Stocks rise after ceasefire between Israel and Iran, even as Fed Chair Jerome Powell holds off on rate cuts

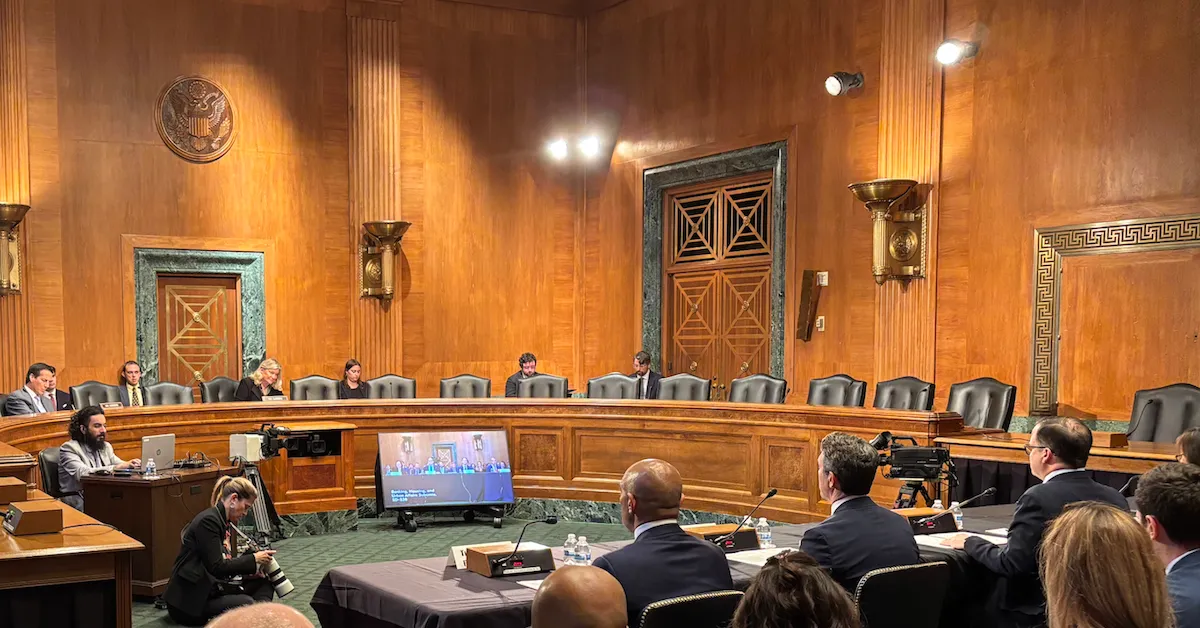

Federal Reserve Chair Jerome Powell told lawmakers on Tuesday that the central bank continues to monitor the threat of inflation.

- Markets continued to climb after an apparent end to the escalating war between Iran and Israel, though the threat of inflation means the Federal Reserve is unlikely to cut interest rates in the near future.

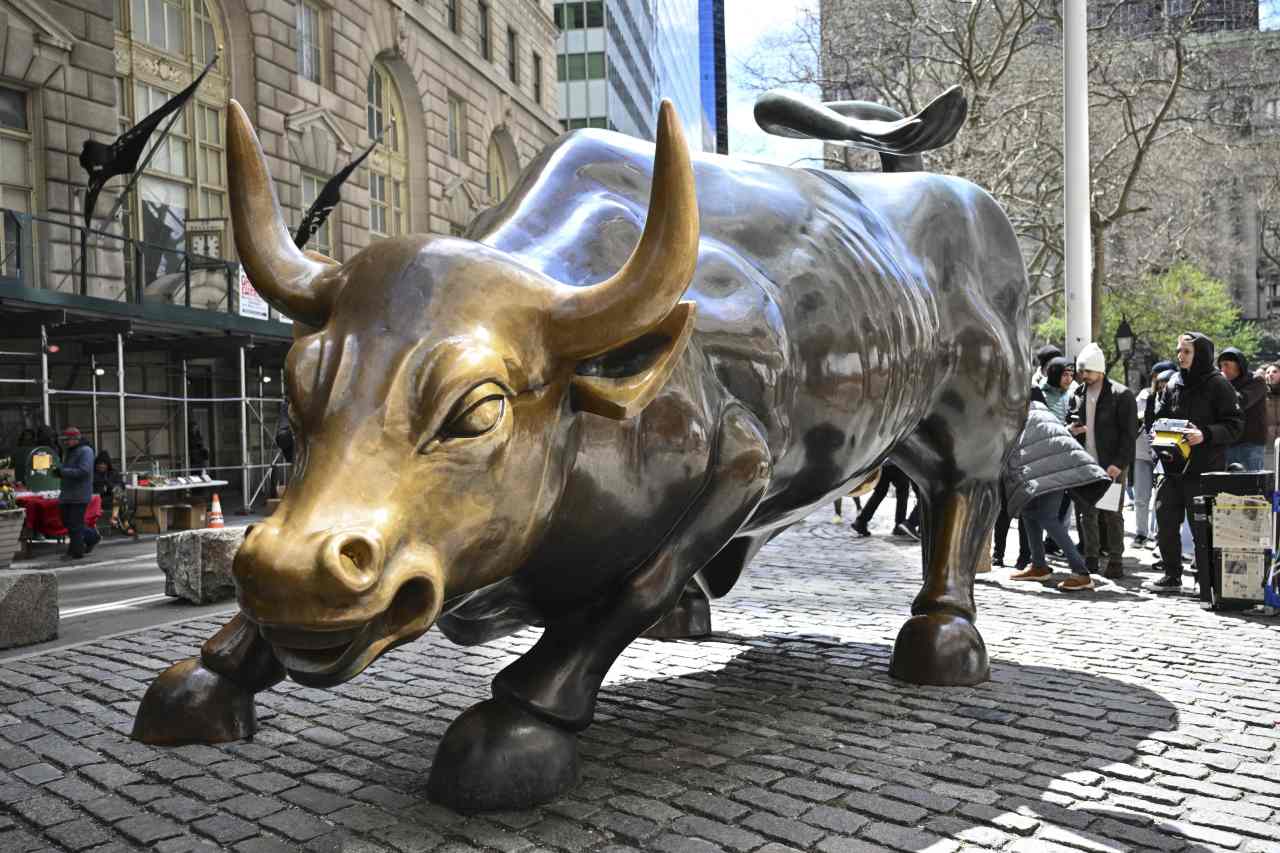

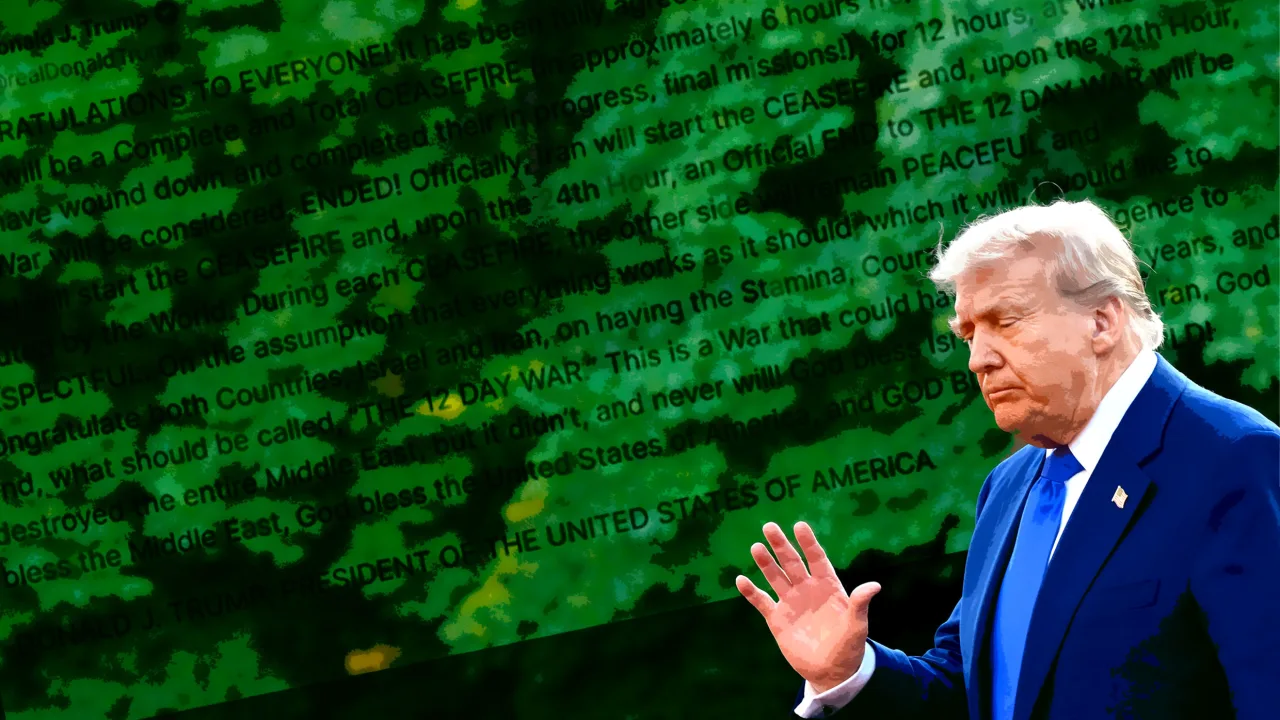

Stock prices leapt on Tuesday as an escalating war between the U.S., Iran, and Israel appears to have been avoided—at least for now. The S&P 500 jumped 1.11%, with share prices green across the board as investors relaxed after President Donald Trump announced a ceasefire on Monday evening.

Despite the bump, bearish signals remain on the horizon, with Federal Reserve Chair Jerome Powell testifying at a House Financial Services Committee hearing on Tuesday that the central bank will likely keep rates steady as the threat of inflation remains. “If it turns out that inflation pressures do remain contained, we will get to a place where we cut rates sooner rather than later, but I wouldn’t want to point to a particular meeting,” Powell told lawmakers.

Market relief

Though Trump announced a ceasefire between Iran and Israel yesterday on Truth Social, questions remained whether it would hold as the two countries continued to conduct military operations. Trump even lashed out at Israel Monday morning, telling the government to “turn around” its planes and “head home.” Still, as of publication, the ceasefire appears to have held, even if the success of the U.S. strikes against Iran’s nuclear capabilities remains in doubt.

Despite the lasting uncertainty, investors celebrated the news, with oil prices falling as the risk of further disruptions evaporated and airline stocks such as Delta and United climbing. Markets also rose on Monday after Iran’s restrained response to the U.S. strike against Iran over the weekend.

Still, Powell’s testimony before the House of Representatives could spell bumpy waters ahead. Along with outlining the central bank’s continued fears over the impact of tariffs on inflation, Powell also raised the possibility of retaliatory Iranian cyberattacks on the U.S. “The government generally spends a lot on these things,” he said. “That said, you can never, ever be comfortable in this area because the bad guys are always getting better.”

Iranian cyberattacks have previously been an issue, with the U.S. Treasury Department last April sanctioning two Iranian companies and four individuals for a series of phishing and malware attacks against American companies and government employees that compromised upwards of 200,000 employee email accounts, allegedly in conjunction with the Iranian Islamic Revolutionary Guard Corps’ cyber division.

Beyond the threat of cyberattacks, more worrying for investors is Powell’s resistance to rate cuts, despite pressure from Trump. Powell said that he expects inflation to move up over the summer. “I don’t think we need to be in any rush because the economy is still strong, the labor market is strong,” he added.

This story was originally featured on Fortune.com

![How Google’s AI Mode Compares to Traditional Search and Other LLMs [AI Mode Study]](https://static.semrush.com/blog/uploads/media/86/bc/86bc4d96d5a34c3f6b460a21004c39e2/f673b8608d38f1e4be0316c4621f2df0/how-google-s-ai-mode-compares-to-traditional-search-and-other-llms-ai-mode-study-sm.png)