Bitcoin Holder GameStop Gets an ETF From Bitwise

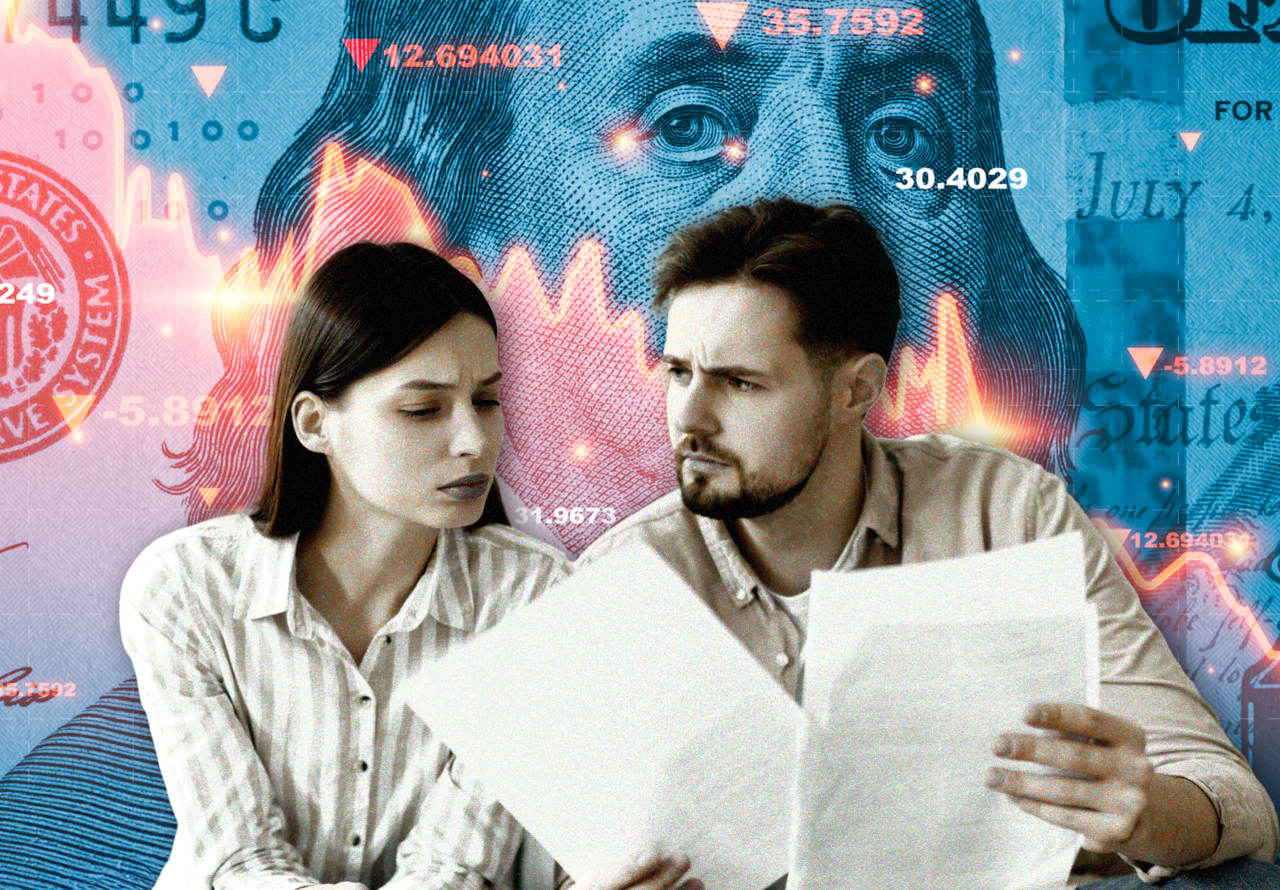

The crypto-focused asset manager is offering a covered call strategy to provide share price exposure to GME while generating income.

Bitwise Asset Management is tapping into the fervor surrounding GameStop’s (GME) bitcoin pivot with the launch of a new exchange-traded fund designed to offer exposure to GME and income.

Dubbed the Bitwise GME Option Income Strategy ETF (IGME), the fund will apply a covered call strategy to both provide exposure to GameStop’s share performance and regular income for investors.

GameStop purchased 4,710 BTC for over $500 million late last month, following its raising of $1.3 billion via convertible debt to initiate a bitcoin treasury strategy.

This new fund will be managed by Jeff Park, Bitwise’s Head of Alpha Strategies, alongside the firm’s portfolio management team.

Covered call strategies involve selling options on holdings to collect premiums, a method that can produce steady income, though capping upside potential.

GameStop has a compelling story, a passionate investor base, and a commitment to bitcoin,” Bitwise wrote on social media. “IGME seeks to harness that in a way that generates income and provides capped upside exposure.”

The fund is Bitwise’s fourth actively managed covered call ETF, joining a growing list of products designed to offer exposure to crypto-linked firms and income.

Bitwise has also filed to launch an ETF offering covered call strategy to generate income from holding shares of Circle (CRCL), which debuted on the New York Stock Exchange earlier this month.