The Next Wave of D2C: How tech, data, and consumer shifts are redefining growth

India’s D2C market is evolving—from early hustle to data-driven, fast-scaling brands built for a new wave of digital consumers.

In the early 2010s, India witnessed the emergence of its first wave of direct-to-consumer (D2C) brands. The promise of this cohort of ambitious startups that aimed to bypass traditional retail channels seemed ripe: internet penetration was rising, online marketplaces were gaining traction, and early ecommerce adoption was beginning to shape a new kind of consumer behaviour.

Many of these brands had to grapple with unique challenges such as high customer acquisition costs, evolving unit economics, and nascent logistics and payments infrastructure. These early D2C brands had to not only build their own products and businesses, but also shape consumer behaviour. The cost of experimentation was high, and the ability to iterate on product-market fit was painfully slow.

Today, that reality has transformed. Trust-building and consumer education, once essential D2C talking points, are no longer at the forefront. The D2C market is expected to grow to $60 billion by 2027, growing at a 40% CAGR. according to a KPMG report.

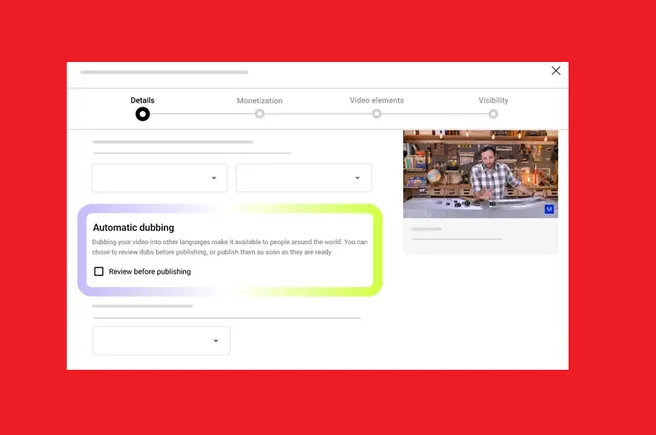

Several enablers have driven this change. Platforms like Shopify have turned storefront building into a weekend project, while fulfilment players and conversion enablers have optimised logistics through delivery reliability, return management and cash-on-delivery complexities. Today, the ecommerce logistics sector is witnessing a boom, and the market is projected to reach $7.8 billion by 2030 from $4.4 billion in 2025, at CAGR of 12.2%.

On the marketing front, several performance channels are now bolstered by the influencer and community-led commerce, allowing for deeper, more authentic engagement with consumers.

This evolution means founders can now focus on what truly matters: the product. They can launch, test, learn, and iterate, all within tighter timeframes.

The result? The path to $100 million in revenue has decreased significantly, according to a Redseer Strategy Consultants study. Brands are hitting that milestone in less time and with less capital, thanks to logistics, infrastructure, and consumer readiness enabling leaner, faster growth trajectories.

A different kind of consumer is emerging

The first wave of D2C brands catered to a relatively small segment, largely urban, price-sensitive shoppers experimenting with ecommerce for the first time. These consumers were cautious, discount-driven, and still building trust in digital shopping. The addressable market was constrained not just by infrastructure, but also by consumer readiness.

Fast forward to today: India had over 345 million digital shoppers in 2023, and this number is likely to exceed over 400 million by 2027. More importantly, a majority of these consumers are likely to come from Tier II cities, a demographic that is reshaping the narrative around online consumption, and now considered part of the broader “India One” consumer segment. These customers are discerning, value-conscious, brand aware, digitally fluent, and actively seeking out differentiated, quality-first products.

This is a pivotal shift. Premiumisation, once considered a niche metro trend, is now mainstream behaviour across categories. This shift supports brands with stronger margins, better retention, and sustainable growth.

Online-first, not online-only

The first generation of D2C brands demonstrated early success by scaling online before eventually expanding offline to reach the next level of growth. These pioneering brands paved the way for omnichannel thinking, proving that physical presence wasn’t at odds with digital DNA. Modern D2C brands are not tied to one channel—they are channel-agnostic.

But the biggest unlock is coming from Quick Commerce, a sector that is poised to grow to $9.94 billion by 2029. Quick Commerce already accounts for sizeable revenue for top FMCG players, and D2C brands are quickly catching on.

The rise of deep vertical plays

Earlier, many brands pursued horizontal expansion to capture more wallet share. But that playbook has now been flipped. Successful D2C brands in this new wave are narrowing in, not spreading out, as customer loyalty is being built within focused verticals, such as women’s fashion, intimate care, pet nutrition, Ayurveda-backed wellness, etc.

Rather than trying to be everything to everyone, these brands are becoming essential to someone and then scaling from that core. This creates not just better economics, but stronger consumer relationships that compound over time.

Data-led brand building is the new default

Data isn’t just a tool, it’s the foundation of modern brand building. Successful D2C brands are not just consumer-focused; they are data-obsessed. They operate more like product labs, rather than traditional retail businesses.

With access to granular analytics and real-time customer insights, brands are constantly learning and iterating. This shift is not just operational, but also strategic. The real moat today is built not on design or aesthetics, but on intelligence.

A new playbook for consumer brand building

This second wave of D2C is marked by insight-led decision-making, modular infrastructure, and a digitally fluent consumer base. It rewards founders who blend agility with long-term thinking, those who don’t just chase growth, but build with staying power.

The winning brands will be those that are able to marry speed with sustainability, combine distribution reach with authentic brand trust, and build not just products, but relationships and communities powered by data.

For investors and operators alike, this isn’t about betting on fleeting trends. It’s about tuning into a new playbook, one that’s still unfolding, but more grounded and executable than ever before.

(Pavitra Gupta is the Director of Portfolio Development at RTP Global)

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![[Weekly funding roundup May 17-23] VC inflow remains steady](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)