BNP Paribas rotates India portfolio with big moves in Nykaa and Eternal

Global financial services firm BNP Paribas bought 62,485,371 shares at an average price of Rs 238.25 per share, amounting to a deal value of approximately Rs 1,488 crore.

Investment firm BNP Paribas Financial Markets executed two major block trades on Thursday, significantly trimming its position in FSN E-Commerce Ventures (Nykaa) while acquiring a substantial stake in Eternal, exchange data showed.

The global financial services firm bought 62,485,371 shares at an average price of Rs 238.25 per share, amounting to a deal value of approximately Rs 1,488 crore. It simultaneously sold a smaller lot of 188,998 shares at Rs 239.95 per share.

The global financial services firm sold 2,48,31,803 shares of Nykaa at an average price of Rs 202.81, offloading stock worth approximately Rs 503 crore. It simultaneously bought 1,01,548 Nykaa shares at Rs 202.08.

BNP Paribas Financial Markets is an investment arm of the French multi-national bank BNP Paribas. The entity offers a broad range of hedging, financing and market-intelligence products to customers across countries.

Quick commerce and food delivery firm Eternal saw its profits tank in the fourth quarter of FY25 as fierce rivalry in the quick commerce space prompted aggressive spending on expansion, weighing heavily on the company’s bottom line.

The Deepinder Goyal-led company clocked a whopping 77% decline in net profit to Rs 39 crore, from Rs 175 crore a year earlier. The net profit declined on a sequential basis too, as the company clocked Rs 59 crore in Q3.

Eternal, formerly known as Zomato, posted an over 63% growth in its consolidated operating revenue to Rs 5,833 crore, an improvement from Rs 3,562 crore in the corresponding period of the previous year. On an annual basis, the company registered 67% year-on-year (YoY) growth in its topline.

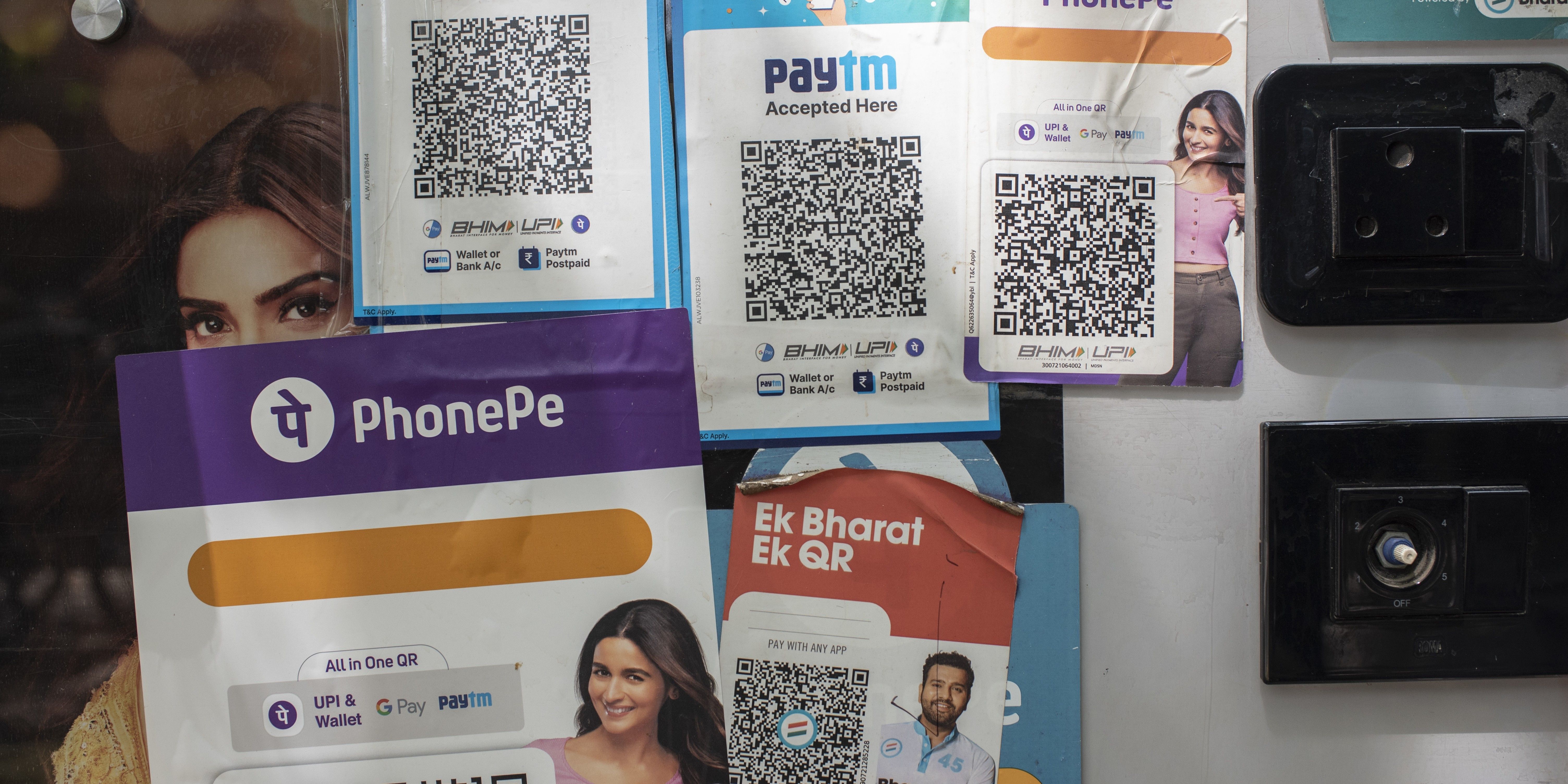

FSN Ecommerce Ventures, the parent company of beauty ecommerce platform Nykaa, nearly tripled its after-tax profit, buoyed by the robust performance of its core beauty and personal care (BPC) businesses.

During the March quarter, the startup earned Rs 20.28 crore net profit, compared with Rs 6.93 crore it posted in the corresponding quarter of the previous year as the margins of its core business improved.

The Mumbai-based player saw its operational revenue surge 23% year-on-year (YoY), from Rs 1,667.9 crore to Rs 2,061 crore in the fourth quarter of FY25, according to regulatory filings made with NSE.

Edited by Kanishk Singh