Gaming Startup Funding Levels Down Further In 2025

This is not shaping up as a strong year for gaming startup funding. Per Crunchbase data, only around $627 million in global venture funding has gone to companies in gaming-related industry categories so far in 2025, putting the industry on track for its worst annual funding total in years.

This is not shaping up as a strong year for gaming startup funding.

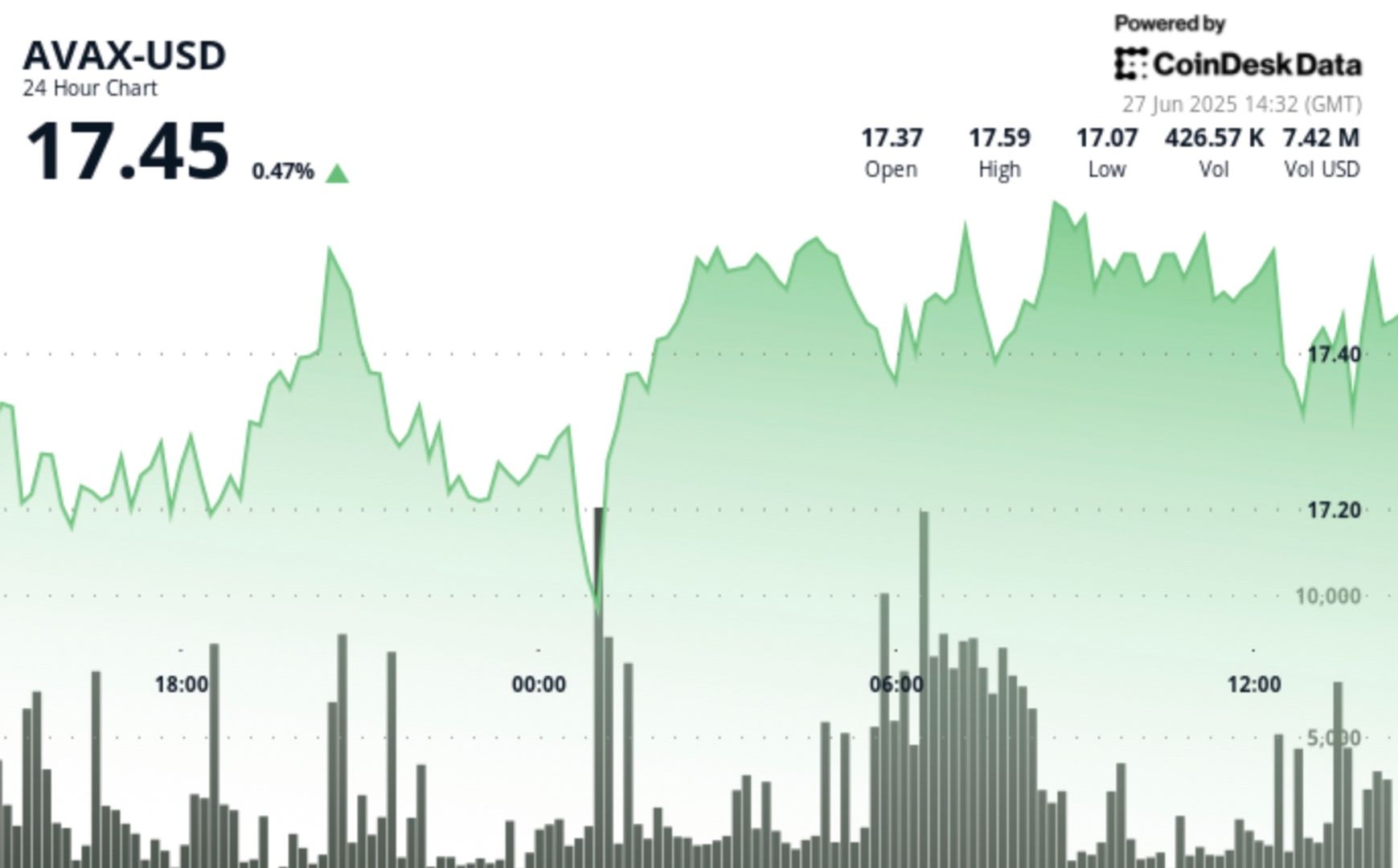

Per Crunchbase data, only around $627 million in global venture funding has gone to companies in gaming-related industry categories so far in 2025. That puts the industry on track for its worst annual funding total in years, as charted below.

Investment has also been trending lower the past few quarters. With Q2 winding to a close, it looks like it’s the weakest quarter in years for gaming investment.

By many other measures, gaming looks pretty robust

As usual, sluggish funding has nothing to do with the number of people who play games or the amount of time they spend on them. Last year, for instance, more than 190 million Americans engaged with video games, per an Entertainment Software Association report.

They’re not doing so on the cheap, either. Collectively, Americans spent over $57 billion on content, hardware and accessories in 2023, the last annual tally covered in the report.

Notably, the largest gaming brands are also doing well on public markets. Shares of Roblox, Nintendo, Take-Two Interactive Software and others all soared higher this year.

On the M&A front, the gaming sector also looks strong. The space provided one of the largest startup acquisitions of recent months with Scopely’s March purchase of Pokemon GO maker Niantic’s gaming business in a deal valued at $3.5 billion.

May brought another 10-figure transaction, as private equity firm CVC Capital Partners made a $2.5 billion debt-and-equity investment in Istanbul-based Dream Games, maker of the popular mobile games Royal Match and Royal Kingdom. Under terms of the deal, Dream’s initial venture backers will exit, with CVC reportedly holding a majority stake in the company.

Startups that are getting funded

Actual startup funding, by contrast, consists of much smaller sums. For instance, there were no venture rounds of $100 million or more so far in 2025, a sharp contrast to prior years.

Still, we did see some good-sized deals. Underdog Fantasy — an apt name for a gaming startup seeking funding in the current investment environment — scored the largest venture round of the year so far. The Brooklyn-based company, which operates a fantasy sports betting platform, closed on $70 million in a March Series C led by Spark Capital.

The next-largest round, a $30 million Series A, went to Istanbul-based Grand Games, known for its brightly animated mobile games. In third place was a $25 million Series A for another Istanbul company, Bigger Games, which makes the puzzle game Kitchen Masters. Altogether, it appears that Turkey’s largest city is shaping up as a global center for gaming talent.

Below, we used Crunchbase data to aggregate a list of the eight largest gaming-related rounds so far this year.

Strange times

The sluggish pace of gaming startup funding comes amid challenging times for industry professionals.

In particular, it’s a challenging time for job seekers. The Game Developers Conference’s 2025 State of the Game Industry report found that 1 in 11 developers had lost their jobs over the past year. In recent years, the largest gaming companies, including Microsoft, Sony and Electronic Arts, have carried out mass layoffs, and several studios pulled the plug on prominent titles in development.

Like many sectors, gaming funding may also be affected by the huge wave of investment in generative AI unicorns whose tools can be used across a myriad of industries. While Crunchbase doesn’t classify OpenAI and other GenAI giants as gaming-related companies, developers do use their tools and technology for tasks like creating dialogue or mockups of characters and environments.

Looking ahead, however, it’d be nice to see a pickup in gaming-specific venture investment as well. Particularly given that so many talented developers are struggling to find employment at established companies, there ought to be an easier path for their skills and drive to migrate to the startup world.

Related Crunchbase queries:

Illustration: Dom Guzman

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)

![[Weekly funding roundup June 21-27] A sharp rise in VC inflow](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)