Prediction Market Growth Lifts USDC Flows, Signaling Stablecoin Utility Shift

Polymarket, the decentralized prediction market platform, sought to become the latest crypto unicorn after closing a new funding round at a roughly $1 billion valuation, Coinbase noted in its latest research.The raise, led by Founders Fund, marks a major turning point for event-driven crypto platforms as venture capital pivots toward consumer-focused applications in the space.In just one day, regulated rival Kalshi followed with its own $185 million raise at a $2 billion valuation, signaling that prediction markets may be one of the few crypto sectors seeing accelerating traction in 2025.Rising Volumes, Mainstream AppealPolymarket’s growth has been driven by surging user activity despite regulatory barriers preventing US-based trading. The platform has handled more than $14 billion in lifetime trading volume, with over $1 billion processed in May alone. It now reportedly attracts between 20,000 and 30,000 daily traders, outpacing many mid-tier decentralized exchanges and positioning itself as a go-to destination for non-crypto-native users interested in financial betting on news cycles.New partnerships are reinforcing this momentum. A recently announced content deal with X (formerly Twitter) aims to boost visibility by embedding viral prediction content across mainstream feeds, pushing the platform beyond niche crypto circles.USDC Gains as Settlement TokenStablecoins are riding the coattails of prediction market growth. All Polymarket transactions settle in USDC on the Polygon blockchain, contributing to a sharp increase in stablecoin flows. The structure, unlike lending platforms that lock up user assets, ensures constant on-chain movement as positions are opened and resolved.While the crypto spotlight has turned to consumer apps, macro developments also helped ease market stress. A ceasefire between Israel and Iran, in place since June 23, contributed to improved risk sentiment. Crypto markets stabilized alongside equities, with the COIN50 index recovering and bitcoin holding above $100,000.Volatility has declined. Short-term demand for downside hedges in bitcoin has faded, as reflected in 25-delta put-call skews on 30-day options. Longer-dated options suggest that investors want exposure to crypto upside without incurring full spot costs, indicating renewed confidence despite geopolitical uncertainty.With the July 9 and August 12 deadlines for tariff decisions approaching, traders remain largely indifferent to the potential impact on inflation. Fed Chair Jerome Powell warned this week that tariffs could influence prices in the second half of the year, but markets continue to focus on disinflation trends, especially in services.Legislative Momentum Builds for StablecoinsPolicymakers also made headway on regulatory clarity. The US Senate passed the GENIUS Act, a stablecoin framework, with a 68–30 vote. House Majority Whip Tom Emmer now seeks to merge it with the CLARITY Act, a broader market structure bill, though such a move may delay passage.President Trump called on lawmakers to swiftly and without amendments approve the stablecoin measure. Meanwhile, Senate Banking Committee Chair Tim Scott said the market structure bill could be completed by the end of September.Separately, the Fed announced it would eliminate “reputational risk” from its bank supervision guidelines, a move seen as further easing pressure on crypto firms that had faced banking restrictions under earlier policies. This article was written by Jared Kirui at www.financemagnates.com.

Polymarket, the decentralized prediction market platform, sought to become the latest crypto unicorn after closing a new funding round at a roughly $1 billion valuation, Coinbase noted in its latest research.

The raise, led by Founders Fund, marks a major turning point for event-driven crypto platforms as venture capital pivots toward consumer-focused applications in the space.

In just one day, regulated rival Kalshi followed with its own $185 million raise at a $2 billion valuation, signaling that prediction markets may be one of the few crypto sectors seeing accelerating traction in 2025.

Rising Volumes, Mainstream Appeal

Polymarket’s growth has been driven by surging user activity despite regulatory barriers preventing US-based trading. The platform has handled more than $14 billion in lifetime trading volume, with over $1 billion processed in May alone.

It now reportedly attracts between 20,000 and 30,000 daily traders, outpacing many mid-tier decentralized exchanges and positioning itself as a go-to destination for non-crypto-native users interested in financial betting on news cycles.

New partnerships are reinforcing this momentum. A recently announced content deal with X (formerly Twitter) aims to boost visibility by embedding viral prediction content across mainstream feeds, pushing the platform beyond niche crypto circles.

USDC Gains as Settlement Token

Stablecoins are riding the coattails of prediction market growth. All Polymarket transactions settle in USDC on the Polygon blockchain, contributing to a sharp increase in stablecoin flows. The structure, unlike lending platforms that lock up user assets, ensures constant on-chain movement as positions are opened and resolved.

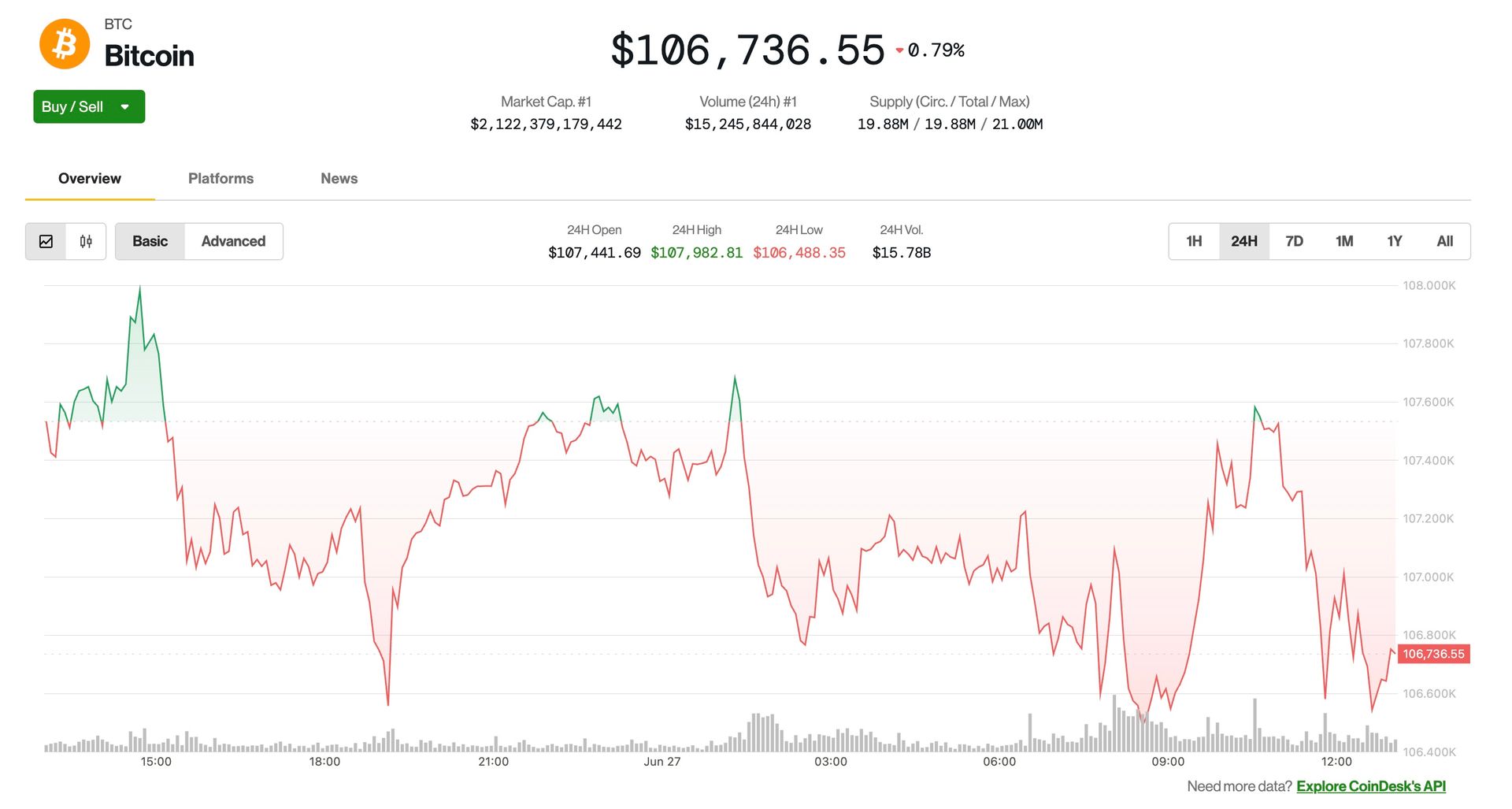

While the crypto spotlight has turned to consumer apps, macro developments also helped ease market stress. A ceasefire between Israel and Iran, in place since June 23, contributed to improved risk sentiment. Crypto markets stabilized alongside equities, with the COIN50 index recovering and bitcoin holding above $100,000.

Volatility has declined. Short-term demand for downside hedges in bitcoin has faded, as reflected in 25-delta put-call skews on 30-day options. Longer-dated options suggest that investors want exposure to crypto upside without incurring full spot costs, indicating renewed confidence despite geopolitical uncertainty.

With the July 9 and August 12 deadlines for tariff decisions approaching, traders remain largely indifferent to the potential impact on inflation. Fed Chair Jerome Powell warned this week that tariffs could influence prices in the second half of the year, but markets continue to focus on disinflation trends, especially in services.

Legislative Momentum Builds for Stablecoins

Policymakers also made headway on regulatory clarity. The US Senate passed the GENIUS Act, a stablecoin framework, with a 68–30 vote. House Majority Whip Tom Emmer now seeks to merge it with the CLARITY Act, a broader market structure bill, though such a move may delay passage.

President Trump called on lawmakers to swiftly and without amendments approve the stablecoin measure. Meanwhile, Senate Banking Committee Chair Tim Scott said the market structure bill could be completed by the end of September.

Separately, the Fed announced it would eliminate “reputational risk” from its bank supervision guidelines, a move seen as further easing pressure on crypto firms that had faced banking restrictions under earlier policies. This article was written by Jared Kirui at www.financemagnates.com.

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)

![[Weekly funding roundup June 21-27] A sharp rise in VC inflow](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)