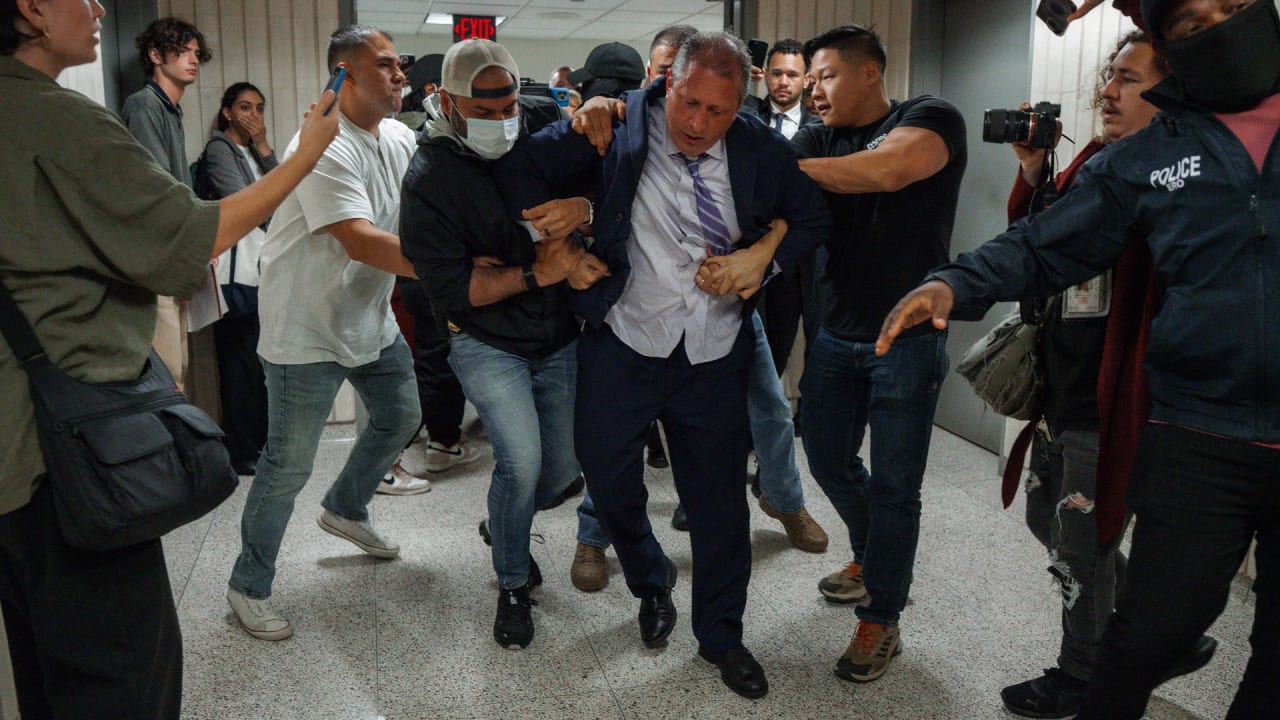

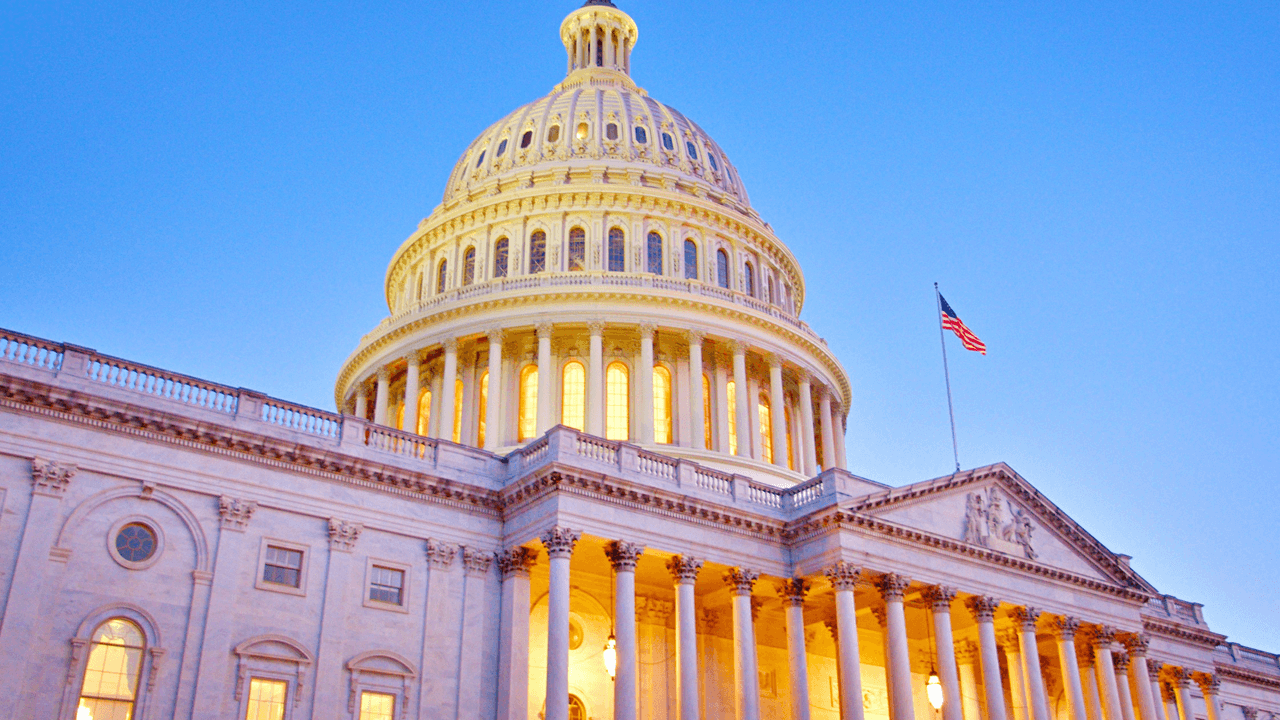

Shiba Inu Slides to Two-Month Low as Trump Threatens Khamenei, Demands Unconditional Surrender

SHIB experienced a 3.5% decline amid broader crypto market losses and U.S. stock market weakness.

Shiba inu (SHIB), the world's second-largest meme token by market value, faced selling pressure alongside losses in the broader crypto market and U.S. stocks.

SHIB fell over 3.5% to 0.00001134, the level last seen on April 9, according to data source CoinDesk. Bitcoin, the leading cryptocurrency by market value, slipped nearly 3% to $103,800. The risk aversion happened after President Donald Trump downplayed reports of his administration seeking truce with Iran and threatened assassination of Iran's Supreme leader Ayatollah Ali Khamenei, calling for IRan's unconditional surrender in the ongoing war with Israel.

SHIB's decline follows rejection at the $0.00001230 resistance level Monday, which paved for the sell-off with exceptionally high trading volumes exceeding 1.2 billion tokens.

Support had briefly emerged at around $0.00001167 early today, but was eventually pierced by bears, driving prices lower.

Market analysts note that SHIB's performance reflects broader cryptocurrency market trends, which continue to be influenced by global economic factors and trade disputes between major economies.

As traditional financial markets respond to these tensions, cryptocurrencies like SHIB face increased volatility while traders closely monitor key support and resistance levels for signs of directional movement.

Key AI insights (Monday-Tuesday)

- Clear rejection at the $0.0000123 resistance level during the 20:00-21:00 timeframe.

- Aggressive sell-off with exceptionally high volume (1.23B and 1.31B) during the 22:00-00:00 period.

- Support emerged around $0.00001167, coinciding with high-volume buying interest.

- Bearish momentum appears to be losing steam as price consolidates in the $0.00001176-$0.00001182 range.

- Decreasing selling pressure evident in the diminishing volume profile.

- Increased volatility in the last hour, forming a notable price structure between $0.00001175-$0.00001182.

- Recovery attempt reached a local high of $0.00001182 at 13:30, accompanied by substantial volume (8.8B).

- Bullish momentum was short-lived as sellers returned at 13:44, driving price down 3% with exceptional volume (9.7B).

- Final minutes show consolidation around $0.00001175, with decreasing volatility and volume suggesting exhaustion of selling pressure.