Term Sheet Next: How Facebook’s former chief revenue officer is coaching the next generation of startup founders

Why 01 Advisors partner David Fischer went from Google and Facebook to venture investor.

Every venture investor tells their portfolio companies that they’re more than just a check. They help with introductions, they help with recruiting, and they help with going public. Some have even been operators themselves and encountered the same problems as their startup founders. But how many full-time VCs can boast that they helped build the biggest tech companies in the world?

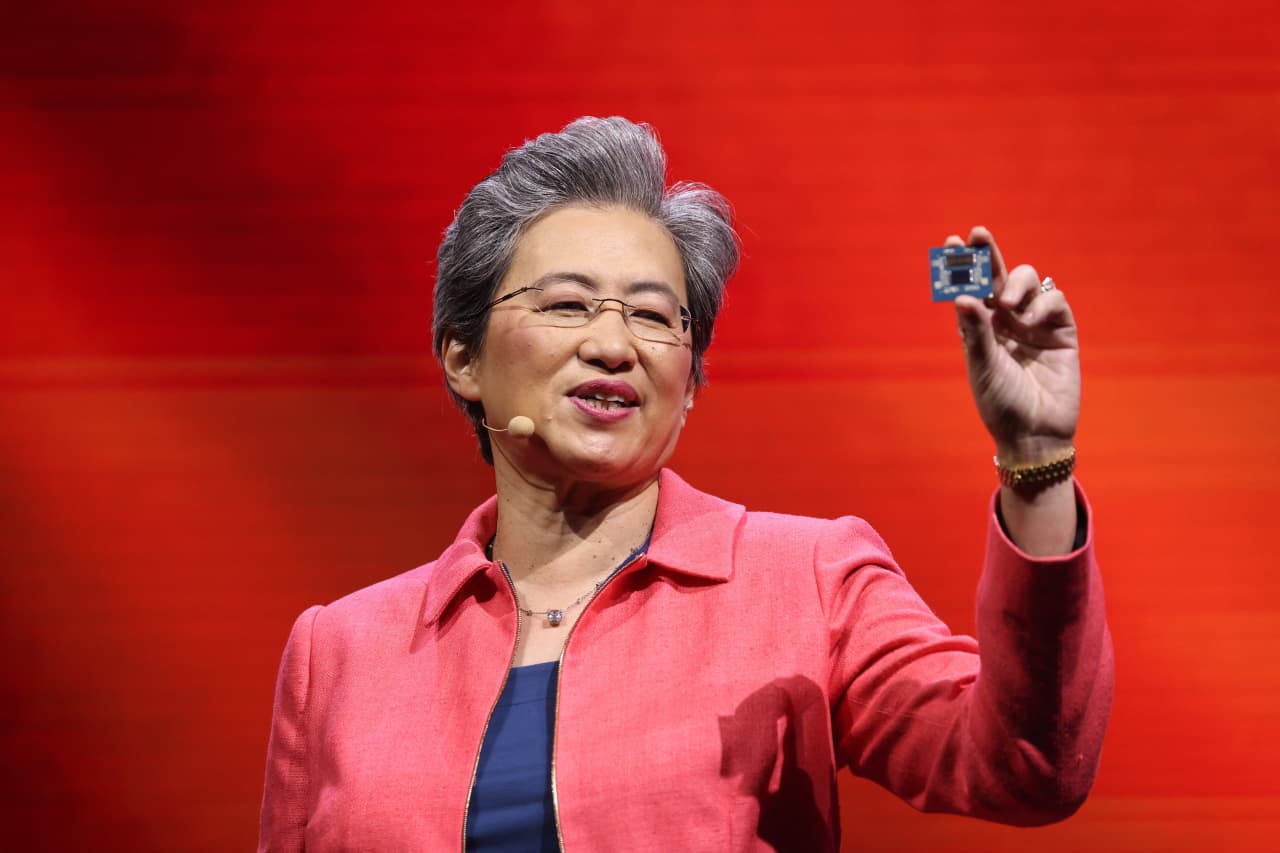

There’s Marc Andreessen, of course, and Peter Thiel and Vinod Khosla. David Fischer, a partner at 01 Advisors, may not yet have the same name recognition, though he served as a vice president of sales at Google and then chief revenue officer at Facebook as both companies burst out of the stratosphere. And for founders hoping to scale their companies from zero to one in this era of hyper-speed, Fischer’s background may make him as valuable as the giants of Sand Hill Road.

I met with Fischer this spring in 01A’s New York office, which is in the same Lower Manhattan building that houses Union Square Ventures and Inspired Capital. Even before Fischer joined the VC ranks during the pandemic, he took a circuitous route into tech. He worked briefly as a journalist before a stint at the Treasury Department for Larry Summers, which is where he met his future boss at Google and Facebook, Sheryl Sandberg. (Fischer’s father, the famed economist and central banker Stanley Fischer, recently passed away.)

After attending Stanford Business School, Fischer entered Silicon Valley at a transformative time for the tech sector, joining Google in 2002 right after it launched AdWords and was beginning to bring in revenue. He spent eight years at the search giant before Facebook hired him to pull off the same feat. When Fischer started, Facebook had about 1,200 employees, $750 million in revenue, and had yet to wade into mobile. Its acquisition of Instagram and IPO were still two years away. “Ads were a little bit of an afterthought,” Fischer tells me. When he left in 2021, Facebook’s revenue had topped $100 billion.

So, where do you go next? Fischer may not have been in the first 10 or 100 employees at either tech behemoth, but he had experienced the addictive period when a company goes from product-market fit to market domination—and in the case of Google and Facebook, world domination. “I always like to take what I’ve learned before and bring it to do something real and rewarding,” Fischer says.

He began to channel that into investing, first as an angel and then connecting with two friends who had started their own firm. Fischer isn’t the only former operator at 01A—the firm was founded by former Twitter CEO Dick Costolo, as well as Fischer’s one-time counterpart at Twitter in the CRO role, Adam Bain. Fischer joined full-time for 01A’s third fund, a $395 million vehicle it launched in October 2023.

At a time when many VC firms are either looking for early or late-stage investments, 01A takes a more down-the-middle approach, mostly writing Series B checks of about $15 million. It’s not quite the stage that Fischer joined Google and Facebook, or Costolo and Bain joined Twitter, but it’s still that same sweet spot where a company has a viable product but needs to figure out how to sell it. “That’s the time you actually need some counsel from some folks who ideally have done this before,” Fischer tells me. 01A helps with those key questions, from transitioning from founder-led sales to a real sales operation to building out the executive team to sizing up the competitive landscape. “Sometimes it’s just talking it through,” Fischer adds. “Being a founder is incredibly solitary.”

01A funds a variety of verticals, though only one startup in the advertising and marketing tech space, which may seem surprising given the background of its partners—a San Francisco-based company called Haus, founded by a former Google employee, that helps companies quantify the effectiveness of their marketing. 01A led a $20 million investment into the company last year after Insight Partners backed an earlier round.

The firm’s partners may have helped lead three of the fastest-growing companies in Silicon Valley history, but Fischer acknowledged that the rise of AI is creating a new ballgame. He’ll sit through a pitch now where the founder puts a chart on the screen showing that their annual recurring revenue is going from zero to $10 million faster than Apple, Google, and Meta. “That’s amazing,” Fischer says. “The only problem with it is, I’ve had four other people this month put the same chart up, and two of them are your competitors.”

Still, he thinks that while revenue timeframes may be accelerated, that’s the same for everyone. In other words, there will still only be a few winners per category—the competition is just able to grow faster. Having a head start doesn’t mean much anymore. “Before we make an investment, we have to really have conviction that this is a company that can win,” Fischer says.

ICYMI…I had the exclusive this morning on flexible labor platform WorkWhile’s $23 million Series B. Read the full story here. —Allie Garfinkle

Leo Schwartz

X: @leomschwartz

Email: leo.schwartz@fortune.com

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

This story was originally featured on Fortune.com