Wall Street buoyed by Lutnick’s 10-deal pipeline, but analyst warns the calm may merely be the ‘eye of the storm’

Lutnick's China promise did little to impress markets, but overall added to a period of relative stability. Yet one analyst warned this may be a "false dawn."

- Markets have entered a period of relative calm despite recent volatility driven by geopolitical tensions and President Trump’s tariffs. The S&P 500, Nasdaq, and FTSE 100 all posted modest gains and are nearing their all-time highs. Investors were cheered by U.S. Commerce Secretary Lutnick statements about imminent trade deals the White House is prepared to sign with key partners. Analysts caution that this may just be a temporary lull before renewed uncertainty around the upcoming tariff deadline.

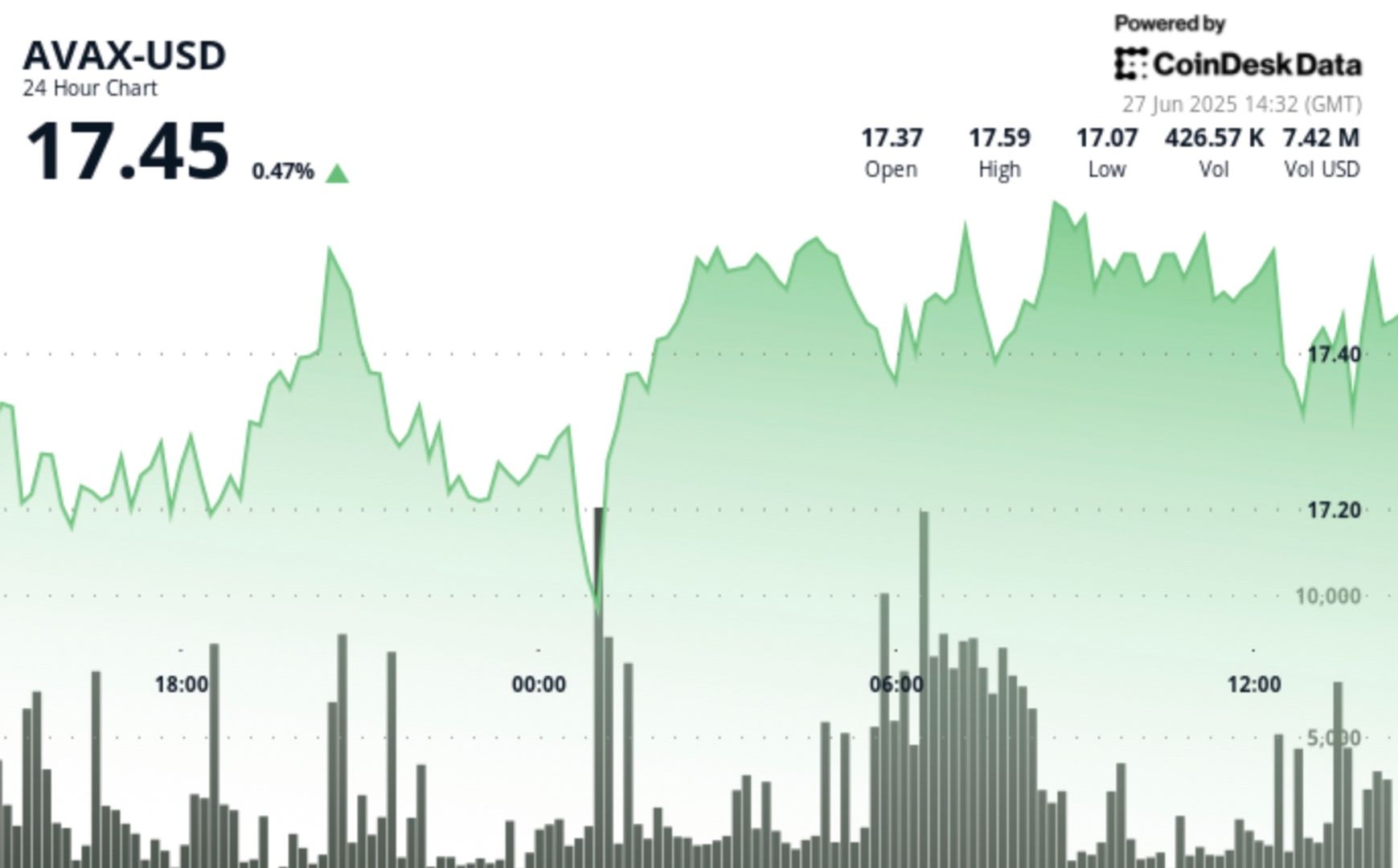

Despite the macroeconomic factors swirling over Wall Street, a relative calm has descended across markets. At the time of writing, the S&P 500 is up 0.8% over the past day, the Nasdaq was up 1% and the FTSE 100 up 0.5% in early trading this morning. S&P futures were up 0.23% this morning, premarket.

It’s a far cry from the choppy trading seen in recent months as investors reacted to Trump’s tariff announcements, military action in the Middle East, and concerns over the White House’s attempts to influence the central bank.

Secretary of Commerce Howard Lutnick had more good news for speculators this week. He confirmed late last night that the Oval Office had a slate of deals ready to be signed off before the end of Trump’s 90-day pause.

Lutnick also revealed part of the system for how other negotiations may be sped up. He said America’s top 10 deals with partners would be used as category blueprints for other agreements, explaining the White House will “put them in the right category, and then these other countries will fit behind.”

With preliminary frameworks in place with the U.K. and China, speculation is rife about who the following agreements may be with.

Japan and India seem to be strong contenders, with noise out of both governments suggesting negotiations may prove fruitful.

On Japan, for example, Lutnick told Bloomberg the nations are “currently discussing the series of U.S. tariff measures, and we will continue to make our utmost efforts on the matter as our top priority.”

Those who don’t have a deal come July 9, the end of the 90-day pause, will also be categorized into their “proper buckets.”

Lutnick said: “Those who have deals will have deals, and everybody else that is negotiating with us, they’ll get a response from us and then they’ll go into that package.

“If people want to come back and negotiate further, they’re entitled to, but that tariff rate will be set and off we’ll go.”

The commerce secretary also confirmed a deal signed with China—“they’re going to deliver rare earths to us” and when that happens “we’ll take down our countermeasures”—but if he was hoping for a gold star from marketeers, they won’t be forthcoming.

As UBS’s chief economist Paul Donovan put it in a morning note sent to Fortune: “U.S. Trade Secretary Lutnick declared an agreement with China over trade. Markets do not care, as this seems to be just a codification of the agreement made in Geneva and reaffirmed in London.”

He added: “Lutnick promised ten trade deals were coming (no news on whether this includes the penguins of the Heard and McDonald Islands).”

Eye of the storm

Analysts may head into the weekend questioning “Why the brief reprieve?” with so much uncertainty still swirling. At the start of the week economists were nervously eyeing whether Iran’s parliament would shut the Strait of Hormuz, a blockage to the world’s global oil supply that could send prices spiraling. But that fear has receded. Goldman Sachs’ Yulia Zhestkova Grigsby and her team put the chances of Iran closing the ocean bottleneck at just 4%, in a note sent to clients yesterday.

The relative calm may merely be the eye of the storm, wrote Deutsche Bank’s Jim Reid in a note seen by Fortune this morning.

“A rare period of 2025 calm seems to have broken out for now. It may be that we’re in the eye of the storm that was the Middle East, and later to become tariffs again,” Reid wrote. “However for now markets are not thinking about, or are not particularly concerned about, the upcoming July 9th tariff deadline.”

He added that President Trump’s potential early intervention into naming the next Fed chairman is also generating expectations for lower borrowing costs in the future, with Trump’s candidate expected to be more open to lowering rates.

“Whether this will prove to be yet another false dawn only time will tell,” Reid added.

Here’s a snapshot of the action prior to the opening in New York this morning:

- For the third day in a row, investors will be watching to see if the S&P 500 can break its all-time record.

- The S&P 500 closed at 6,141 yesterday, just a few points below its record-high from February (6,144.15).

- S&P futures were up 0.24% this morning, priced at $6,209.50—above the all-time high.

- Stoxx Europe 600 was up 0.85% this morning in early trading.

- The UK’s FTSE 100 hit 0.5% in early trading.

- Japan’s Nikkei 225 was up 1.43% this morning.

- The major indexes in South Korea, Hong Kong and China all declined.

This story was originally featured on Fortune.com

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)

![[Weekly funding roundup June 21-27] A sharp rise in VC inflow](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)