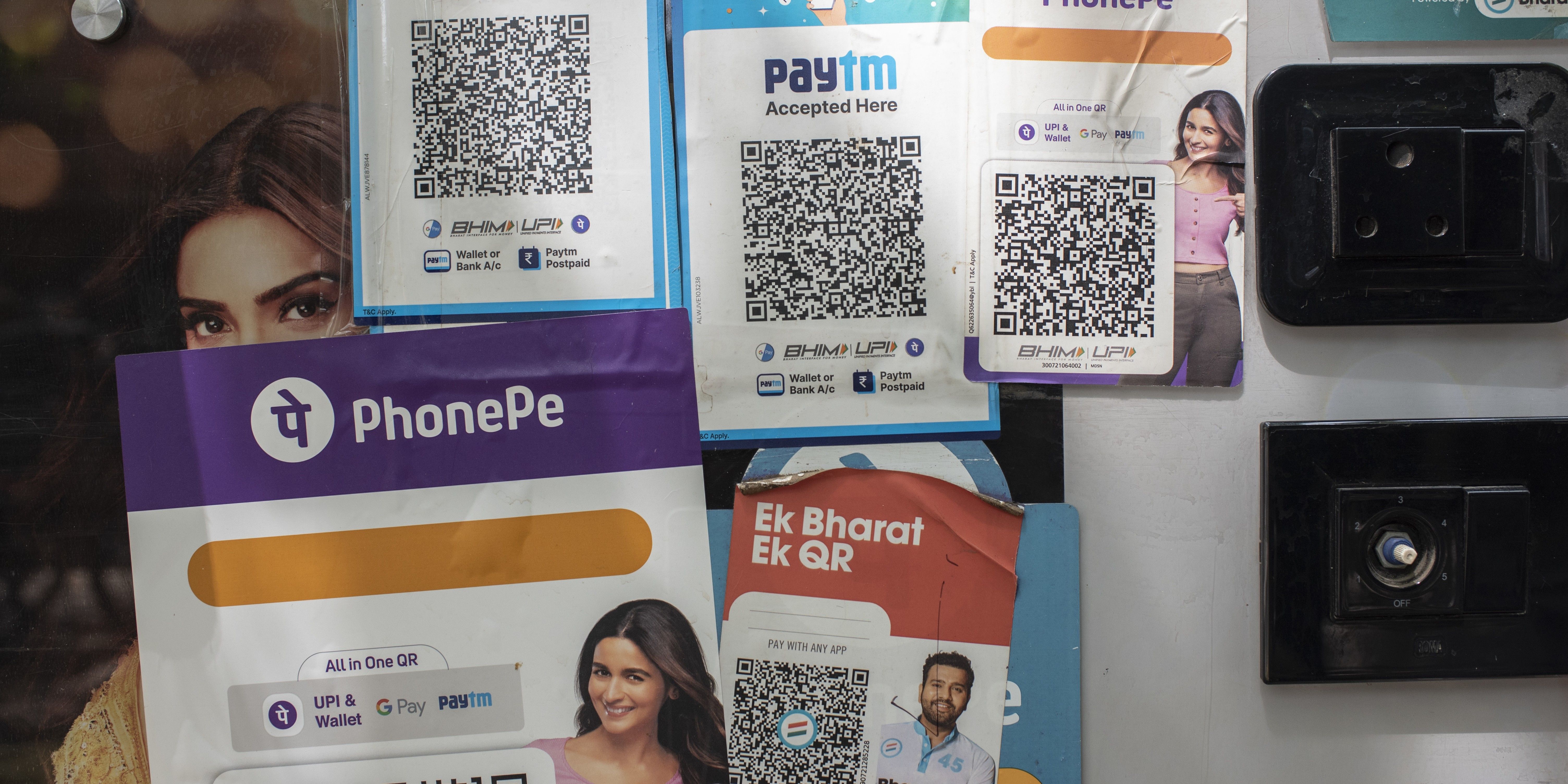

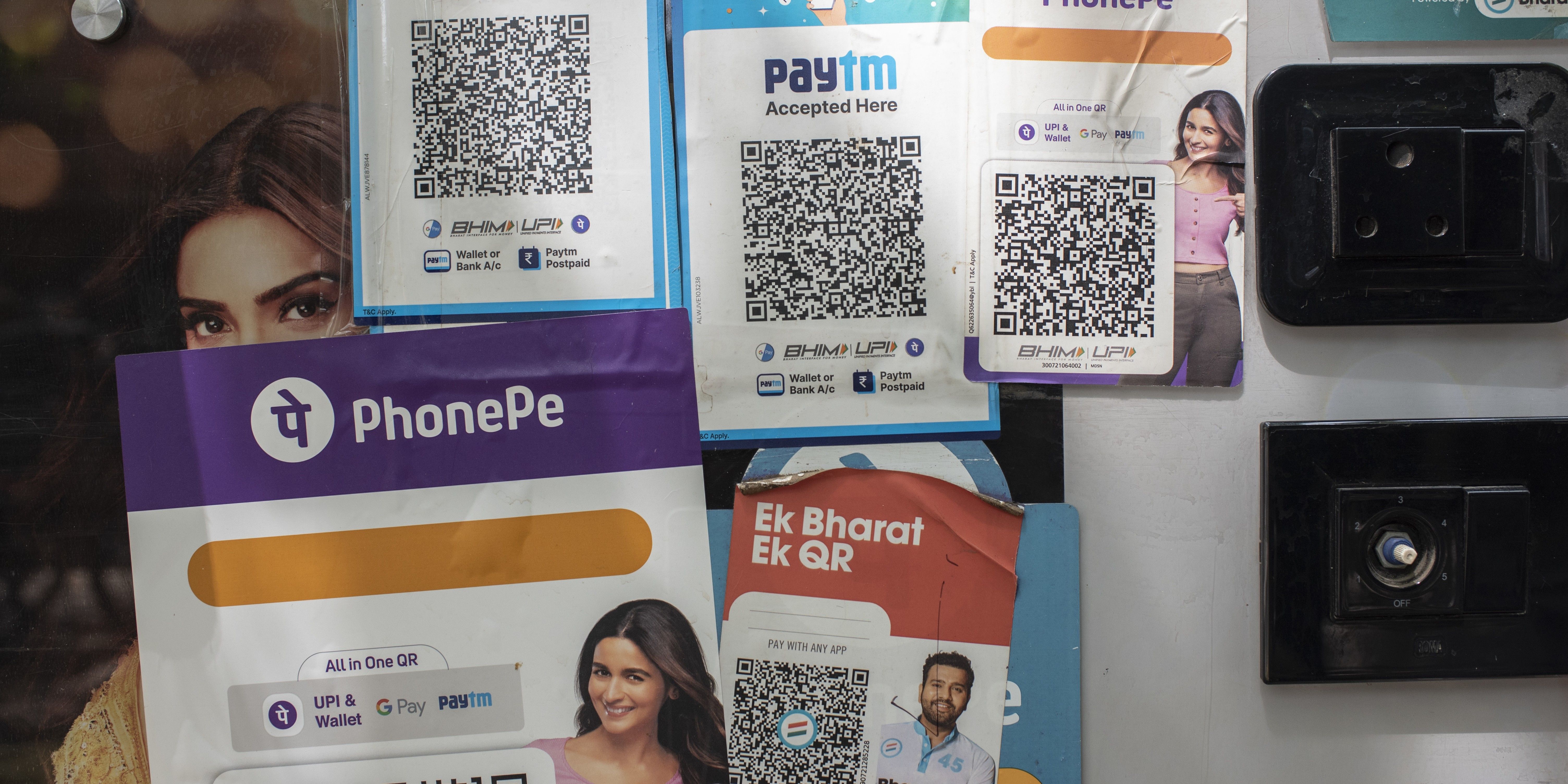

Swipe. Pause. Monetise: Indian fintechs signal the end of volume-first strategy in Q4 FY25

India’s digital finance ecosystem has a new mantra: profit over proliferation. This shift was visibly apparent in the FY25 earnings for the once volume-obsessed industry, which pursued breakneck growth through high-frequency transactions and easy credit. Today, Indian fintech startups are focu

India’s digital finance ecosystem has a new mantra: profit over proliferation.

This shift was visibly apparent in the FY25 earnings for the once volume-obsessed industry, which pursued breakneck growth through high-frequency transactions and easy credit.

Today, Indian fintech startups are focusing on making each rupee count—whether through fatter margins on secured loans, improved take rates on payments, or streamlined operating costs.

Fintechs are no longer just chasing size; they’re chasing sustainability.

The regulator’s nudge becomes a shove

Behind this strategic pivot lies a stern reality. The Reserve Bank of India (RBI) has made it abundantly clear that it’s no longer comfortable with the explosion of unsecured credit, especially when tech-first lenders are distributing it with little visibility into borrowers’ repayment ability.

The regulatory clampdown has compelled digital lenders to reassess their strategies. Risky, short-tenure loan products are phased out; business models are reworked, and across the board, fintech firms are moving towards lending models and payment flows that promise margin stability over market share.

MobiKwik: Exit BNPL, enter profitable payments

Among the first to feel the heat—and react decisively—was MobiKwik. Its flagship Buy Now, Pay Later (BNPL) product, Zip, has seen disbursals drop to Rs 5,358 crore in FY25—down 41% annually from Rs 9,093 crore in FY24.

Once accounting for over half of MobiKwik’s credit GMV, Zip has now become too costly and exposed to the risk of not surviving in the RBI’s new normal. Thus, the company pivoted to a longer tenure variant—Zip EMI—and newer, safer offerings, such as loans against mutual funds.

The real story, however, lies in payments. As its lending engine cools, the Gurugram-based fintech has turned to its payments arm, ZaakPay, to drive growth.

In FY25, MobiKwik’s payments GMV tripled to Rs 1.15 lakh crore. The company has tightened user incentives and is focusing on high-yield use cases such as RentPay, where users pay rent via credit cards. Even UPI—typically a margin killer—contributed 36% to the company’s GMV.

MobiKwik also managed to squeeze out a Q4 take rate of 0.64% and net margins of 15 basis points (bps)—solid numbers in a segment where many players struggle to break even.

Paytm: Pullback and patience

At Vijay Shekhar Sharma’s Paytm, the transformation has been more about consolidation than reinvention. Its personal loan disbursals fell 19% in Q4 FY25—an intentional slowdown. Founder and CEO VSS put it bluntly: “Personal credit, unless something bigger changes, will not see much larger growth.”

Instead, the Noida-based fintech is leaning into merchant lending, where the risk is partly underwritten by Default Loss Guarantee (DLG) structures. In Q4, merchant loans grew 13% sequentially to Rs 4,315 crore, now accounting for over three-fourths of Paytm’s total disbursals.

DLG is a risk-sharing arrangement where a third party—often the lending platform—guarantees to cover a portion of loan defaults, reducing the lender's exposure to bad debts.

Financial services revenue rose 9% in the quarter, powered by better collections and higher-margin loans. With 14 lending partners and a deeper push into merchant and secured credit, the One97 Communications company is hedging its bets against regulatory unpredictability.

On the payments side, the fintech is focusing on steadying the ship after a turbulent year, including regulatory action against Paytm Payments Bank. While it hasn’t disclosed its Q4 TPV, Paytm says merchant ecosystems—especially QR and card-based acceptance—are stabilising, but consumer-side recovery is still some way off.

Much of Paytm’s future monetisation depends on whether regulators allow Merchant Discount Rates (MDR) on UPI transactions. If greenlit, the Gurugram-based company expects to capture 5–8 bps of MDR, thanks to its widespread QR and wallet infrastructure.

MDR is the fee that merchants pay as a percentage of each transaction value when customers use digital payment methods. Paytm would earn 0.05-0.08% of every UPI transaction if regulators allow MDR charges.

Until then, it’s relying on cost control and product-led retention to stay profitable.

PB Fintech: Locking in security

PB Fintech, which operates credit marketplace Paisabazaar, is working towards de-risking by doubling down on secured products such as home loans and loans against property, as the unsecured loan engine slows.

CEO Yashish Dahiya summed it up well: “The industry is seeing a slowdown in unsecured credit. We’ve scaled our secured credit distribution through stronger fulfilment infrastructure and deeper lender partnerships.”

In FY25, Paisabazaar disbursed Rs 20,465 crore worth of loans—a 38% increase over the previous year. Most of that growth came from secured lending.

While the Gurgaon-based lender continues to underwrite some unsecured credit through DLG, it’s also betting big on safety and scale via secured loans.

Infibeam Avenues: Making margins from merchant tech

Infibeam Avenues’ story is less about credit and more about infrastructure. Under the CCAvenue brand, the fintech is emerging as one of India’s most efficient payment processors.

In FY25, its total processing volume grew 27% to Rs 3.99 trillion, and added 4.2 lakh merchants, with 1.1 lakh onboarded just in Q4.

Despite this growth in volumes, the Ahmedabad-based payments startup is squeezing more margin out of every rupee processed. Its take rate rose to 10.6 bps in Q4, up from 9.2 bps a year earlier, which helped it post an impressive 58% EBITDA margin on net revenue—a rare feat in the Indian fintech sector.

The take rate is the percentage of the total transaction value that Infibeam keeps as revenue.

Infibeam’s hardware stack—Smart SoundBox and TapPay—is gaining ground in Tier II and III cities. Its SoundBox integrates multiple offerings into one terminal, enabling merchants—who previously only used it for QR-based UPI payments—to adopt other services.

“In essence, the people who are just using a bland speaker box today are graduating to accept all kinds of payments through our CCAvenue Smart SoundBox,” Infibeam’s joint Managing Director Vishwas Patell said.

Combining TapPay’s functionality for cards and CCAvenue merchant platform with its SoundBox brings in MDR and potential SaaS revenue for Infibeam, which offers much higher take margins.

Infibeam is also making significant inroads in the Middle East and North Africa (MENA) region, with operations in Saudi Arabia and Oman already demonstrating considerably higher take rates than its domestic Indian market.

"Fortunately, internationally, the margins—low margins itself is slightly higher than our margins here in India. So, in other words, the net—the take rate over there, internationally, is almost 2x more of what we get in India," said Chairman and Managing Director Vishal Mehta.

While initial international revenues would likely come from high-volume, lower-margin enterprise clients, the inherent take rates are still double those in India, and the payback period for international infrastructure investment is estimated to be one to three years.

From land grab to value creation

The post-pandemic years saw India’s digital finance sector focus heavily on scale—whether in disbursing credit, onboarding merchants, or expanding payments infrastructure. However, recent regulatory tightening, a higher cost of capital, and changing investor expectations are now prompting a shift in strategy.

Today, fintechs are reorienting themselves around margin-focused growth. Whether it’s through a tilt towards secured lending, more efficient payment monetisation, or controlled incentive structures, companies are experimenting with sustainable models—financially and operationally.

This change is not uniform. While players like MobiKwik and Infibeam are leaning into monetisation opportunities more aggressively, others, such as Paytm, are treading cautiously amid external uncertainties. The underlying direction, nonetheless, appears consistent: digital financial companies are recalibrating their growth engines to align with a more measured, profitability-first market environment.

How this plays out over the next few quarters will depend on multiple factors. Regulatory clarity, consumer demand for credit, lender appetite, and the possible introduction of monetisation levers such as MDR on UPI.

For now, the Indian fintech industry appears to be in the midst of a structural reset, one that favours long-term value over rapid expansion.