Central banks have dumped $48 billion in Treasuries as foreign wealth officials divorce the dollar

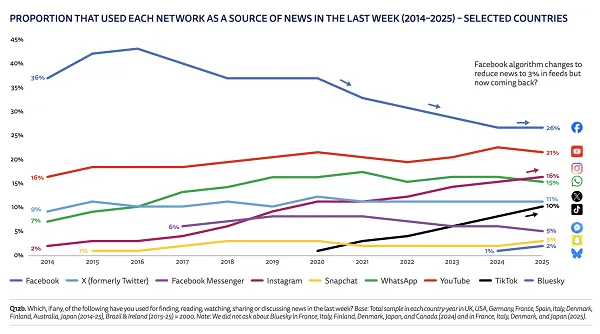

Foreign buyers account for roughly 30% of the U.S. Treasury market.

- More than 200 central banks and other foreign entities like sovereign wealth funds keep Treasuries and other assets in the custody of the New York Federal Reserve. Those holdings declined by $17 billion last week and have fallen by $48 billion since late March, just before Trump’s tariffs sparked a confounding bond sell-off.

Markets are watching closely for any signs foreign investors are souring on U.S. debt. A pullback in bond buying from central banks could send borrowing costs higher if other investors don’t fill the gap, potentially putting the U.S. government in a tight spot.

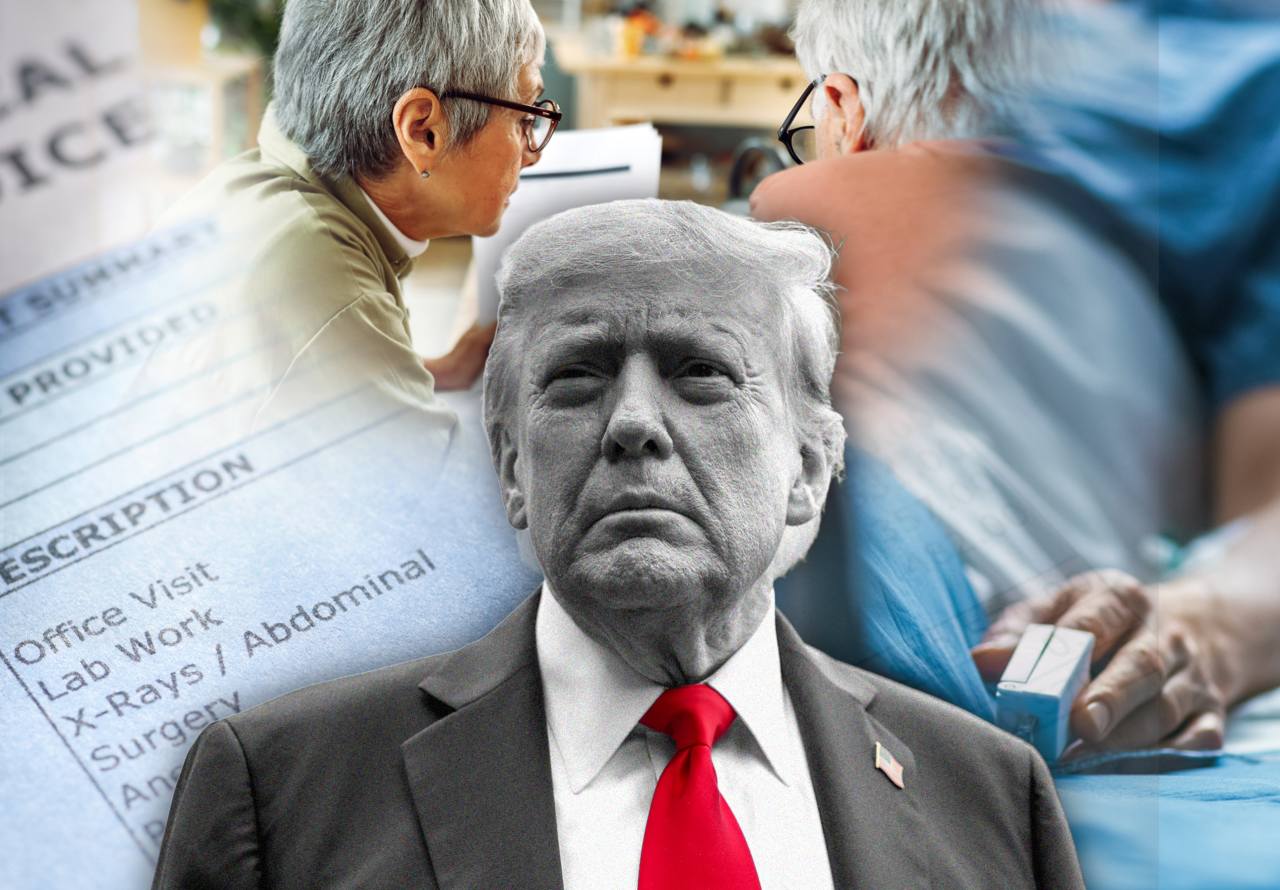

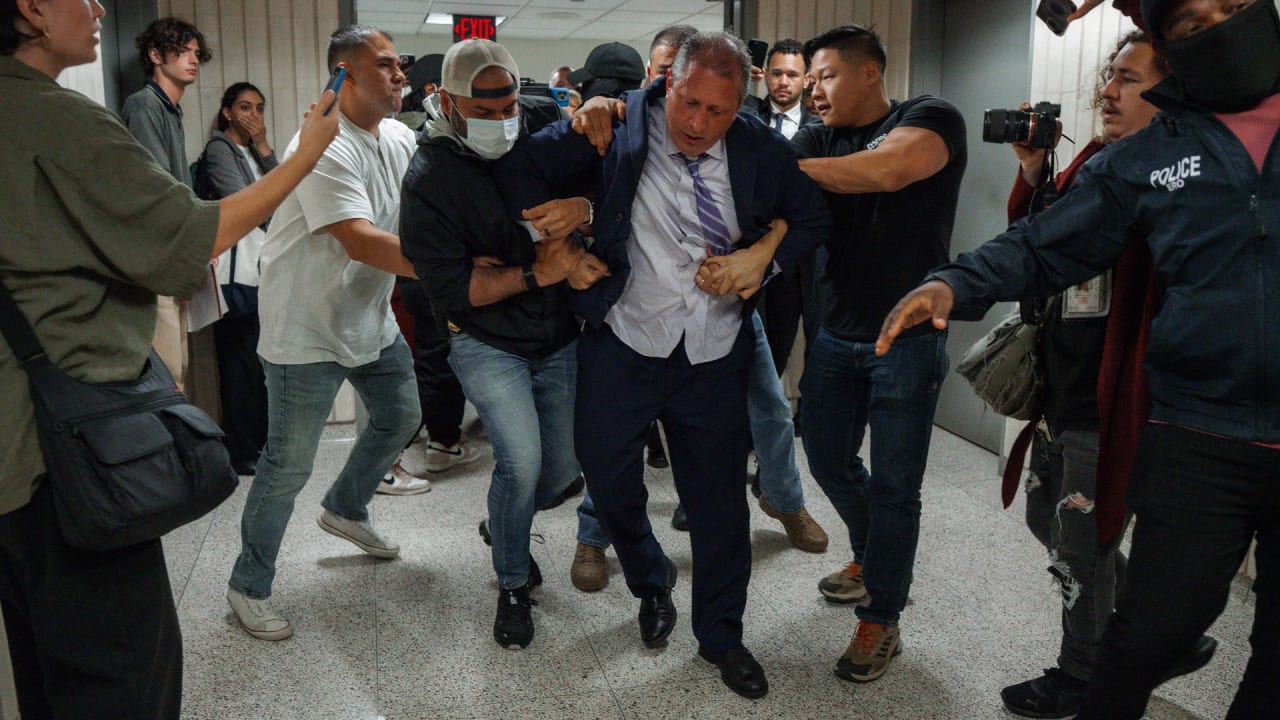

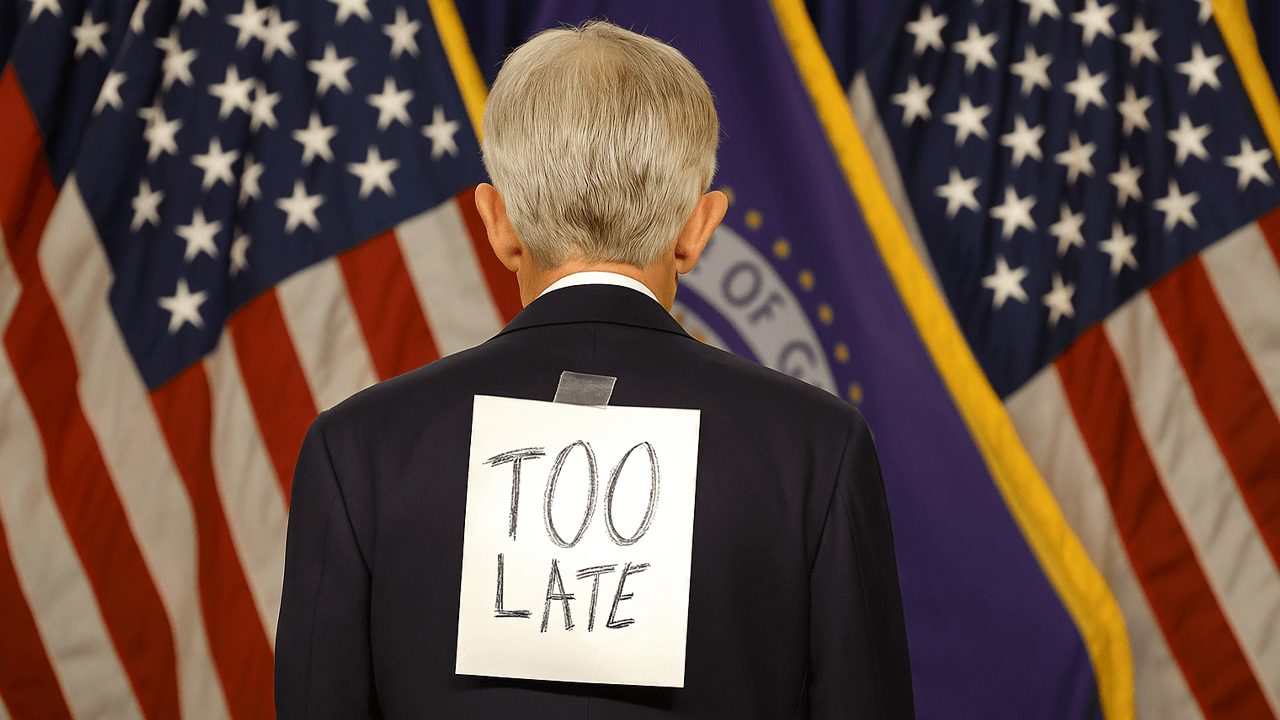

President Donald Trump’s chaotic tariff rollout in April marked the high point of the “Sell America” trade as stocks, bonds, and the dollar all sank. Since then, equities have rallied dramatically to pre- “Liberation Day” levels, and Treasury yields, which fall as bond prices rise, have settled.

A sinking dollar remains one of the biggest stories on Wall Street in 2025, though, and monetary authorities seem to be reducing their exposure to American bonds. As large and stable central bank buyers take a step back, it’s fueling concern that more turbulence could be careening into the fixed-income market.

“The other big thing that we worry about is the fact that foreign private investors may not be adding to Treasury securities [and] may likely be stepping back from the market as well,” Meghan Swiber, a managing director and U.S. rates strategist at Bank of America, told Fortune. “So it creates a lot of concern around foreign investors continuing to support the Treasury supply picture.”

Foreign buyers account for roughly 30% of the U.S. Treasury market, according to Apollo chief economist Torsten Sløk. A note from Swiber and fellow BofA credit strategist Katie Craig on Monday suggested demand from these investors is showing “cracks.”

Because of the dollar’s status as the world’s reserve currency and confidence from investors that America’s government will always pay its bills, the U.S. borrows at much better rates than its underlying finances would normally allow.

If foreign investors no longer see U.S. Treasuries as a safe haven, however, that could force the Treasury to pay higher yields to bring back buyers. Such a move would put upward pressure on interest rates for mortgages, small business loans, and other common types of borrowing throughout the economy.

“The big picture here is that [the] Treasury has more debt to finance,” Swiber said. “We’re of the view that deficits are going to continue to climb higher in the coming years, and what we struggle with is, ‘Who is going to help support that higher level of supply?’”

The paradox of a weaker dollar

Foreign holdings of U.S. Treasuries hit an all-time high of $9.05 trillion in March, according to the latest data from the Treasury, up nearly 12% from last year. The Treasury will release data from April, which marked the height of bond market volatility, on Thursday.

More current data, however, might already be flashing a warning sign.

More than 200 central banks and other foreign official entities like sovereign wealth funds keep Treasuries and other assets in the custody of the New York Federal Reserve. Those holdings declined by $17 billion last week and have fallen by $48 billion since late March, just before Trump’s tariffs sparked a confounding bond sell-off.

Usually, monetary authorities will park the cash they generate from selling U.S. debt in the New York Fed’s reverse repurchase facility, where they receive Treasuries as collateral.

That’s not been the case this time, though. Foreign participation in the facility has fallen by $15 billion since late March. All told, that suggests U.S. assets held by foreigners at the Fed have dropped by around $63 billion in just over two months.

“It looks like a net outflow of those asset holdings from the Fed balance sheet,” Swiber said.

This drop is unusual, Swiber and Craig noted, considering the dollar’s big decline in 2025. Typically, these types of sales happen when the dollar is strong.

Monetary authorities, Swiber explained, might sell their dollar holdings and invest elsewhere for cheap. Or nations like Japan, India, and Turkey might sell the greenback and buy back their own currency to prevent it from falling further against the dollar.

That’s not the case right now, however, with the dollar down 9% compared to the basket of currencies in the DXY index.

“So that’s kind of why this is particularly strange, right?” Swiber said. “The sales are not happening to defend currencies or to rebalance.”

Instead, Swiber and Craig wrote, it looks like central banks and other official entities are diversifying away from U.S. assets. Rising trade tensions, of course, give nations more reason to lower their dependence on the world’s largest economy.

“The official sector really hasn’t been buying Treasury securities en masse for a number of years,” Swiber said. “Their holdings have pretty much been relatively flat since COVID.”

Now, the sector is also selling.

If foreign private holders like banks and institutional investors follow suit, Swiber is worried about who will pick up the slack.

Looking at the Fed’s “flow of funds” data from the first quarter of 2025, demand essentially stemmed solely from foreign investors and broker-dealers, she and Craig noted.The latter, they wrote, fills in the gap domestically when households and institutions like hedge funds don’t show up.

“Foreign investors were some of the biggest buyers that we saw in Q1,” Swiber said.

If there are worries about them going forward, she added, that doesn’t bode well for the bond market.

This story was originally featured on Fortune.com