SEBI mandates new UPI mechanism for registered intermediaries to improve safety

To address the issue of impersonation and enhance investor confidence, the regulator has mandated a new UPI address structure for all Sebi-registered intermediaries who collect funds from investors.

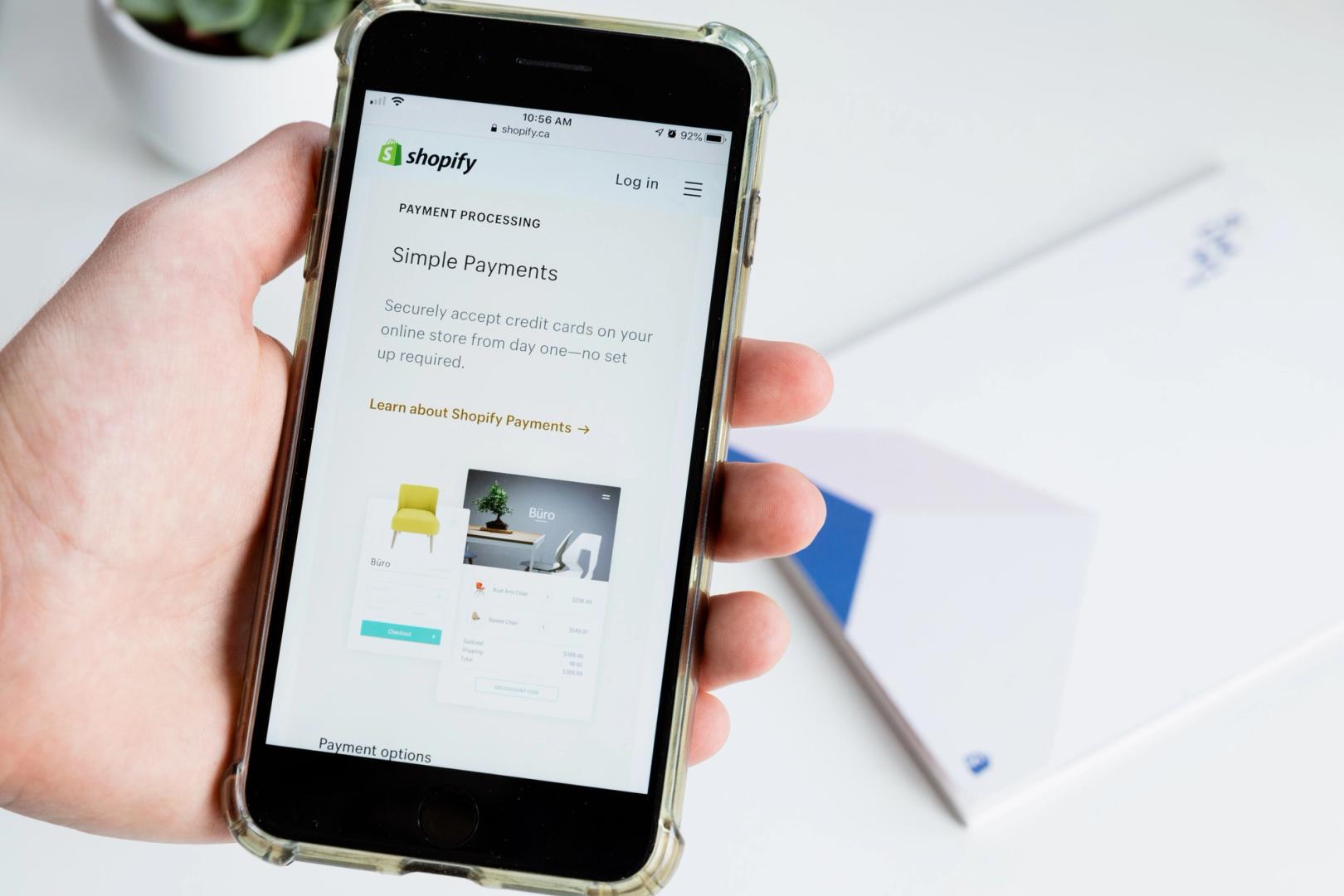

Markets regulator SEBI on Wednesday said it has mandated a new UPI payment mechanism for all registered intermediaries, who collect funds from investors, to improve the safety and accessibility of financial transactions within the securities market.

The Unified Payments Interface (UPI) payment mechanism will go live from October 1, 2025, Sebi chief Tuhin Kanta Pandey told reporters here.

In recent years, unregistered entities have increasingly misled investors by fraudulent activities.

To address the issue of impersonation and enhance investor confidence, the regulator has mandated a new UPI address structure for all Sebi-registered intermediaries who collect funds from investors.

"This innovative mechanism is set to significantly improve the safety and accessibility of financial transactions within the securities market by providing a verified and secure payment channel," Pandey said.

To empower investors, the market regulator is developing a new functionality called "Sebi Check".

This upcoming tool will enable investors to verify the authenticity of UPI IDs either by scanning a QR code or entering the UPI ID manually and confirming the bank details, such as the account number and India Financial System Code (IFSC) of a registered intermediary.

In January, the Securities and Exchange Board of India (SEBI) floated a consultation paper in this regard.