Pantomath Group asset management arm launches Rs 2,000 Cr Bharat Bhoomi Fund

The fund, which targets the real estate, has a Rs 1,000-crore Category II AIF with a Rs 1,000-crore greenshoe option.

The Wealth Company Asset Management Pvt Ltd, part of the Pantomath Group, has launched a Rs 2,000-crore Bharat Bhoomi Fund, a Rs 1,000-crore Category II AIF with a Rs 1,000-crore greenshoe option, under its fifth Bharat Value Fund Series, targeting the real estate sector.

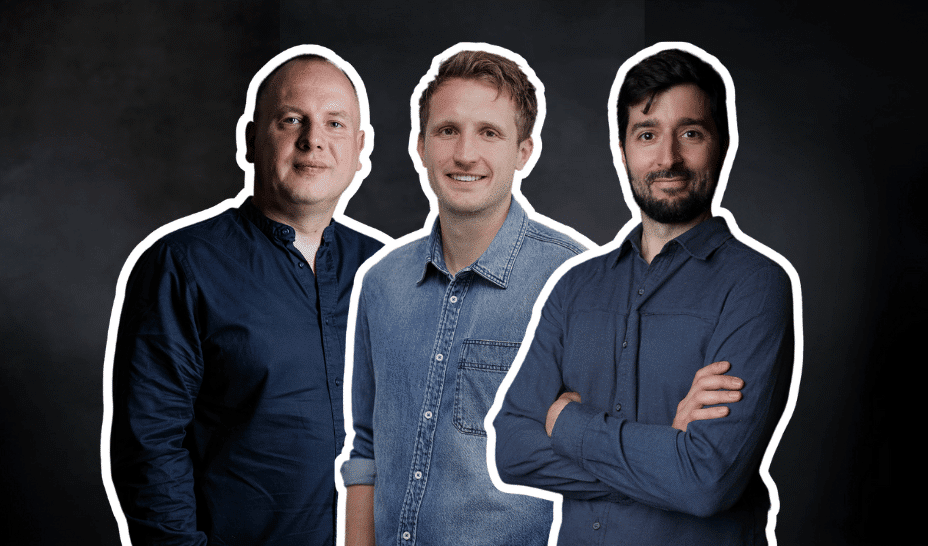

The fund is led by Rakesh Kumar, whose experience spans over 50,000 real estate transactions and senior leadership roles at Shell, Walmart, and Reliance, along with Bhavya Bagrecha, who has executed over Rs 2,500 crore in institutional real estate investments and introduced India's first REIT-style structure under SEBI's VCF regulations.

Peter Sharp, former head of Walmart's Asia real estate operations, has joined the team as an advisor with over 35 years of global experience.

The fund will target ready-to-launch assets that can move swiftly from investment to value creation. With a robust pipeline of about 1,200 acres across six projects, Bharat Bhoomi Fund is well-positioned to deploy capital with speed, prudence and precision, said the company.

Bharat Bhoomi Fund marks an expansion of The Wealth Company's investment canvas, it said, adding that this fund provides a natural way to broaden exposure to real assets.

"As capital becomes more thoughtful, the demand for real assets with real outcomes has never been higher. Bharat Bhoomi Fund allows meeting that demand with discipline, data, and domain expertise. The wealth company's investment ethos is now extending into India's real estate space," said Madhu Lunawat, Founder and Director of The Wealth Company Asset Management.

The fund will follow a diversified capital allocation strategy, investing in data centres, warehousing, hospitality, renewable parks, and sectors aligned with India's evolving infrastructure, digital transformation, and sustainability priorities, said the company.

Investor demand for these new economic assets is growing, driven by the country's digital and green energy transitions, it added.

Alongside this, investments will target mid-to-premium residential, retail, plotted villas, and mixed-use developments across high-growth cities such as Mumbai, NCR, Pune, Bengaluru, Chennai, and Hyderabad.

Edited by Swetha Kannan

![The Most Searched Things on Google [2025]](https://static.semrush.com/blog/uploads/media/f9/fa/f9fa0de3ace8fc5a4de79a35768e1c81/most-searched-keywords-google-sm.png)

![What Is a Landing Page? [+ Case Study & Tips]](https://static.semrush.com/blog/uploads/media/db/78/db785127bf273b61d1f4e52c95e42a49/what-is-a-landing-page-sm.png)