Quadria Group takes full control of HealthQuad, launches $200M fund III

Quadria Group takes complete control of HealthQuad platform after the original founding team departed to launch a competing $300-million fund.

Quadria Group, one of Asia's largest healthcare-focused private equity firms, has launched HealthQuad Fund III with a targeted corpus of $200 million and a greenshoe option of an additional $100 million. The new fund represents a strategic consolidation as Quadria assumes full ownership of the HealthQuad platform, ending its eight-year partnership with impact investment firm KOIS.

The HealthQuad acquisition marks a significant milestone for Quadria, consolidating its position as a dominant force across the healthcare investment spectrum from early- to late-stage capital. Originally co-incubated with KOIS in 2016, HealthQuad has evolved into a key component of Quadria's comprehensive healthcare investment strategy.

HealthQuad's track record speaks to its strategic value. The platform's first two funds have backed over 18 companies, including notable success stories such as Qure.ai (AI-powered medical imaging), Medikabazaar (medical supply chain), and Redcliffe Labs (diagnostics). Many of these portfolio companies have emerged as category leaders in their respective segments, demonstrating the platform's ability to identify and scale innovative healthcare solutions.

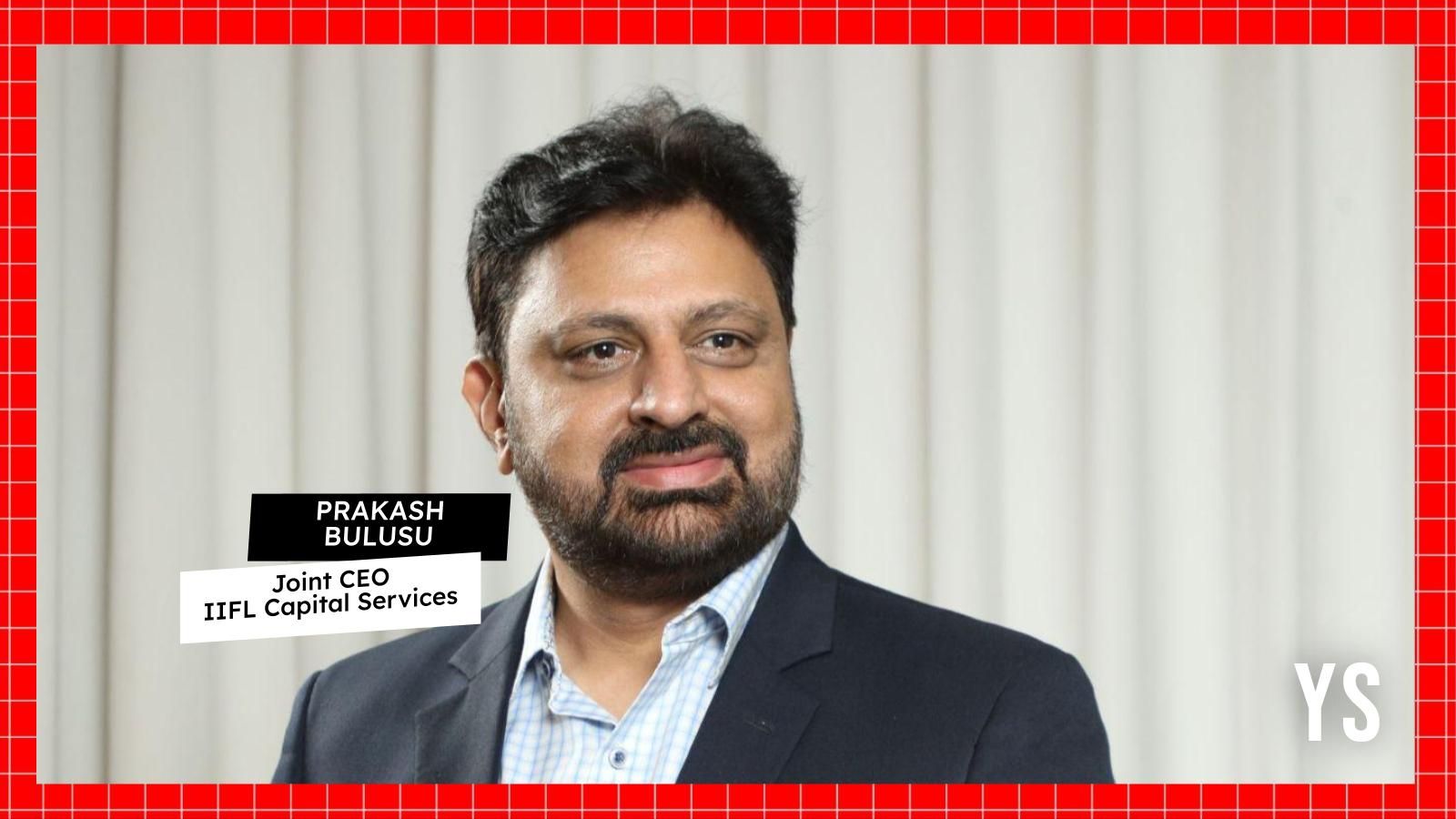

Under the new structure, Quadria's leadership triumvirate—Dr Amit Varma, Abrar Mir, and Sunil Thakur—will assume complete operational control of HealthQuad. The firm has emphasised that the core investment team and committee members from previous funds will remain in place, ensuring continuity for the existing portfolio and maintaining institutional knowledge.

Leadership transition

This transition follows a period of organisational restructuring. The original HealthQuad founding team, including Charles-Antoine Janssen (former CIO), Ajay Mahipal, and Dr Pinak Shrikhande, has departed to launch HealthKois, a new fund targeting $300 million. Janssen joined as the fourth founder and CIO when HealthQuad was established in 2015 to focus on early-stage healthcare opportunities in India.

HealthQuad's fundraising journey reflects the growing investor appetite for healthcare investments in Asia. The platform raised its inaugural fund of Rs 75 crore in 2016, followed by a significantly larger second fund with a corpus of $162 million, which has yet to be fully deployed. This measured approach to capital deployment suggests disciplined investment practices and selective deal-making.

The launch of Fund III comes at a time when its flagship Quadria Capital Fund III was closed at $1.07 billion.

While maintaining its core focus on innovation, scalability, and impact, HealthQuad Fund III will operate with an expanded mandate. The fund will continue targeting tech-enabled and disruptive healthcare startups but with broader geographic reach across South Asia, Southeast Asia, and the Gulf Cooperation Council (GCC) region.

Key investment themes include primary care delivery models, diagnostic innovations, chronic disease management solutions, and digital health platforms. This focus aligns with macro trends driving healthcare demand across these regions, including demographic shifts, digital acceleration, and significant underserved market segments.

Dr Varma emphasized the opportunity landscape. "India presents one of the world's most compelling healthcare investment opportunities—driven by growing demand, digital acceleration, and underserved segments. With the full ownership of Fund III and expanded leadership, we are better positioned than ever to deliver cross-regional value for our portfolio companies," he said.

The consolidation reflects Quadria's broader ambition to create what Abrar Mir described as a "distinctive healthcare platform that accelerates diverse healthcare models across stages and regions." This integrated approach combines early-stage venture capital through HealthQuad with growth and buyout capabilities through Quadria's main funds.

Sunil Thakur highlighted the strategic alignment benefits. "The platform is now better aligned to combine Quadria's pan-Asian network with global institutional capital and clinical expertise. The encouraging outcomes from Funds I and II, along with continued investor support, give us the confidence to further our mission of creating meaningful financial and social value."

HealthQuad Fund III's launch comes at a pivotal moment for healthcare innovation in Asia. The region's healthcare systems face mounting pressure from ageing populations, chronic disease burdens, and the need for more efficient care delivery models. This creates substantial opportunities for technology-enabled solutions that can improve access, quality, and cost-effectiveness.

Edited by Kanishk Singh