Ethereum's 'Identity Crisis' Is What Real Decentralization Looks Like

The Ethereum community must avoid getting distracted by price movements, governance drama, or competing narratives and unite around their common mission: building credibly neutral infrastructure that serves humanity's needs, says Nick Johnson, Co-Founder and Lead Developer of Ethereum Name Service.

Ethereum faces widespread perception as a network in crisis. It has been characterized as a platform plagued by governance upheaval, community fragmentation, and high gas fees. Additionally, Ethereum receives a lot of criticism for its slow performance, which lags behind Bitcoin's institutional appeal and Solana's speculative excitement.

This narrative misses Ethereum’s central purpose and strategy. Both of which are driven by deliberate decentralized innovation, which is now beginning to pay off.

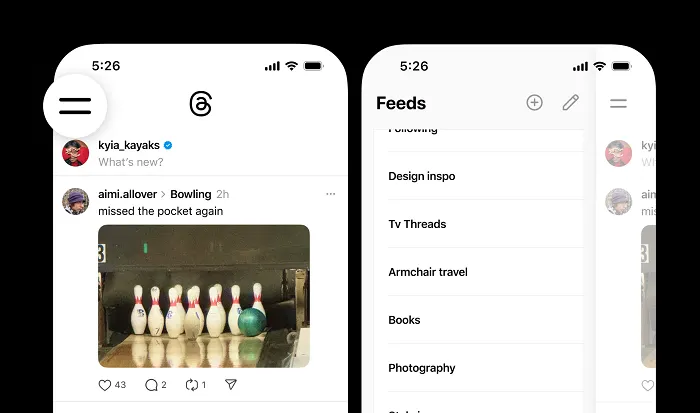

Ethereum’s “Identity Crisis”

Ethereum has chosen the more difficult but ultimately more sustainable path. This is based on the fact that it has maintained functional governance, which enables continued technical advancement. It also preserves credible decentralization, creating competitive advantages that neither pure stability nor pure speed can replicate. This positions Ethereum as the only blockchain capable of long-term sustainable innovation.

Concerns around Ethereum’s “identity crisis” reflect a fundamental misunderstanding of what makes blockchain technology valuable in the first place. When critics focus on short-term metrics like transaction costs and processing speed, they’re forgetting the revolutionary potential of a truly decentralized computing platform.

Ethereum's challenges are the growing pains of building something unprecedented: a global, permissionless computer that no single entity can control or shut down. The high gas fees demonstrate real demand for blockspace on the world's most secure and decentralized smart contract platform.

The governance discussions that appear as "upheaval" to outsiders represent healthy democratic processes that other chains avoid by maintaining centralized control, or by effectively forbidding all change and improvement. This nuanced reality gets lost in narratives that prioritize simplicity over substance.

Bitcoin’s Pet Rock Problem

Despite being criticised as a digital “pet rock,” Bitcoin has received widespread respect as the first cryptocurrency to see legitimacy outside of the industry. “Bitcoin-maxis” even point to the chain’s inertia as a critical tenet of bitcoin’s value. Since the chain rarely updates, except for predictable supply halvings, bitcoin can remain a “digital gold.” However, this simplicity is a ceiling, not a strength.

Bitcoin has ossified; initially slow to innovate, improvements are now effectively impossible.

“Bitcoin-maxis” would argue that the chain’s ossification only strengthens the asset’s immutable value. But, bitcoin’s liquidity is tenuous; it relies on perception, and recent reports demonstrate that bitcoin's value isn’t an inherent certainty.

Ethereum, by contrast, continues to evolve through major upgrades like the transition from Proof-of-Work to Proof-of-Stake in 2022 and the recent Pectra update. Unlike Bitcoin, the Ethereum community continues to demonstrate that it is capable of meaningful technological innovation.

Ethereum’s Decentralization Is Key

Many of Ethereum’s critics point to the impressive speed and low costs of other chains as examples of where Ethereum is failing. These feats are achieved quickly only by giving up on meaningful decentralization.

Ethereum is a credibly neutral world computer with thousands of projects innovating on it precisely because of its ethos of decentralization.

Some form of centralized leadership may seem like a small price to pay for quicker change, but decentralization matters in the same way that seat belts do. It's an inconvenience until it’s necessary; until an account is de-platformed, or the system makes an unpopular choice because of centralized interests that are not in line with its users’ values.

History provides countless examples of centralized systems eventually serving their controllers rather than their users - this is such a common pattern it's practically a law. Traditional financial institutions routinely freeze accounts, deny services, or impose arbitrary fees based on political or business considerations.

Decentralization is not a long-term goal; it is a foundational necessity for building systems permanently free from corruption.

Ethereum Is Taking the Harder Path

Ethereum has chosen the most technically and socially difficult but correct route: building a truly decentralized platform that serves the needs of its users. That's the hard thing to do, but it's also the right thing to do, because it produces the best result in the long term.

This approach is slower than Solana’s and less obvious than Bitcoin’s, but it's the only path that delivers both continued innovation and genuine user sovereignty.

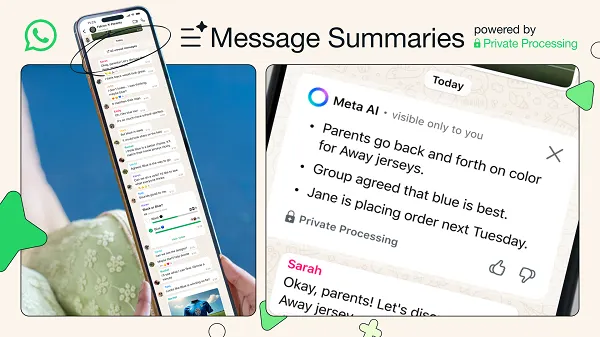

It is beginning to see results, too. Earlier this month, Bernstein analysts published a research report stating that "The narrative around value accrual of public blockchain networks is at a critical inflection point,” and “starting to reflect in investor interest in ETH ETF inflows."

Ethereum price is certainly trending upwards. Ethereum ETFs just completed their longest inflow streak of 2025, with BlackRock's ETHA fund alone adding $492 million in a single week. Meanwhile, Bitcoin ETFs experienced $582 million in net outflows during the same period.

Despite this positive momentum, the Ethereum community needs to concern itself less with trailing indicators of success like price. As John Maynard Keynes famously warned, “the market can stay irrational longer than you can stay solvent.”

The Ethereum community must avoid getting distracted by price movements, governance drama, or competing narratives and unite around their common mission: building credibly neutral infrastructure that serves humanity's needs. Ethereum's ability to innovate while staying decentralized requires developers, researchers, validators, and users to shut out the noise and remain focused on building. This path is harder, but it's the only one that leads to sustainable success.

![What Is a Markup Language? [+ 7 Examples]](https://static.semrush.com/blog/uploads/media/82/c8/82c85ebca40c95d539cf4b766c9b98f8/markup-language-sm.png)