Startups, This Is Why Japan Can’t Be Ignored

The Japanese startup ecosystem is substantial, growing and seeing increased government investment and international interest, writes guest author Alberto Onetti of Mind the Bridge, who shares his learnings from the recent Scaleup Summit Japan to remind startups about the robust Japanese innovation landscape.

After spending a week in Tokyo recently, I think it’s worth sharing some key takeaways and data on the Japanese startup ecosystem, which is substantial, growing and seeing increased government investment and international interest.

The occasion for my visit was the first-ever Scaleup Summit Japan, organized by Mind the Bridge in collaboration with JETRO, Japan’s government agency dedicated to supporting internationalization.

JETRO has a large, well-structured team focused on startups, led by Noriya Tarutani, with a presence in nearly every major market. We timed our summit to coincide with SusHi Tech Tokyo, one of the most prominent startup events in the Far East. We also added a tech mission for some international companies (like A2A), focused on exploring the Japanese innovation landscape and identifying startups and technologies of interest for potential adoption or investment.

We’re already planning a broader mission for next year to further deepen engagement with the local ecosystem.

Here’s what I took away from the trip.

Japan has a solid startup ecosystem

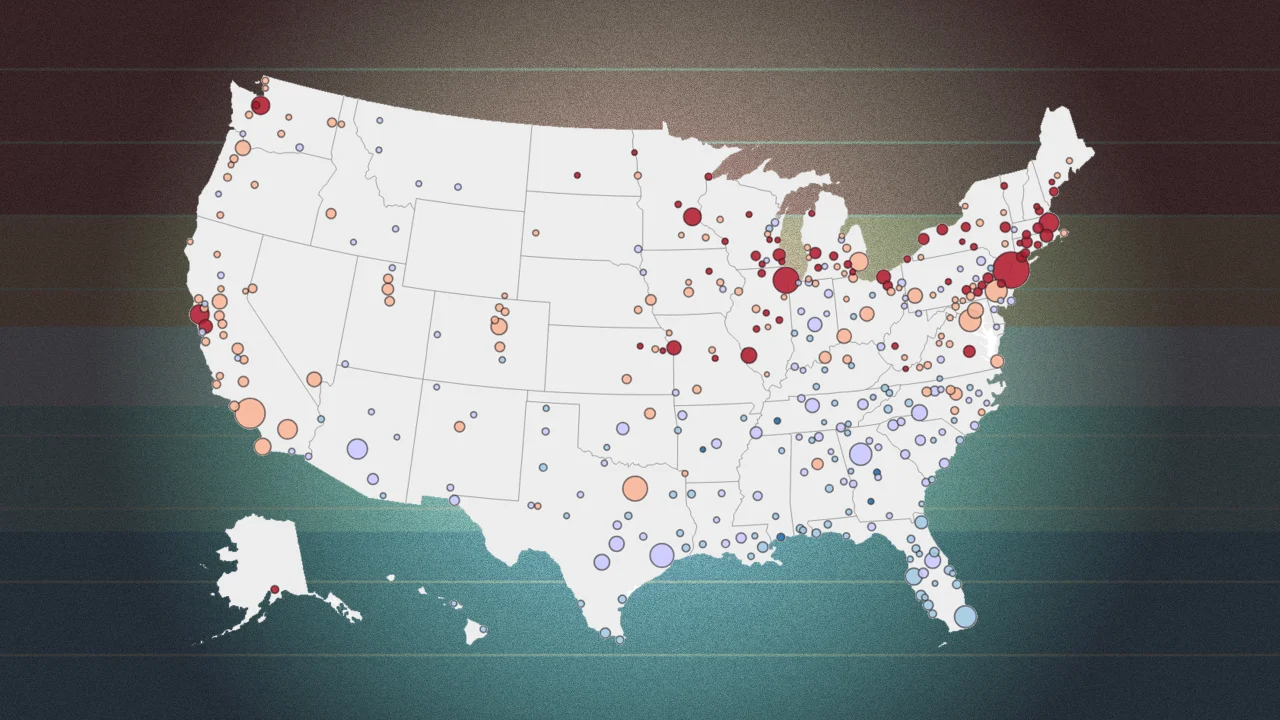

The Japanese startup ecosystem is far from small. The country counts nearly 22,000 startups and 2,300 scaleups, according to data from the Tech Scaleup Japan report (produced by Mind the Bridge in conjunction with Crunchbase and downloadable here).

Of those, 86 have raised more than $100 million, and two have raised over $1 billion, with six unicorns in total. This puts Japan on par with France and Germany — and significantly ahead of many other nations.

Massive growth underway

The momentum is real — and accelerating.

In 2022, Prime Minister Kishida launched the Startup Development Five-Year Plan with bold ambitions and substantial investments. From 2023 to 2027, the Japanese government will invest 10 trillion yen in innovation, aiming to grow the ecosystem to 100,000 startups (4x to 5x the current volume) and 100 unicorns (a 10x jump).

Are these targets overly ambitious? Perhaps. But Japan is incredibly effective at implementing structured processes to make things happen. A signal: In 2024 alone — while most ecosystems globally slowed down after the 2021 funding boom — Japan added 238 new scaleups and attracted $5 billion in investment.

It’s also important to consider Japan’s strong orientation toward deep and hard tech, which typically requires more capital and longer development timelines. In this space, the role of NEDO (Japan’s innovation agency) is pivotal.

The rest of the world is already moving

Opportunities go to those who show up early — and many are doing just that.

Unsurprisingly, the U.S. leads the way, maintaining a historically close relationship with Japan. Of the 41 international innovation outposts currently in Japan, 15 are American.

But France and Germany are also moving fast. As Jean-Eric Paquet, EU Ambassador to Japan, noted at the Scaleup Summit’s opening, today’s global instability — and the growing unpredictability of U.S. policy — could create new strategic opportunities for other countries to gain ground in Japan.

The role of Japanese corporates

This is where the game will be won — or lost.

Japanese corporates still lean heavily on traditional, internal R&D-driven innovation models, and only now are beginning to embrace open innovation in a meaningful way. Among the Fortune 500 companies in Japan, adoption of external innovation models is still emerging (see the benchmarking analysis on the adoption of open innovation tools by Fortune 500 companies).

But if this shift takes hold, the impact could be enormous. These are massive conglomerates spanning multiple sectors. Take Mitsubishi, for example — it covers everything from automotive to mining, energy to materials, food to infrastructure. It’s many large companies under one roof.

The trend is toward consolidating resources that were once siloed in individual business units — from corporate venture capital initiatives to the newly formed AI Solutions Task Force.

Unlike many European firms, Japanese corporates have a deep-rooted presence in the world’s top innovation ecosystems. In fact, Japan is the top foreign corporate venture capital investor in both Silicon Valley and the U.S. East Coast. Their global exposure gives them a sharp eye on what’s coming next.

In short: Japan is awakening — and doing so at scale. Ignore it at your own risk.

Alberto Onetti is chairman of Mind the Bridge and a professor at University of Insubria. He is a serial entrepreneur who has started three startups in his career, the last of which is Funambol, among the five Italian scaleups that have raised the largest amount of capital. He is recognized among the leading international experts in open innovation and has wide experience in setting up and managing open innovation projects — venture clients, venture builders, intrapreneurship, CVCs — with large multinational companies, as well as advising and training on this subject. Onetti has a column on Sifted (Financial Times) and several other tech blogs.

Photo by Cullen Cedric on Unsplash.

![[Weekly funding roundup May 24-30] Capital inflow continues to remain steady](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1741961216560.jpg)