Trump’s ‘Liberation Day’ led to a tidal wave of stock trades from members of Congress

More than 700 trades within a week of Trump's tariff announcement.

- Lawmakers were active stock traders in the days following Trump’s Liberation Day tariff announcement. A study of trades shows House lawmakers (or their families) made 1,865 trades in April. This comes amid calls for reform that would prevent lawmakers from trading individual stocks.

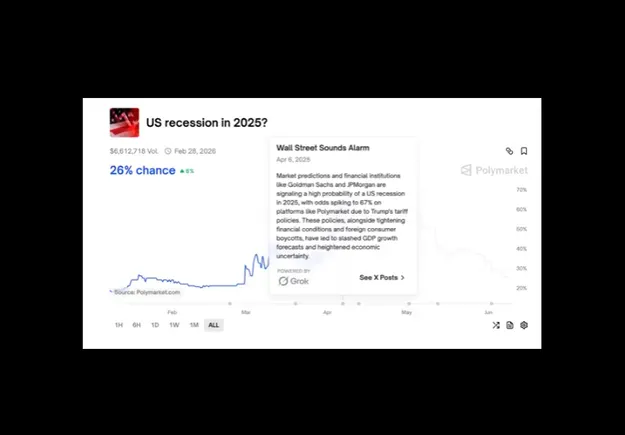

While the debate on whether to ban members of Congress from trading individual stocks rages on, lawmakers were particularly active in April amid the announcement of Donald Trump’s tariffs.

A study by The Wall Street Journal found that House lawmakers reported 1,865 trades by them or their families in April, the highest number, by far, since January 2024. From the period between April 2, when Trump announced the tariffs, to April 8, when he paused them, over a dozen members of the House and their family reported over 700 trades.

And the most transactions, the paper says, were made by Reps. Ro Khanna (D., Calif.) and Rob Bresnahan (R., Pa.), who have previously called for stock-trading bans. Both said their trades were made by outside financial advisors.

Lawmakers weren’t the only ones selling and buying stocks during that period, of course. The S&P 500 fell more than 4.5% for two consecutive sessions after the so-called Liberation Day announcements. And after the pause, the Nasdaq index saw its biggest gain in 24 years, a 12% increase.

Because of the vague nature of disclosure rules for members of the House, it’s not possible to determine if the lawmakers made or lost money in those trades.

Two lawmakers seemed well-positioned to have profited, however. Marjorie Taylor Greene (R., Ga.) and Jared Moskowitz (D., Fla.) both bought in early April, so were likely to see those investments gain value after the market rebounded. Greene spend roughly $28,000 on FedEx, Amazon.com, Lululemon Athletica and Palantir Technologies. Moskowitz made 23 stock purchases of at least $1,000 each in companies such as Amazon, Nvidia and Visa.

Both said financial advisors made the trades.

This story was originally featured on Fortune.com