Luck by D2C: How Bold Care sailed on quick commerce tailwind to reach Rs 100 Cr sales

Ranveer Singh-backed Bold Care is riding its quick commerce success to offline retail while banking on its brand recall to grow women's sexual health brand Bloom.

In the sexual health and wellness industry, consumers had to conventionally trade privacy for access. While visiting a pharmacy remains an awkward proposition for many, ecommerce deliveries come with a time gap. All that changed with quick commerce.

The growth and popularity of quick commerce channels could not have come at a better time for D2C brands like Bold Care, which has clocked upwards of Rs 100 crore through online-only sales.

“In any startup journey, luck and timing play their part too. For us, quick commerce helped us scale by opening up a channel where fast delivery and impulse buying aligned perfectly with consumer expectations in this category,” Rajat Jadhav, Co-founder and CEO of Bold Care, tells YourStory.

The luck Jadhav refers to is the company’s robust success on quick commerce platforms. Since its launch on Swiggy Instamart and Zepto in 2022, Bold Care has become the second-largest player on quick commerce platforms in its category, behind Durex. It has a strong presence in categories like lubricants and condoms, according to data shared by iStack Digital, a quick commerce analytics firm.

“In the sexual health industry, trust, privacy, and convenience drive the entire customer journey. That is why customers resonated towards quick-commerce platforms, where they can explore and buy products comfortably, discreetly, and with fast delivery,” he adds. Bold Care

Jumping on the q-com train

Jadhav, who started an online pharmacy business back in 2015, realised that almost 30-35% of the orders pertained to the sexual wellness category. While the business eventually shut down, Jadhav realised the men’s sexual health space online was ripe for disruption as only a fraction of sales for contraceptives and wellness products was coming from online retail despite the category promising privacy.

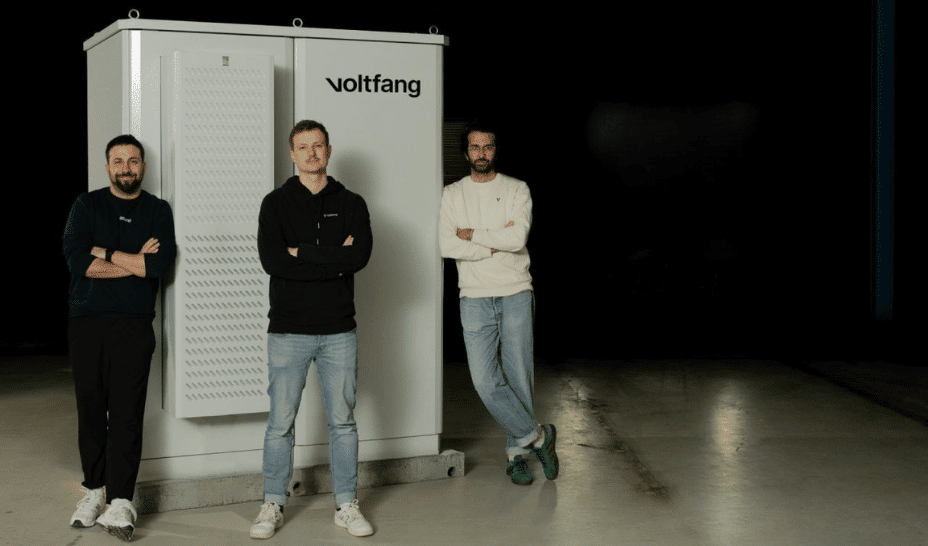

After shutting down the business, Jadhav moved to the other side of the table, with stints at Quadarch Fund and growX Ventures as an investment analyst. Three years in, he partnered with Mohit Yadav and Rahul Krishnan to launch Bold Care in 2020, just as quick commerce apps found relevance during the pandemic.

The sexual health and wellness brand became one of the first D2C brands to jump on the bandwagon. Its approach towards embracing new channels paid off. In the six months between November 2024 to April 2025, Bold Care saw its entire portfolio grow over three-fold on Zepto. As of today, the company is on track to be profitable over the next 12 months.

With a steady brand name and being among the top two in online sales, Bold Care has now set its sights on traditional retail. It is currently available across 1,000 pharmacy stores in Mumbai and is actively working to scale further.

While D2C continues to be a crucial growth engine for the category, brands are actively diversifying across quick commerce and offline retail, as well as through partnerships with service providers such as diagnostic companies and health professionals like doctors and nutritionists, who are playing an active role as coaches in the consumer's health journey. This multi-channel approach allows them to reach distinct consumer segments and reduce dependency on any single platform, says Ankur Khaitan, Principal at Fireside Ventures.

After raising a small angel round in 2020, BoldCare recently closed a $5 million Series A round in February earlier this year, led by Nithin Kamath’s Rainmatter, CaratLane’s Mithun & Siddhartha Sacheti, and AVT Group, along with other investors. It also counts actor Ranveer Singh as one of its key backers and co-founders.

The brand clocked Rs 34.5 crore in operating revenue in FY24 against Rs 31.5 crore in the previous year. During the same period, it saw its losses widen to Rs 19.3 crore, compared with Rs 15.8 crore a year ago.

A to Z of sexual health

“We want to offer a comprehensive solution for key concerns like erectile dysfunction and premature ejaculation, with products that range from trusted over-the-counter options to natural Ayurvedic and nutraceutical alternatives. Our goal is to give customers the flexibility to choose what works best for them,” explains Jadhav.

To this tune, the company offers performance boosters, vitamin supplements, immunity boosters, urinary health and prostate supplements, and even some personal care products like perfumes. Across segments, it has over 50 SKUs and closes about three lakh orders between all the channels.

“The next wave of growth in sexual wellness is expected to come from intimate hygiene and men’s sexual health. These sub-categories are gaining traction as consumers increasingly prioritise self-care, seek greater awareness and look for products that address root-cause health concerns,” says Khaitan. The Indian sexual wellness market is poised to reach $2.5 billion by 2033, with a CAGR of 6.20% over the next five years, according to IMARC Group.

Bold Care launched Bloom by Bold Care in October last year, marking its foray into the women’s sexual health and wellness category. It offers nutraceuticals, supplements and sexual health solutions for women. It also sells menstrual hygiene, beauty and personal care products, and has also introduced personal massagers.

The online-only brand has already crossed Rs 1 crore in monthly recurring revenue within five months, less than half the time it took for Bold Care to reach the same scale, the company says. Bloom by Bold Care competes with players like Mirabilis Investment Trust-backed Nua, Blume Ventures-backed Plush, and Sirona.

“Overall, we believe that the women’s wellness space is still in its early stages—and the demand is also steadily growing for accessible solutions in all aspects of a woman’s life. Search volumes for the Bold Care keyword are quite solid across third-party platforms, and that credibility is benefiting Bloom as well," explains Jadhav.

With a focus on expanding retail penetration, increasing its product portfolio and making a mark in a more competitive women’s health category, Bold Care is betting on trust, discretion and accessibility to move from its digital-only niche roots to becoming a category-leading brand.

Edited by Kanishk Singh

![X Highlights Back-to-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)