5 things every 20-something must do with their money

Discover the 5 smartest ways to grow your money in your mid-20s—covering investing, saving, and smart budgeting to secure your financial future.

Your mid-20s are a weird in-between stage. You're no longer a teenager, but you don’t quite feel like a fully functioning adult either. You’ve started working (or are about to), maybe moved to a new city, and suddenly, you’re earning real money. But with that freedom comes a twist: bills, rent, EMIs, lifestyle temptations, and the constant pressure of “figuring it all out.”

Many 20-somethings feel overwhelmed about finances because no one taught us how to manage or grow money, only that we should. Schools didn’t cover credit scores, investing, or tax-saving instruments. So, we often learn through trial and error.

But here’s the truth: what you do with your money in your 20s sets the tone for the next 20 years.

Whether you're making ₹20,000 a month or ₹2,00,000, these five practical and powerful steps will help you grow your money confidently—and avoid common pitfalls that most young adults fall into.

Five financial steps to master in your 20s

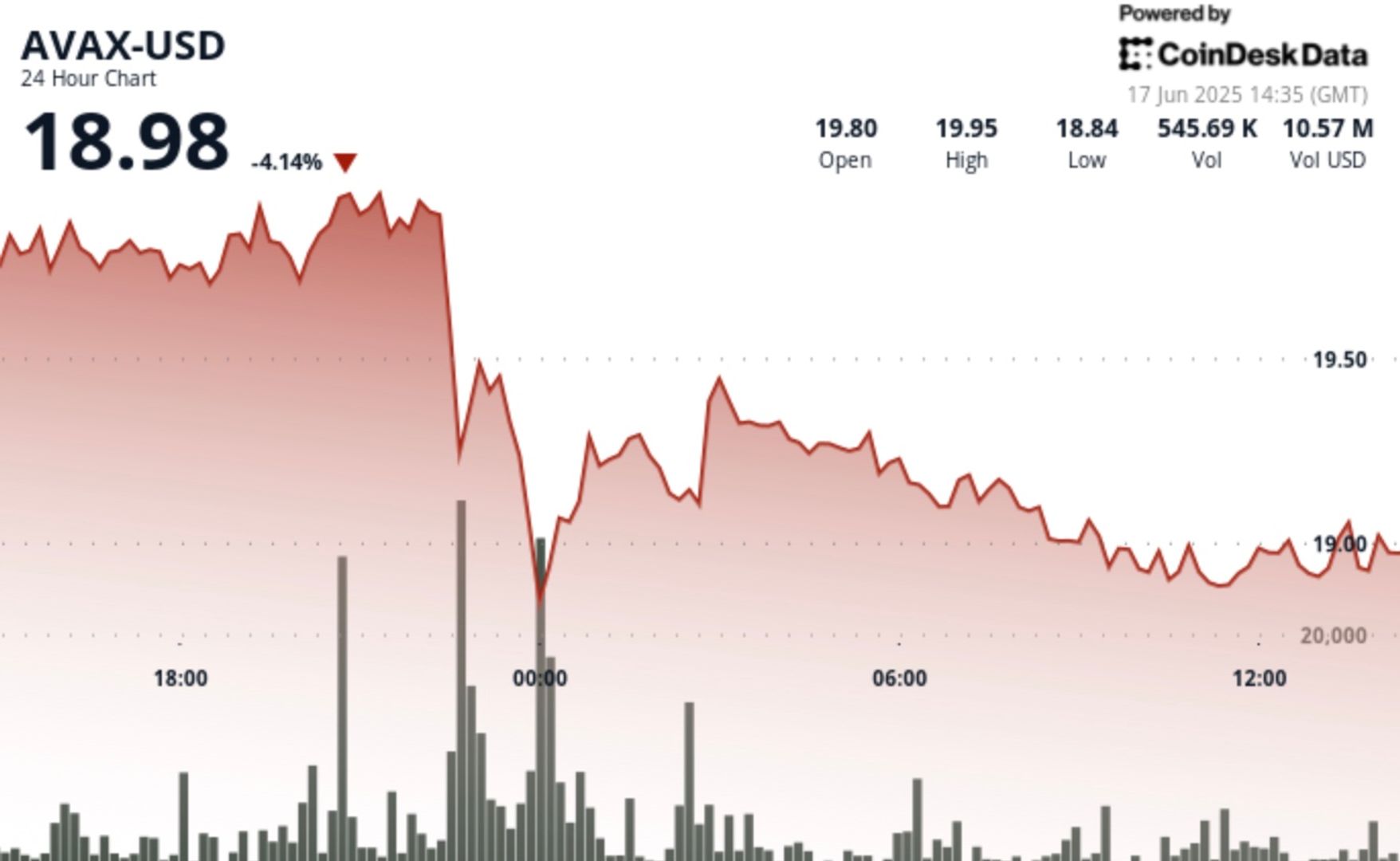

1. Start investing early

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

One of the biggest financial mistakes people make in their 20s is waiting until they “have more money” to start investing. In reality, time is more powerful than the amount. Thanks to compound interest, even ₹500 a month invested wisely can grow into lakhs over a decade.

Try this:

- Open a SIP (Systematic Investment Plan) in mutual funds with as little as ₹500/month.

- Explore index funds or ETFs if you prefer passive investing.

- Use apps like Zerodha Coin, Groww, or Kuvera to get started easily.

2. Build an emergency fund first

“The only certainty is that nothing is certain.” — Pliny the Elder

Life throws curveballs—medical bills, job loss, or broken gadgets right before rent is due. That’s why you need a financial cushion in the form of an emergency fund.

Aim: Save 3–6 months of essential living expenses in a separate bank account or liquid mutual fund. This fund is not for impulse shopping—only true emergencies.

Try this:

- Set up an automatic transfer of a fixed amount to a high-interest savings account every month.

- Avoid the temptation to keep this in your main account.

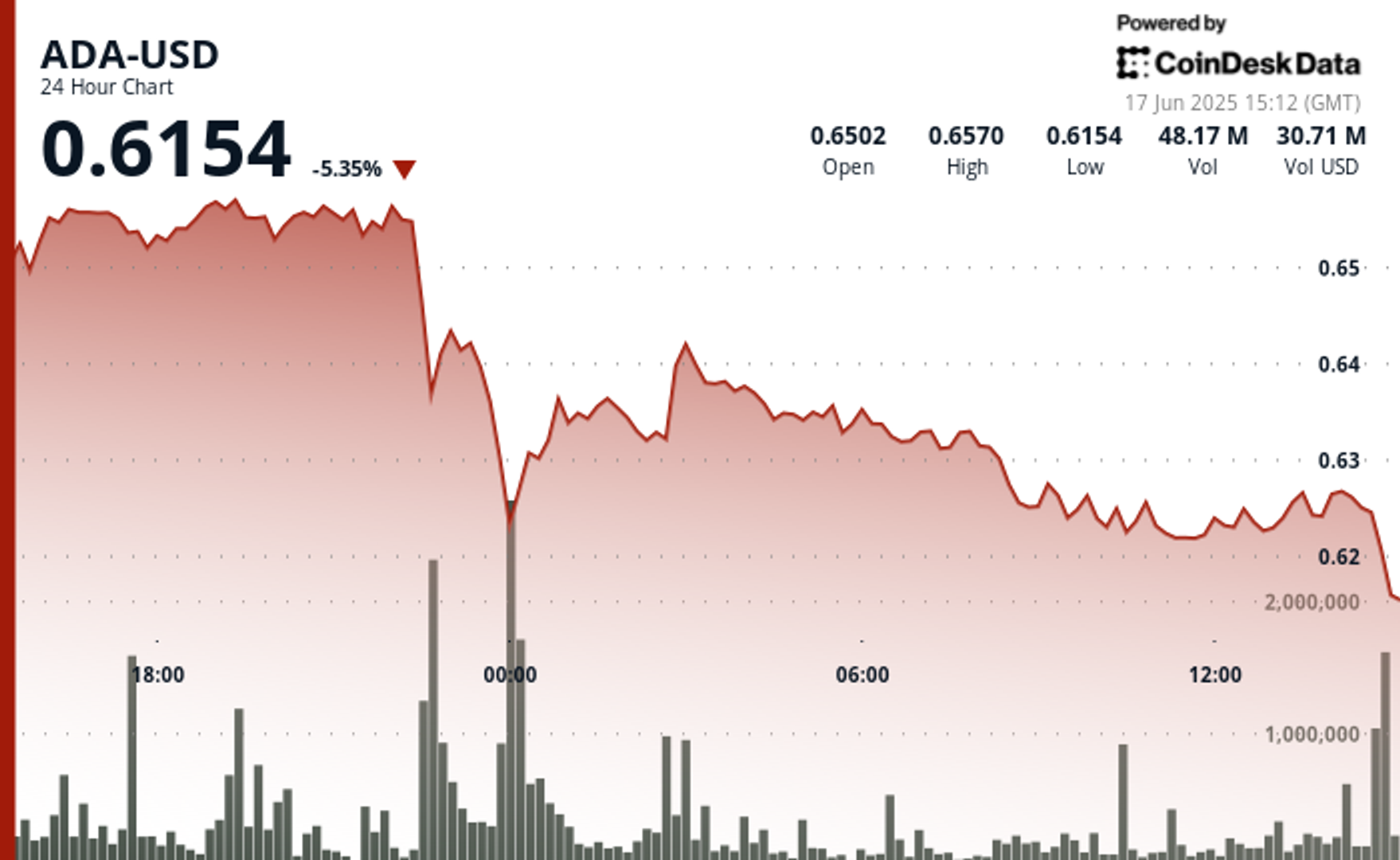

3. Cut lifestyle inflation before it starts

“Too many people spend money they haven't earned, to buy things they don't want, to impress people they don't like.” — Will Rogers

As your income grows, so does the temptation to “level up”—a nicer phone, more takeout, fancier vacations. That’s lifestyle inflation, and it’s a trap.

Enjoying your money is fine, but don’t let your expenses rise as fast as your income.

Try this:

- Follow the 50-30-20 Rule: 50% needs, 30% wants, 20% savings/investment.

- Automatically divert raises or bonuses to savings before upgrading your lifestyle.

4. Learn the basics of tax saving

“It's not about how much money you make, but how much you keep.”

In your 20s, tax deductions can be your secret weapon. The sooner you learn how to legally reduce your tax burden, the more money you keep and grow.

Try this:

- Understand Section 80C (₹1.5 lakh limit)—options like ELSS mutual funds, PPF, and EPF fall under this.

- Use health insurance premiums under Section 80D for deductions.

- File your own taxes to understand where your money is going.

5. Develop multiple streams of income

“Never depend on a single income. Make investment to create a second source.” — Warren Buffett

Your 20s are the best time to explore side hustles, freelancing, or monetising skills, because you likely have more energy, fewer responsibilities, and greater tech access.

Try this:

- Freelance in your skill area—design, writing, coding, marketing, etc.

- Sell digital products on platforms like Gumroad or Etsy.

- Start a blog, YouTube channel, or Instagram page to build future monetisable content.

Final thoughts

Your mid-20s are not too early—they're your financial foundation years. You don’t need to have it all figured out, but doing these five things can ensure you’re not playing catch-up in your 30s.

Money doesn’t grow overnight. But with time, consistency, and smart habits, your money will grow with you.