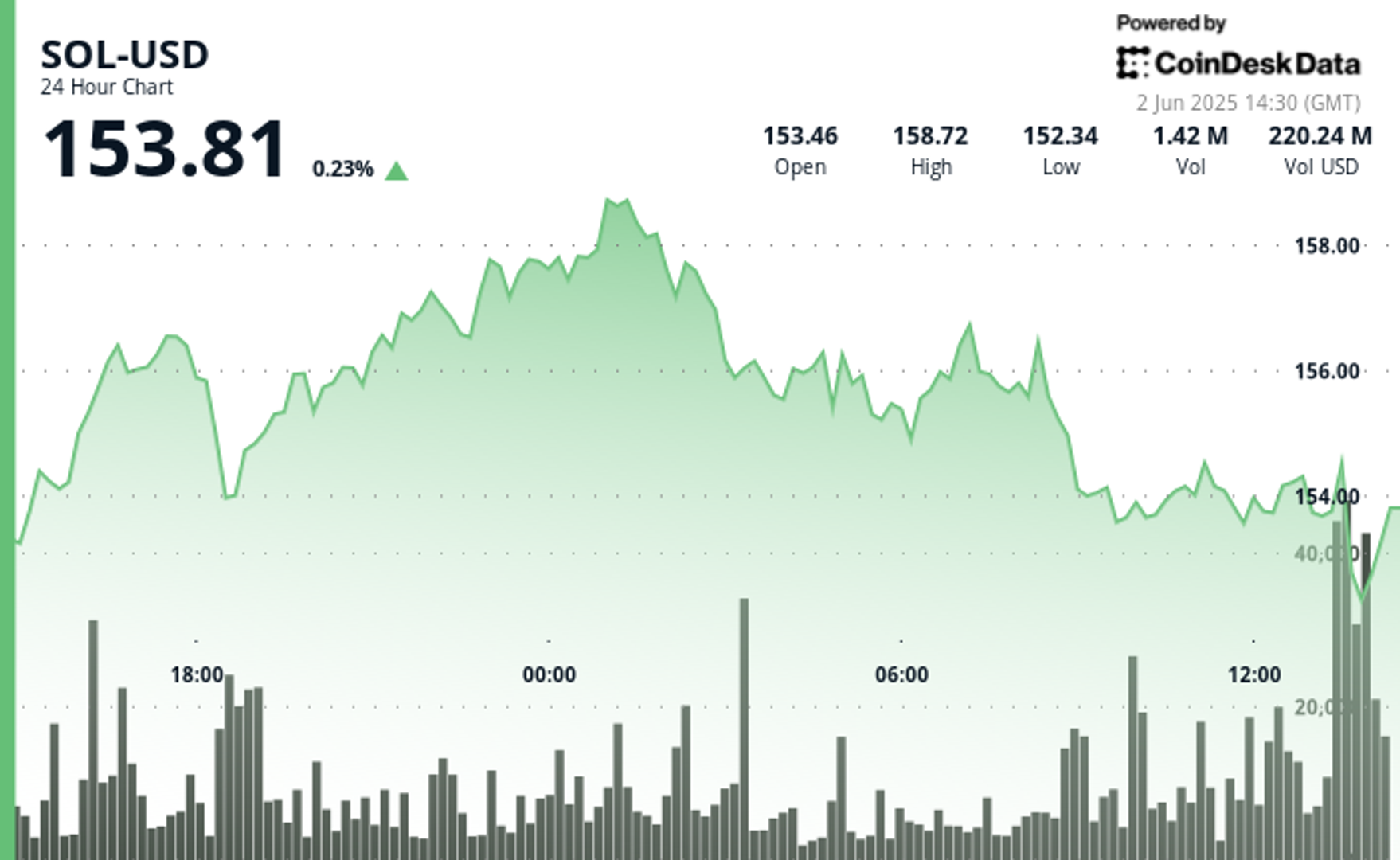

Solana Reverses Gains After Failed Rally Sparks Heavy Selling

Multiple failed breakouts near $159 sent SOL tumbling on heavy volume, with technical signals now pointing to deeper downside risk unless key levels are reclaimed.

Solana (SOL) faced renewed downside pressure after multiple failed attempts to break above the $158–$159 resistance zone.

Sellers took control during the 13:00 hour, where volume surged past 1.1 million, breaking through the $153.10–$153.30 support region and accelerating the bearish momentum.

Despite a modest recovery attempt, SOL remains on the back foot, trading just above $153.

With lower highs forming across recent sessions and key support zones under threat, analysts warn that further downside is possible unless bulls reclaim the $153.30 level.

The psychological $150 mark now looms as the next major line of defense.

Technical Analysis Highlights

- Strong resistance at $158–$159 triggered a 4.48% decline from peak to trough.

- High-volume breakdown below $153.10–$153.30 support zone signals bearish shift.

- SOL fell from $154.53 to $151.89 in the final hour, a 1.7% intraday drop.

- Notable selling at 13:40 (36K) and 13:48 (59K) accelerated downward momentum.

- Price has since rebounded to $153.81, with tentative support near $152.50.

- Lower highs and elevated selling volume suggest continued short-term pressure.

- A close above $153.30 is needed to signal potential trend stabilization.

External References

- "Solana (SOL) Continues to Fall — Is a Reversal in Sight?", NewsBTC, published June 2, 2025.

- "Solana (SOL) Price Prediction for 3rd June 2025: Will $150 Hold or Is a Larger Breakdown Brewing?", Coin Edition, published June 2, 2025.

.png)