Strategy Adds Over 10K BTC to Its Bitcoin Treasury, Funded by New STRD Offering

Firm raises over $1 billion from high-yield preferred stock and share sales to expand record BTC holdings.

Disclaimer: The analyst who wrote this piece owns shares of Strategy (MSTR).

Strategy (MSTR), the largest corporate holder of bitcoin BTC, has expanded its holdings with a new 10,100 BTC purchase, mainly funded by proceeds from its latest preferred stock offering, STRD.

The acquisition brings Strategy’s total bitcoin holdings to 592,100 BTC, now valued at approximately $63.3 billion, based on a current market price of around $107,000 per bitcoin. The average purchase price of the company’s total BTC position now stands at $70,666.

To finance the purchase, Strategy recently completed its 10% Series A Perpetual Stride Preferred Stock (STRD) issuance. Targeted at long-term investors seeking high-yield, fixed-income opportunities, the offering consisted of 11.76 million shares and generated approximately $979.7 million in net proceeds after fees and expenses.

The BTC acquisition was funded through a combination of proceeds from the STRD issuance and an at-the-market (ATM) share sale program, which included sales of its other preferred stock classes, STRK and STRF. Between June 9 and June 15, Strategy raised $TKTK from these equity offerings.

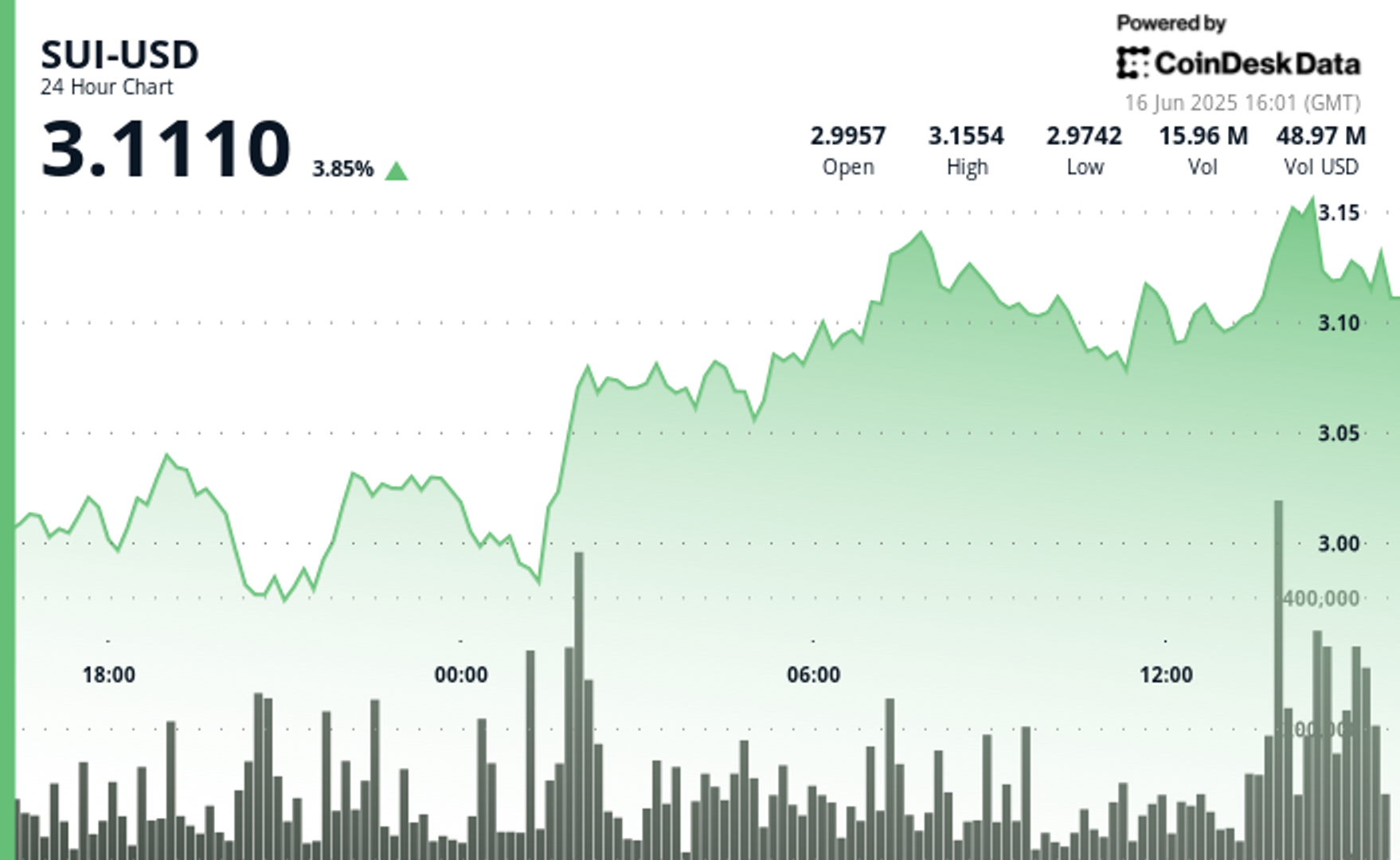

MSTR shares are trading at 1.60%in pre-market hours, while bitcoin is holding near $107,000.