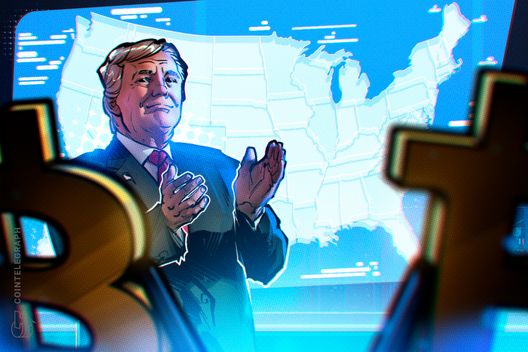

Timing the market is a lack of conviction

I’ve heard it before where people sometimes say buying in lump sums is better than DCAing. Which in theory it would be. However timing the market is often a secondary symptom of simply having no conviction. You can take myself for a prime example of that. Let’s say you do time it - for example you bought a large lump sum 2 months ago at 78 thousand and made some good profit - good for you. But that timing won’t last. Why are you hesitant from buying today? Why are you hesitant from buying tomorrow? Why are you hesitant from buying at all? These questions are a sign that you’re not really as convinced as you say you are. Which is fine but then at that point - why even buy at all? If you’re truly convinced that the landscape will be completely different then it is now in 10-20 years. What is actually stopping you from DCAing as often as possible. The difference in profit in the large scale will be negligible submitted by /u/Rofltage [link] [comments]

I’ve heard it before where people sometimes say buying in lump sums is better than DCAing. Which in theory it would be.

However timing the market is often a secondary symptom of simply having no conviction. You can take myself for a prime example of that.

Let’s say you do time it - for example you bought a large lump sum 2 months ago at 78 thousand and made some good profit - good for you. But that timing won’t last.

Why are you hesitant from buying today? Why are you hesitant from buying tomorrow? Why are you hesitant from buying at all? These questions are a sign that you’re not really as convinced as you say you are. Which is fine but then at that point - why even buy at all?

If you’re truly convinced that the landscape will be completely different then it is now in 10-20 years. What is actually stopping you from DCAing as often as possible. The difference in profit in the large scale will be negligible

[link] [comments]

![X Highlights Back-To-School Marketing Opportunities [Infographic]](https://imgproxy.divecdn.com/dM1TxaOzbLu_kb9YjLpd7P_E_B_FkFsuKp2uSGPS5i8/g:ce/rs:fit:770:435/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2JhY2tfdG9fc2Nob29sMi5wbmc=.webp)