Lenskart next in line for IPO; Bold Care’s quick commerce led growth

Omnichannel eyewear retailer Lenskart is set to file its DRHP confidentially with the markets regulator by the end of this month, sources shared with YourStory. The growth and popularity of quick commerce channels could not have come at a better time for D2C brands like Bold Care.

Hello,

In good news for power companies, the National Stock Exchange has received official permission from the market regulator SEBI to start trading electricity futures contracts.

This means that buyers and sellers can agree now on a price for electricity that will be delivered in the future. NSE is the second exchange in India to get this approval, after the Multi Commodity Exchange got it last week.

India’s largest carmaker, however, isn’t having a good day, thanks to China’s export curbs on rare earths. Maruti Suzuki has cut near-term production targets for its maiden electric vehicle, e-Vitara, by two-thirds because of rare earths shortages, Reuters reported.

Meanwhile, US President Donald Trump said China will supply rare earths up front to the US as part of a trade agreement.

Earlier this week, representatives from both sides revealed that a deal had been reached on trade after a second day of high-level talks in London.

Lastly, ever wondered if your clone, in your stead, could attend those boring meetings?

Turns out that some CEOs are doing exactly that, with AI startups helping them create their digital doubles that do mundane tasks like attending interviews and writing keynote speeches.

The AI divide gets wider.

In today’s newsletter, we will talk about

- Lenskart to file IPO confidentially

- Bold Care’s quick commerce led growth

- Credgenics’ performance fuels lending dreams

Here’s your trivia for today: What was the name of the South American country that existed from 1819 to 1831 and included present-day Colombia, Venezuela, Ecuador, and Panama?

IPO

Lenskart to file IPO confidentially

Omnichannel eyewear retailer Lenskart is set to file its draft red herring prospectus (DRHP) confidentially with the markets regulator by the end of this month, sources shared with YourStory.

According to sources, the NCR-based company is gearing up for a $10-billion IPO, with a public issue of more than $1 billion.

Key takeaways:

- This development comes just days after the company officially transitioned into a public limited company, following a special board resolution. According to regulatory filings, Lenskart dropped 'private' from its name, renaming itself to Lenskart Solutions Limited.

- As it prepares for a public market debut, the Softbank-backed company has, in the last year, focused on profitability. The company managed to rein in its losses by 84% in FY24 to Rs 10.15 crore against a loss of Rs 63.7 crore in FY23.

- The company had last raised $200 million in secondary investment from Temasek and Fidelity Management and Research Company in June last year. It has attracted over $1 billion in the last 18 months.

Funding Alert

Startup: GIVA

Amount: Rs 450 Cr

Round: Series C

Startup: Knest Manufacturing

Amount: Rs 300 Cr

Round: Equity

Startup: PowerUp

Amount: $7.1M

Round: Seed

Startup

Bold Care’s quick commerce led growth

The growth and popularity of quick commerce channels could not have come at a better time for D2C brands like Bold Care, which has clocked upwards of Rs 100 crore through online-only sales.

“For us, quick commerce helped us scale by opening up a channel where fast delivery and impulse buying aligned perfectly with consumer expectations in this category,” Rajat Jadhav, Co-founder and CEO of Bold Care, tells YourStory.

Aboard the q-train:

- Since its launch on Swiggy Instamart and Zepto in 2022, Bold Care has become the second-largest player on quick commerce platforms in its category, behind Durex. It has a strong presence in categories like lubricants and condoms.

- Bold Care launched Bloom by Bold Care in October last year, marking its foray into the women’s sexual health and wellness category. It offers nutraceuticals, supplements and sexual health solutions for women.

- With a steady brand name and being among the top two in online sales, Bold Care has now set its sights on traditional retail. It is currently available across 1,000 pharmacy stores in Mumbai and is actively working to scale further.

Earnings

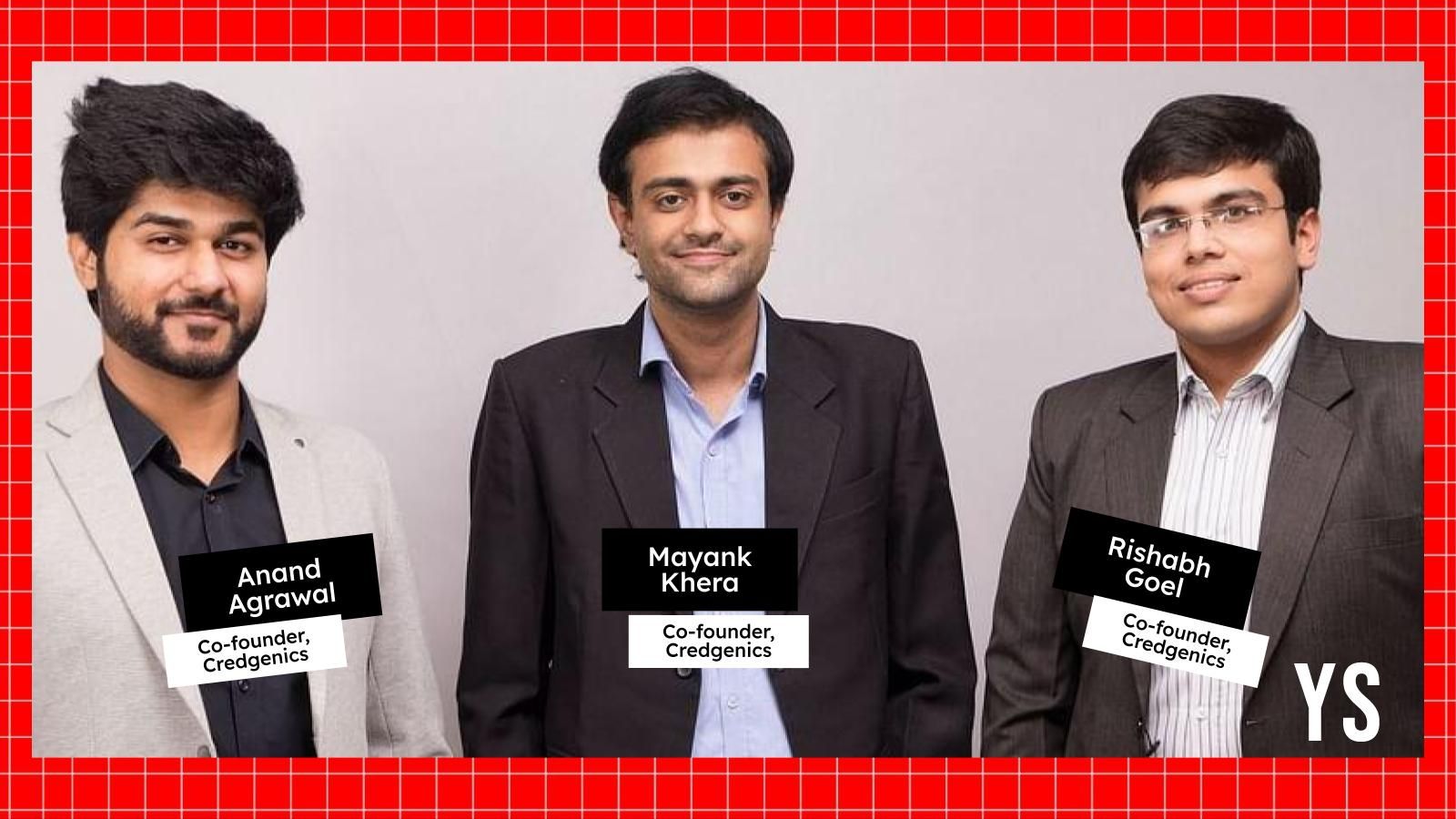

Credgenics’ performance fuels lending dreams

Despite challenges in the personal lending sector, debt collection technology platform Credgenics has clocked a robust revenue growth in FY25 and is poised for expansion and acquisitions. The Noida-based company earned a revenue of Rs 220 crore in FY25, growing 42% from Rs 155 crore in the previous year. It also reported a profit before tax of Rs 25 crore for the fiscal year.

“We have built a strong cash position, exceeding the total primary equity capital we’ve raised,” Rishabh Goel, Co-founder and CEO of Credgenics, told YourStory. “Our business performance has allowed us to generate additional cash beyond the capital infused in our funding rounds.”

News & updates

- Gaming: Japan’s Nintendo said it had sold more than 3.5 million Switch 2 units in the first four days after its launch, making the console the company’s fastest-selling gaming device to date.

- AI deal: Nvidia on Wednesday announced a slew of partnerships with European countries and companies spanning infrastructure to software as it looks to keep itself at the centre of the global AI story.

- Robotaxis: Tesla tentatively plans to begin offering rides on its self-driving robotaxis to the public on June 22, CEO Elon Musk said, as investors and fans of the electric vehicle maker eagerly await the rollout of the long-promised service.

What was the name of the South American country that existed from 1819 to 1831 and included present-day Colombia, Venezuela, Ecuador, and Panama?

Answer: Gran Colombia

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

![X Highlights Back-to-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)