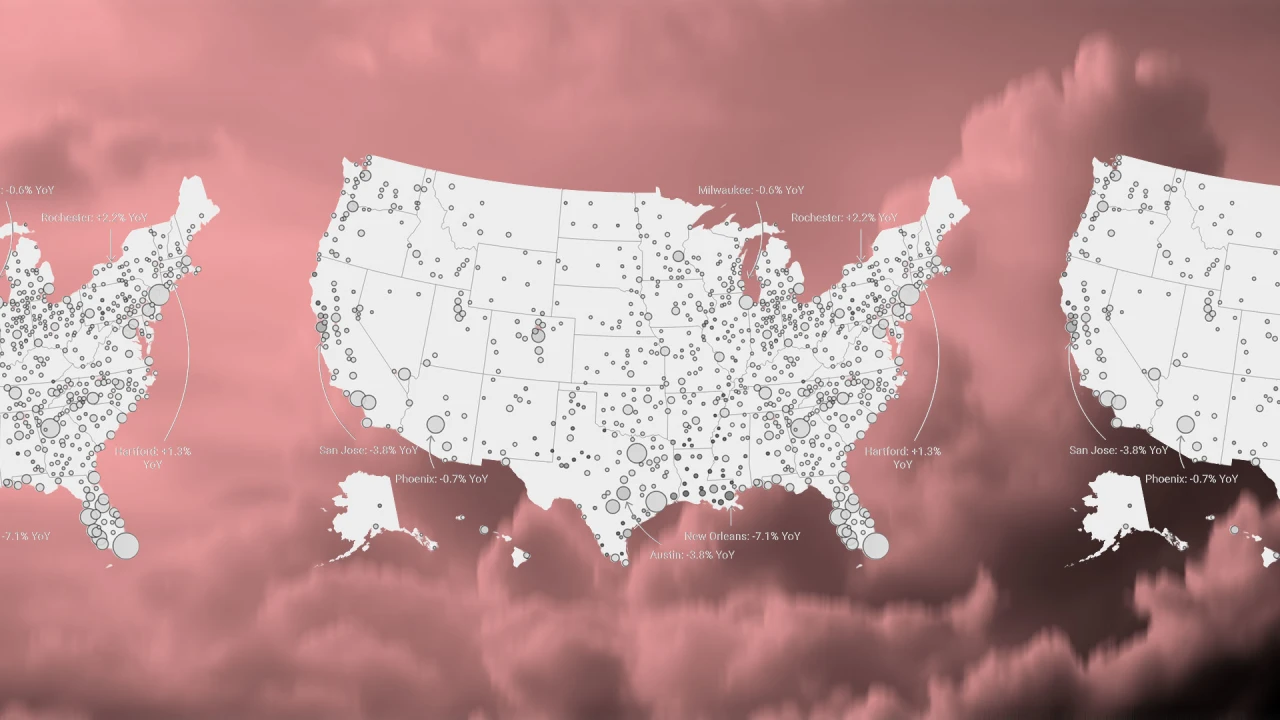

Whatever the reason, the ETF news so far hasn’t turned Trump Media’s fortunes around when it comes to the company’s share price. As of this writing, DJT’s share price has fallen over 11% in the last five trading days alone. Over the past month, DJT shares are down more than 27%. And since the beginning of the year, DJT shares have cratered more than 45%.

What do Trump Media’s financials look like?

On May 9, Trump Media reported its most recent quarterly results, which cover the company’s Q1 of fiscal 2025, which ended on March 31. The company reported a net loss of $31.7 million for the quarter.

In other Trump business news, yesterday, the Trump Organization, a separate entity from Trump Media, announced its plans to launch a new cellular network called Trump Mobile and also a new smartphone called the T1 Phone. The move largely baffled industry experts.

Disclosure: Morningstar was founded by Joe Mansueto, owner of Fast Company‘s parent company.